/Lululemon%20Athletica%20inc_%20storefront%20by-%20Robert%20Way%20via%20iStock.jpg)

With a market cap of $21.5 billion, lululemon athletica inc. (LULU) designs, distributes, and retails technical athletic apparel, footwear, and accessories for women and men under the lululemon brand. The company operates globally through a mix of company-operated stores, e-commerce, and innovative retail formats like pop-ups and re-commerce programs.

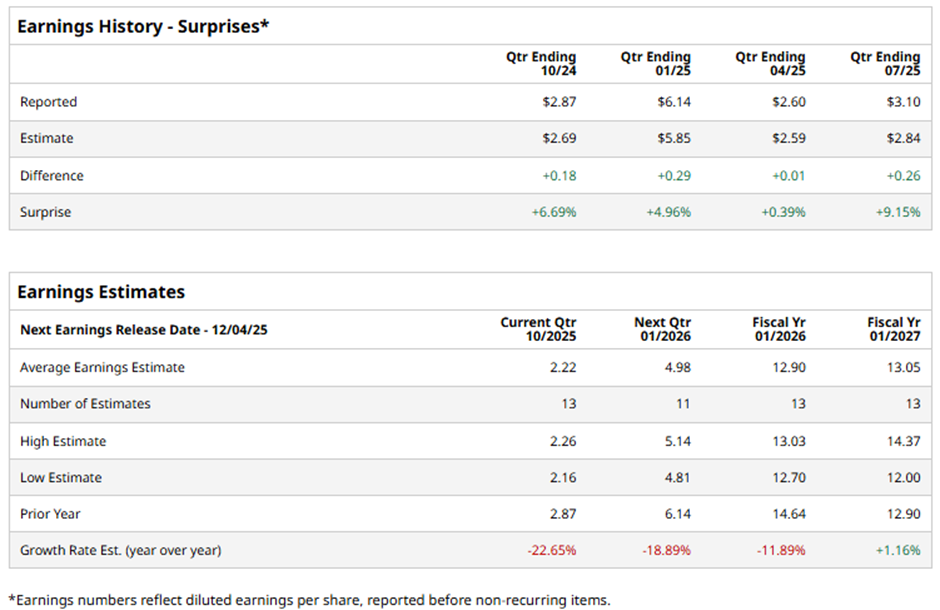

The Vancouver, Canada-based company is set to announce its fiscal Q3 2025 results soon. Ahead of this event, analysts expect lululemon athletica to report an EPS of $2.22, down 22.7% from $2.87 in the year-ago quarter. However, it has surpassed Wall Street's earnings estimates in the last four quarters.

For fiscal 2025, analysts expect the athletic apparel maker to report an EPS of $12.90, a 11.9% drop from $14.64 in fiscal 2024. Nevertheless, EPS is anticipated to rise 1.2% year-over-year to $13.05 in fiscal 2026.

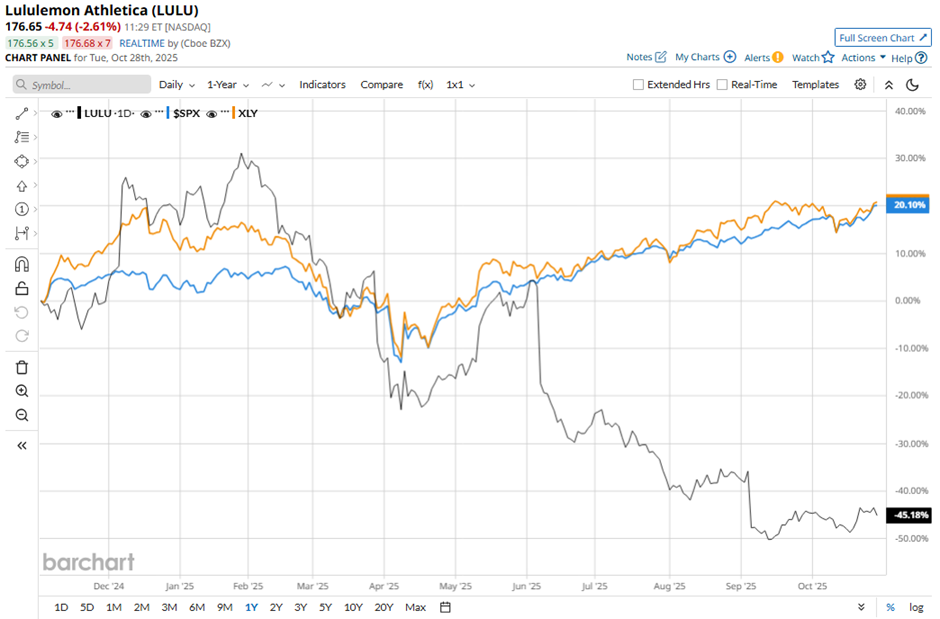

Shares of lululemon athletica have tumbled 42.5% over the past 52 weeks, underperforming both the S&P 500 Index's ($SPX) 18.1% return and the Consumer Discretionary Select Sector SPDR Fund's (XLY) 19.9% increase over the period.

Despite posting better-than-expected Q2 2025 EPS of $3.10 on Sept. 4, shares of Lululemon plunged 18.6% the next day. Lululemon cut its annual revenue forecast to $10.85 billion - $11.0 billion and EPS guidance to $12.77 - $12.97, citing weak U.S. sales, product missteps, and $240 million in expected tariff-related hits to gross profit.

Analysts' consensus view on LULU stock is cautious, with an overall "Hold" rating. Among 31 analysts covering the stock, three recommend "Strong Buy," 24 indicate “Hold,” two advise "Moderate Sell," and two give "Strong Sell." The average analyst price target for lululemon athletica is $189.42, suggesting a potential upside of 7.2% from current levels.