/Stanley%20Black%20%26%20Decker%20Inc%20logo%20on%20building-by%20Jevanto%20Productions%20via%20Shutterstock.jpg)

With a market cap of $10.5 billion, Stanley Black & Decker, Inc. (SWK) is a leading global manufacturer of industrial tools, household hardware, and security products. Its portfolio includes iconic brands such as DeWalt, Stanley, Craftsman, and Black+Decker, serving both professional and consumer markets. The Connecticut-headquartered company operates through two main segments, Tools & Outdoor and Industrial, with a strong presence across North America and international markets.

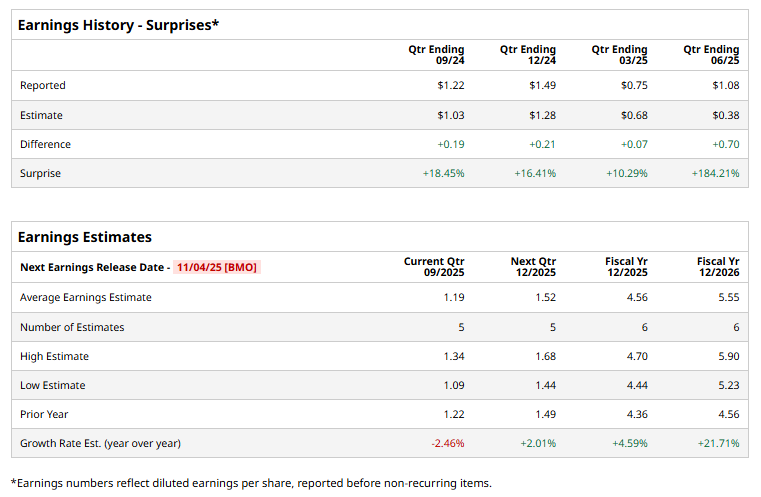

SWK is all geared to post its fiscal 2025 Q3 earnings on Tuesday, Nov. 4, before the market opens. Ahead of the event, analysts expect SWK to report a profit of $1.19 per share, down 2.5% from $1.22 per share reported in the year-ago quarter. However, it has exceeded analysts' earnings estimates in all of the past four quarters, which is impressive.

For the current year, analysts expect SWK to report EPS of $4.56, up 4.6% from $4.36 in fiscal 2024. Looking ahead, analysts expect its earnings to surge 21.7% year-over-year to $5.55 per share in fiscal 2026.

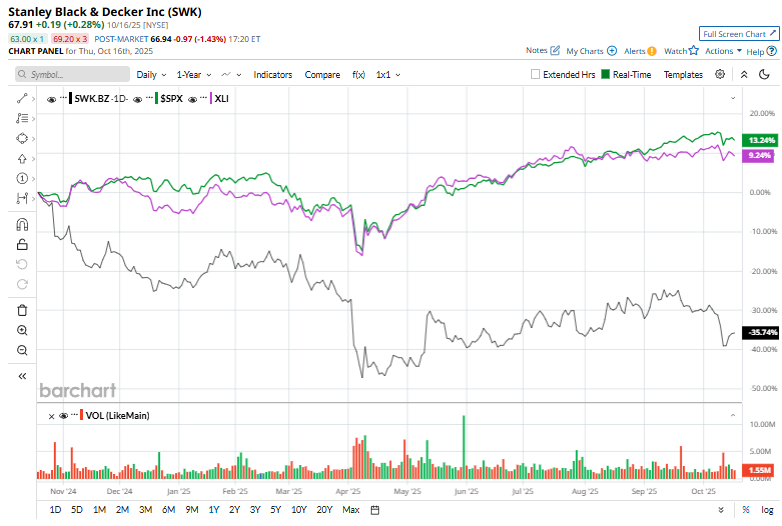

Over the past year, SWK shares have plunged 36.2%, significantly underperforming the S&P 500 Index’s ($SPX) 13.5% gains and the Industrial Select Sector SPDR Fund’s (XLI) 8.9% surge over the same time frame.

On Oct. 7, SWK shares dipped 1.6% after analyst Joe O’Dea of Wells Fargo & Company (WFC) reaffirmed a “Hold” rating on Stanley Black & Decker and set a price target of $80.

Nevertheless, major analysts remain moderately bullish on SWK’s future prospects, with an overall "Moderate Buy" rating. Among the 16 analysts covering the stock, six recommend a “Strong Buy,” nine suggest a “Hold,” and one suggest a “Strong Sell.” SWK's mean price of $83.75 implies a premium of 23.3% from its prevailing price level.