New York-based Omnicom Group Inc. (OMC) offers advertising, marketing, and corporate communications services. With a market cap of $15 billion, the company’s agencies, which operate in major markets around the world, provide a comprehensive range of services, including traditional media advertising, customer relationship management (CRM), public relations, and specialty communications. The global leader in marketing communications is expected to announce its fiscal third-quarter earnings for 2025 on Tuesday, Oct. 21.

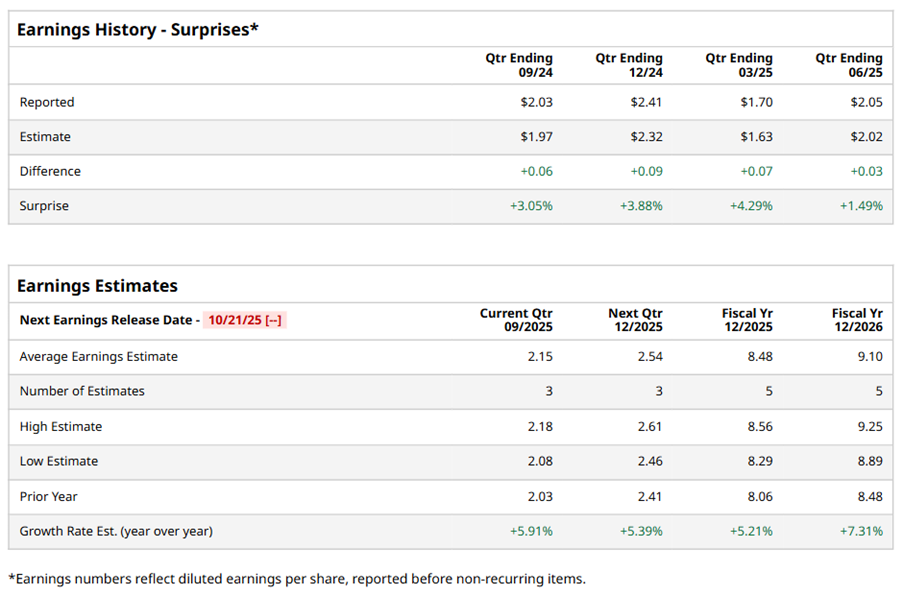

Ahead of the event, analysts expect OMC to report a profit of $2.15 per share on a diluted basis, up 5.9% from $2.03 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the full year, analysts expect OMC to report EPS of $8.48, up 5.2% from $8.06 in fiscal 2024. Its EPS is expected to rise 7.3% year-over-year to $9.10 in fiscal 2026.

OMC stock has considerably underperformed the S&P 500 Index’s ($SPX) 17.6% gains over the past 52 weeks, with shares down 24.7% during this period. Similarly, it considerably lagged behind the Communication Services Select Sector SPDR ETF’s (XLC) 29.1% gains over the same time frame.

On Jul. 15, OMC shares closed down by 2.6% after reporting its Q2 results. Its revenue stood at $4 billion, up 4.2% year-over-year. The company’s adjusted EPS increased 5.1% year-over-year to $2.05.

Analysts’ consensus opinion on OMC stock is reasonably bullish, with a “Moderate Buy” rating overall. Out of 11 analysts covering the stock, five advise a “Strong Buy” rating, and six give a “Hold.” OMC’s average analyst price target is $93.62, indicating a potential upside of 21.8% from the current levels.