/Paychex%20Inc_%20office-by%20Eric%20Glenn%20via%20Shutterstock.jpg)

With a market cap of $52.7 billion, Paychex, Inc. (PAYX) is a leading provider of human capital management solutions, specializing in payroll, HR, benefits, and insurance services for small to medium-sized businesses. The company offers a comprehensive suite of customizable services to help businesses efficiently manage their workforce.

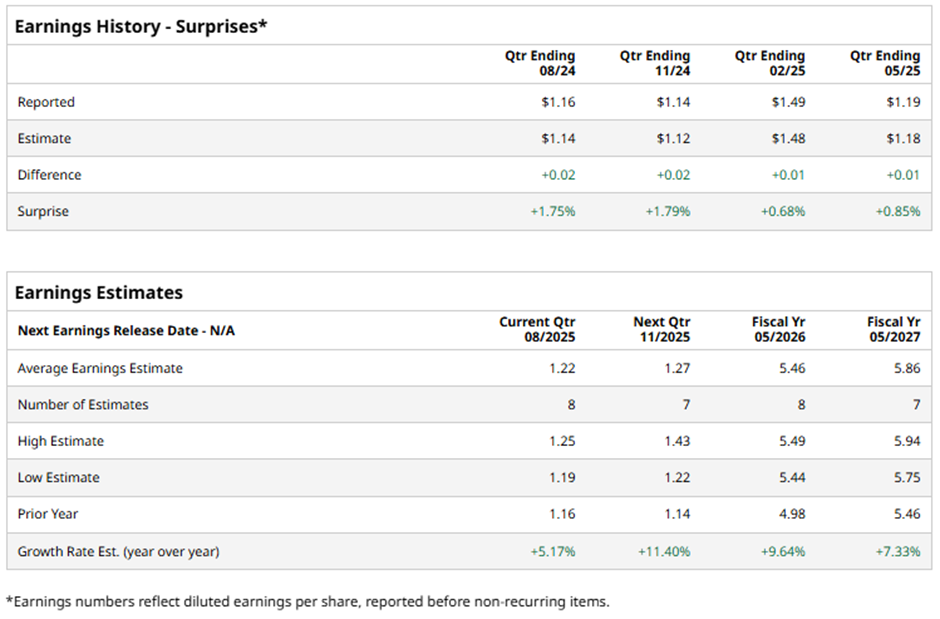

Analysts project the Rochester, New York-based company to report an adjusted EPS of $1.22 in Q1 2026, a 5.2% growth from $1.16 in the year-ago quarter. The company has exceeded Wall Street's bottom-line estimates in the last four quarters.

For fiscal 2026, analysts forecast the payroll processing services expert to report adjusted EPS of $5.46, up 9.6% from $4.98 in fiscal 2025.

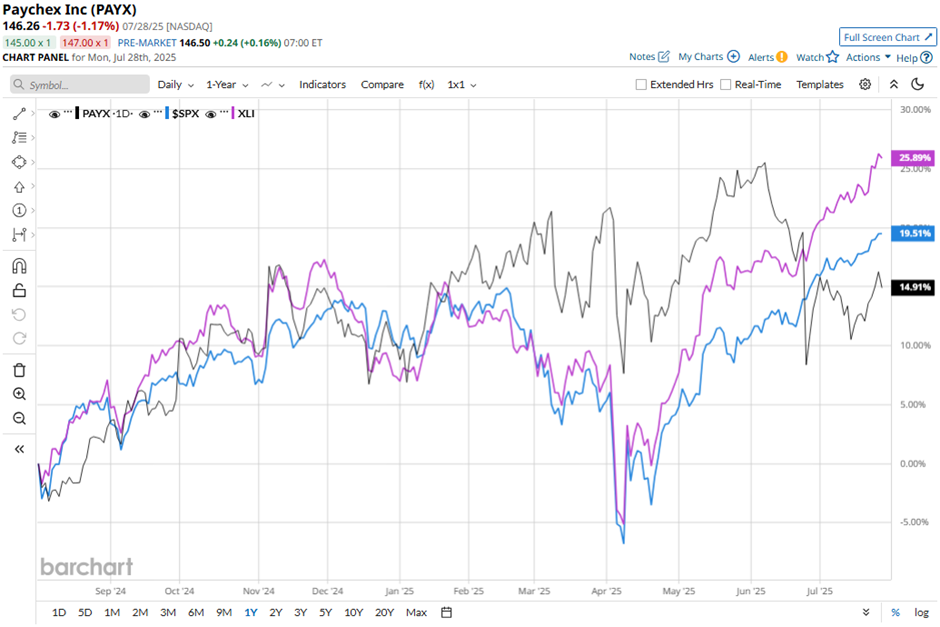

PAYX stock has increased 16.3% over the past 52 weeks, underperforming the broader S&P 500 Index's ($SPX) 17.1% return and the Industrial Select Sector SPDR Fund's (XLI) 22.3% gain over the same period.

Despite Paychex beating Q4 2025 estimates with adjusted EPS of $1.19 and revenue of $1.4 billion, shares tumbled 9.4% on Jun. 25 due to a sharp 11% drop in operating income to $431.1 million and a 700-basis-point decline in operating margin to 30.2%, both missing expectations.

Analysts' consensus view on Paychex stock is cautious, with a "Hold" rating overall. Among 16 analysts covering the stock, 14 suggest a "Hold" and two provide a "Strong Sell" rating. As of writing, the stock is trading below the average analyst price target of $151.