Valued at a market cap of $46.3 billion, Take-Two Interactive Software, Inc. (TTWO) is a leading interactive entertainment developer, publisher, and marketer. Headquartered in New York, the company creates, publishes, and distributes video games and related entertainment software for consoles, PCs, mobile devices, and digital platforms through its major internal labels Rockstar Games, 2K, and Zynga. Take-Two’s portfolio includes some of the most successful and influential franchises in gaming, such as Grand Theft Auto, Red Dead Redemption, NBA 2K, BioShock, Borderlands, Civilization, and Max Payne.

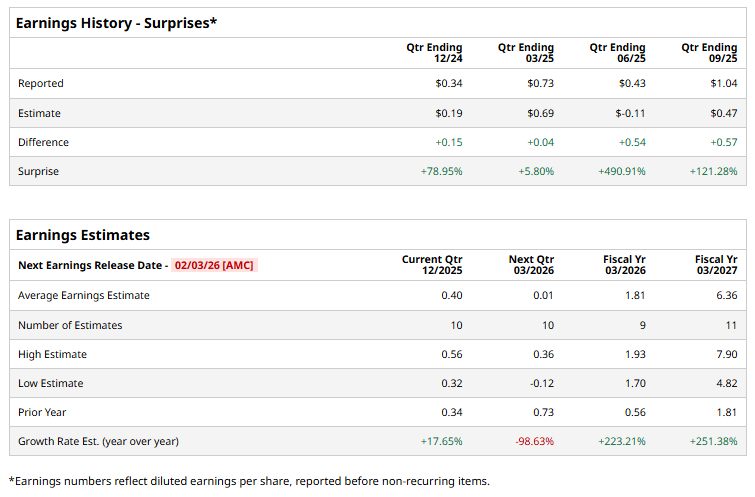

It is scheduled to announce its fiscal Q3 earnings for 2026 after the market closes on Tuesday, February 3. Ahead of this event, analysts expect the gaming titan to report a profit of $0.40 per share, up 17.7% from $0.34 per share in the year-ago quarter. The company has a solid trajectory of consistently beating Wall Street’s earnings estimates in each of the last four quarters.

For fiscal 2026, analysts expect TTWO to report a profit of $1.81 per share, up 223.2% from $0.56 per share in fiscal 2025. Furthermore, its EPS is expected to grow 251.4% annually to $6.36 in fiscal 2027.

Shares of TTWO have rallied 39.4% over the past 52 weeks, outperforming both the S&P 500 Index's ($SPX) 19.7% return and the Communication Services Select Sector SPDR Fund’s (XLC) 22.7% rise over the same time frame.

Over the past year, Take-Two Interactive has outpaced the broader market, largely driven by its solid growth trajectory, franchise strength, and earnings outlook. Investors have also rewarded the stock for its robust revenue growth and high earnings forecasts, including expectations of significant year-over-year profit expansion. Additionally, market participants have looked past short-term volatility to focus on the company’s deep pipeline of popular gaming titles and diversified revenue streams, including mobile gaming growth via Zynga and anticipation for blockbuster releases such as Grand Theft Auto VI, which underpin long-term monetization prospects.

Wall Street analysts are highly optimistic about TTWO’s stock, with an overall "Strong Buy" rating. Among 28 analysts covering the stock, 21 recommend "Strong Buy," three indicate "Moderate Buy,” and four suggest "Hold.” The mean price target for TTWO is $276.11, indicating a 10.9% potential upside from the current levels.