/Packaging%20Corp%20Of%20America%20phone%20and%20data%20by-Piotr%20Swat%20via%20Shutterstock.jpg)

Valued at $19.3 billion by market cap, Packaging Corporation of America (PKG), based in Lake Forest, Illinois, operates as a leading U.S. producer of containerboard and corrugated packaging. Operating through its Packaging and Paper segments, PKG provides essential products like shipping containers and protective packaging to industries such as food, beverages, and industrial goods.

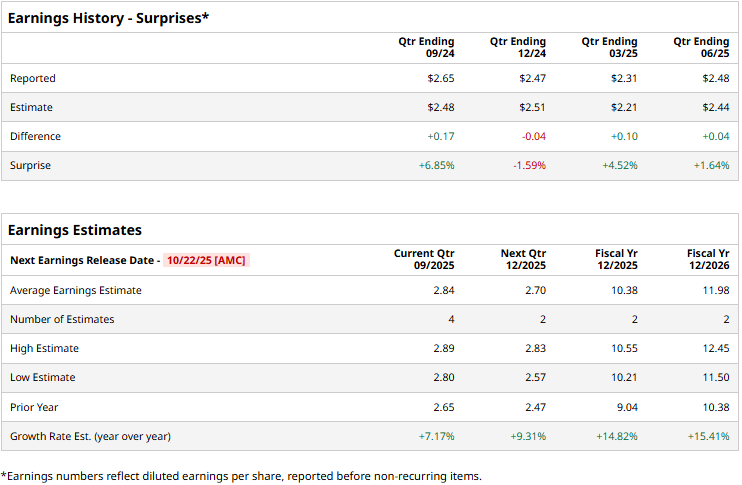

The packaging giant is set to announce its third-quarter results after the markets close on Wednesday, Oct. 22. Ahead of the event, analysts expect PKG to deliver an adjusted earnings of $2.84 per share, up 7.2% from $2.65 per share reported in the year-ago quarter. While the company has missed the Street’s bottom-line estimates once over the past four quarters, it has surpassed the expectations on three other occasions.

Furthermore, for the full fiscal 2025, PKG’s earnings are expected to grow to $10.38 per share, up a notable 14.8% from $9.04 per share in fiscal 2024. Moreover, its earnings are expected to further grow 15.4% year-over-year to $11.98 per share in fiscal 2026.

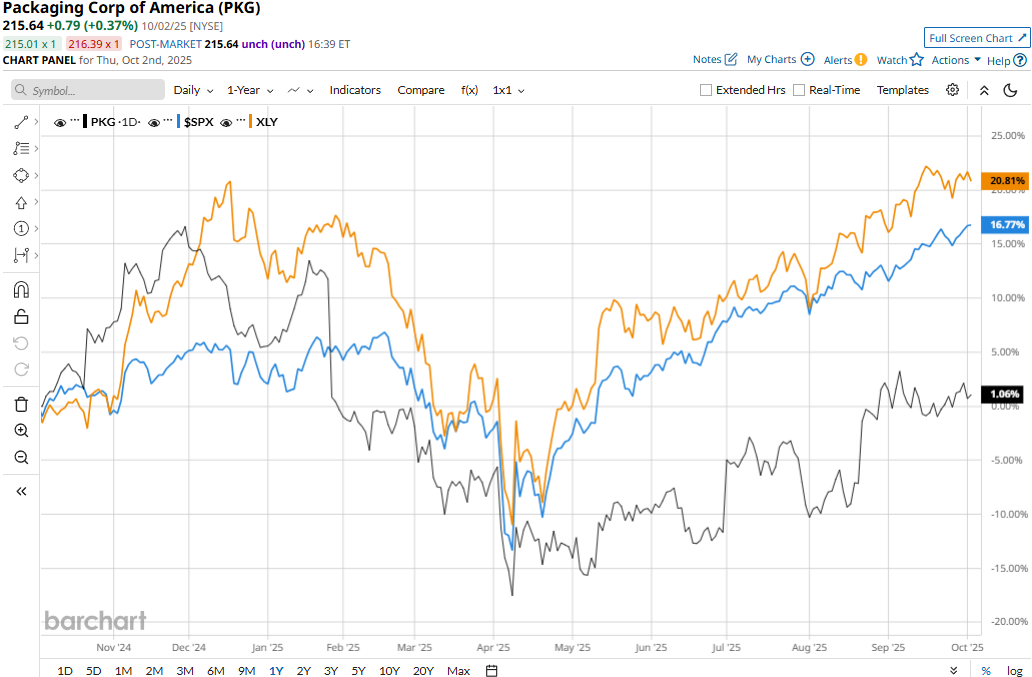

PKG’s stock prices have gained a modest 1.3% over the past 52 weeks, notably underperforming the S&P 500 Index’s ($SPX) 17.6% gains and the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 21% surge during the same time frame.

Packaging Corporation’s stock prices remained mostly flat in the trading session following the release of its Q2 results on Jul. 23. While the company’s Paper segment experienced a slight sluggishness during the quarter, its Packaging segment observed a significant boost. Overall, the company’s topline came in at $2.2 billion, up 4.6% year-over-year and 49 bps above the Street’s expectations.

Its Packaging segments adjusted EBITDA soared 13.2% year-over-year to $452.9 million. This led to a notable 12.7% growth in adjusted EPS to $2.48, exceeding the consensus estimates by 1.6%.

Analysts remain optimistic about the stock’s prospects. PKG has a consensus “Moderate Buy” rating overall. Of the 11 analysts covering the stock, opinions include six “Strong Buys” and five “Holds.” Its mean price target of $225.50 suggests a modest 4.6% upside potential from current price levels.