Denver, Colorado-based Newmont Corporation (NEM) is a mining company. It produces and explores gold, copper, silver, zinc, and lead with a primary focus on gold. With a market cap of $94.4 billion, Newmont’s operations span the Americas, Caribbean, Africa, and the Indo-Pacific.

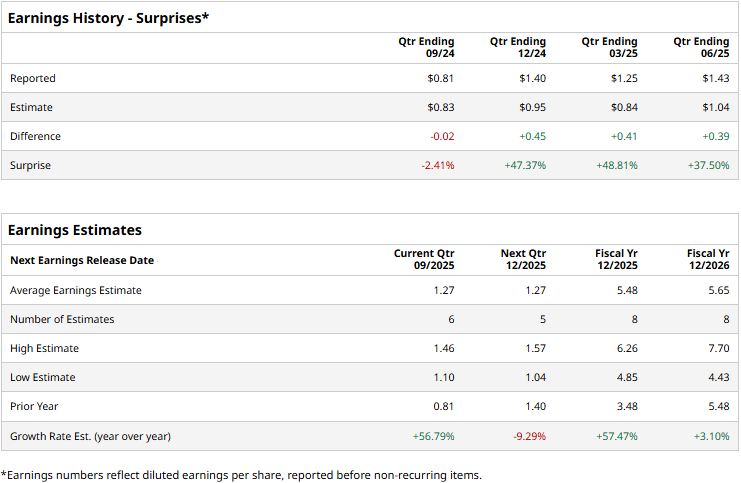

The mining giant is gearing up to announce its third-quarter results after the markets close on Thursday, Oct. 23. Ahead of the event, analysts expect Newmont to report a profit of $1.27 per share, up 56.8% from $0.81 per share reported in the year-ago quarter. The company has a mixed earnings surprise history. While it has surpassed the Street’s bottom-line estimates thrice over the past four quarters, it missed the projections on one other occasion.

For the full fiscal 2025, analysts expect NEM to deliver an EPS of $5.48, up 57.5% from $3.48 in 2024. However, in fiscal 2026, its earnings are expected to grow by a modest 3.1% year-over-year to $5.65 per share.

Newmont’s stock prices have soared 60.1% over the past 52 weeks, notably outperforming the S&P 500 Index’s ($SPX) 17.6% gains and the Materials Select Sector SPDR Fund’s (XLB) 6.3% decline during the same time frame.

Newmont’s stock prices soared 6.9% in a single trading session following the release of its impressive Q2 results on Jul. 24. The quarter was marked with a record quarterly free cash flow of $1.7 billion, supported by approximately 1.5 million attributable gold ounces produced during Q2. The company’s topline surged 20.8% year-over-year to $5.3 billion, beating the Street’s expectations by a large margin. Further, its adjusted EPS skyrocketed 98.6% year-over-year to $1.43, beating the consensus estimates by 37.5%.

Analysts remain optimistic about NEM’s prospects. The stock has a consensus “Moderate Buy” rating overall. Of the 21 analysts covering the stock, opinions include 11 “Strong Buys,” two “Moderate Buys,” and eight “Holds.” As of writing, the stock is trading above its mean price target of $79.20.