New Jersey-based Public Service Enterprise Group Incorporated (PEG) is a diversified electric and gas utilities company. With a market cap of $41.1 billion, the company operates through PSE&G and PSEG Power segments. The utilities giant is set to unveil its third-quarter results before the market opens on Monday, Nov. 3.

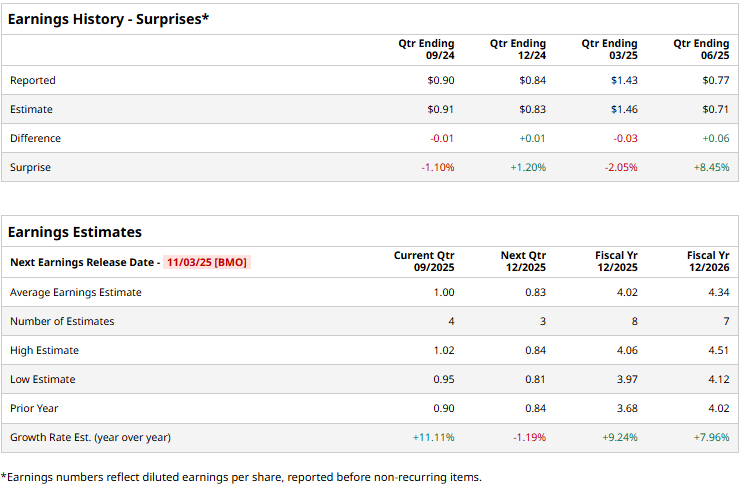

Ahead of the event, analysts expect PEG to report a profit of $1 per share, up 11.1% from $0.90 per share reported in the year-ago quarter. The company has a mixed earnings surprise history. While it surpassed the Street’s bottom-line projections twice over the past four quarters, it missed the estimates on two other occasions.

For the full fiscal 2025, PEG is expected to deliver an EPS of $4.02, up a notable 9.2% from $3.68 reported in 2024. While in fiscal 2026, its earnings are expected to further grow 8% year-over-year to $4.34 per share.

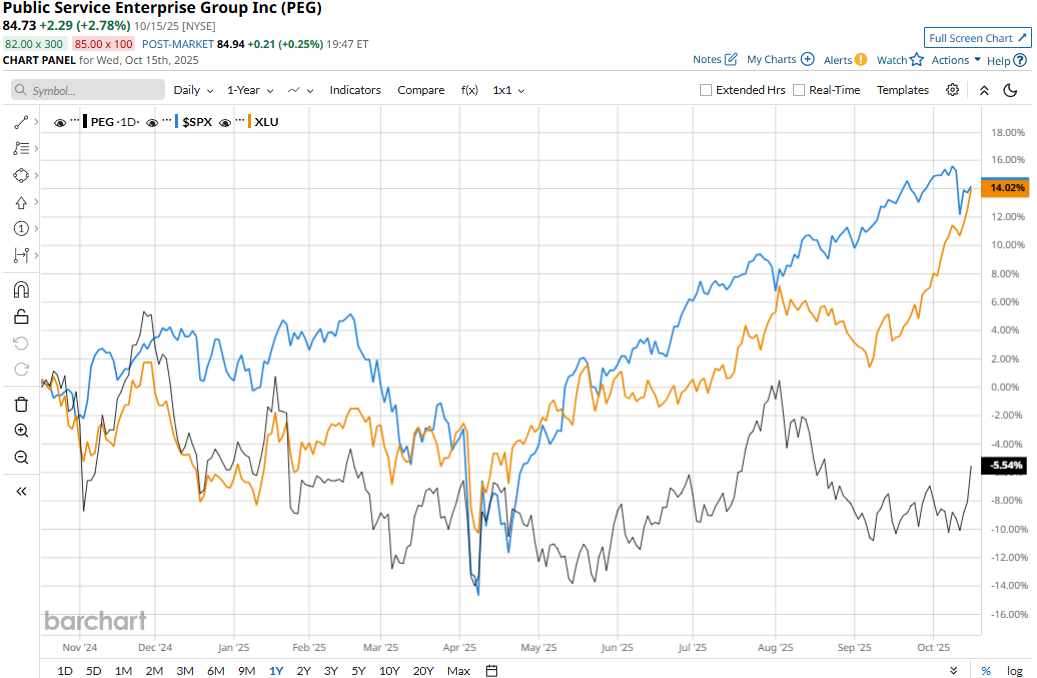

PEG stock prices have declined 3.9% over the past 52 weeks, notably underperforming the Utilities Select Sector SPDR Fund’s (XLU) 15.3% gains and the S&P 500 Index’s ($SPX) 14.7% returns during the same time frame.

Despite reporting better-than-expected results, Public Service Enterprise’s stock prices declined 2.2% in the trading session following the release of its Q2 results on Aug. 5. Driven by the sector-wide momentum, the company’s topline for the quarter surged 15.8% year-over-year to $2.8 billion, exceeding the consensus estimates by 19.6%. Further, its non-GAAP EPS increased 22.2% year-over-year to $0.77, surpassing the Street’s expectations by 8.5%.

However, investors’ concern stems from the company’s rising debt in its capital structure, which has notably increased its finance cost, along with uncertainties surrounding the nuclear production tax credit benefits PEG had enjoyed previously, coming under regulatory scrutiny.

Nonetheless, analysts remain optimistic about the stock’s prospects. PEG has a consensus “Moderate Buy” rating overall. Of the 17 analysts covering the stock, opinions include five “Strong Buys” and 12 “Holds.” Its mean price target of $91.27 suggests a 7.7% upside potential from current price levels.