NiSource Inc. (NI) is a leading U.S. utility holding company headquartered in Merrillville, Indiana. As of October 2025, it serves nearly 4 million natural gas customers and electric customers across six states through its subsidiaries, including Columbia Gas and Northern Indiana Public Service Company (NIPSCO). NiSource’s market cap stands at $20.2 billion. The leading natural gas distribution company is expected to announce its fiscal third-quarter earnings for 2025 soon.

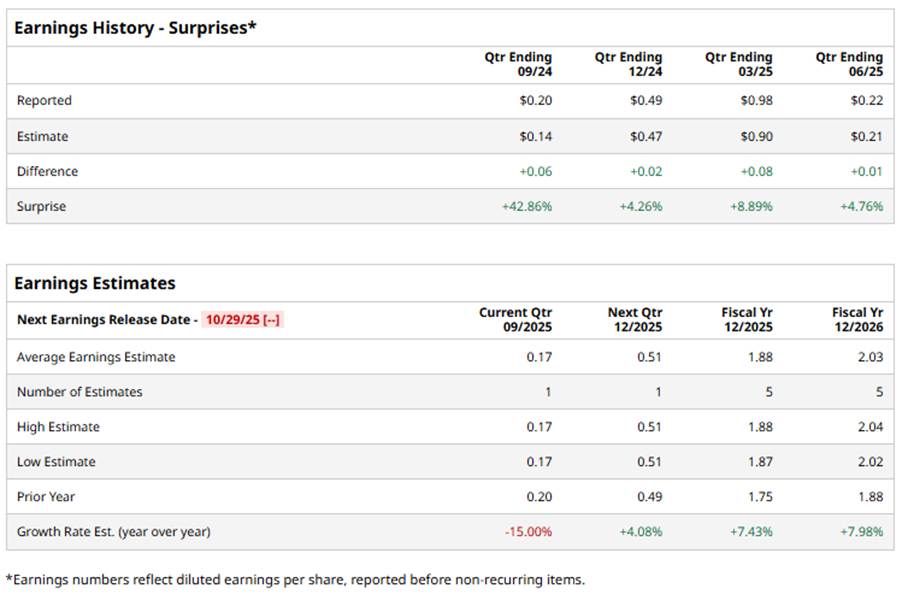

Ahead of the event, analysts expect NiSource to report a profit of $0.17 per share on a diluted basis, a 15% decline from the same quarter last year. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the full year, analysts anticipate NiSource to report EPS of $1.88, representing a 7.4% increase from $1.75 in fiscal 2024. Its EPS is expected to rise 8% year over year to $2.03 in fiscal 2026.

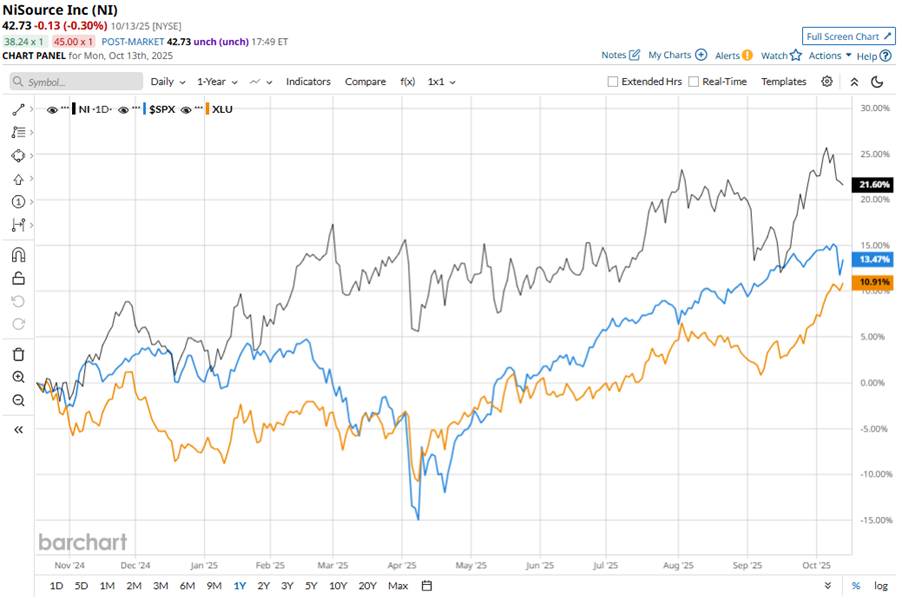

NI stock has outperformed the S&P 500 Index’s ($SPX) 14.4% gains over the past 52 weeks, with shares up 25.9% during this period. Similarly, it outperformed the Utilities Select Sector SPDR Fund’s (XLU) 14.7% gains over the same time frame.

NiSource has been outperforming due to a combination of strong financial performance, strategic initiatives, and positive market sentiment. The optimism also stems from a robust capital expenditure plan of $19.4 billion for 2025–2029, aimed at modernizing infrastructure and enhancing service reliability.

Analysts’ consensus opinion on NI stock is moderately bullish, with the stock having an overall “Moderate Buy” rating. Out of 15 analysts covering the stock, 10 advise a “Strong Buy” rating, and five suggest a “Hold.” NI’s average analyst price target is $44.77, indicating a potential upside of 4.8% from the current levels.