Kimberly-Clark Corporation (KMB), based in Irving, Texas, is a multinational company that produces hygiene and personal care products for everyday use, including Kotex, Kleenex, and Scott. With a market capitalization of $39.99 billion, the company operates manufacturing facilities and offices in dozens of countries, distributing its brands to more than 175 nations globally. Its worldwide reach is supported by a workforce dedicated to delivering trusted, innovative solutions in the health and hygiene sectors.

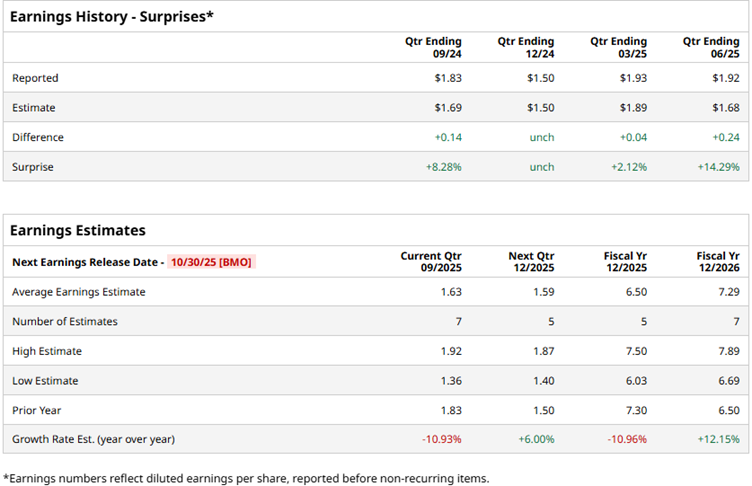

Kimberly-Clark is set to report its third-quarter results for fiscal 2025 on Oct. 30 before the market opens. Ahead of the results, Wall Street analysts expect the company’s profit to decline by 10.9% year-over-year (YOY) to $1.63 per diluted share in the third quarter. However, it has a history of surpassing consensus analyst estimates in three of the four last reported quarters and matching them in one instance.

For the fiscal year 2025, analysts expect Kimberly-Clark’s profit to decrease by 11% from the prior year to $6.50 per diluted share.

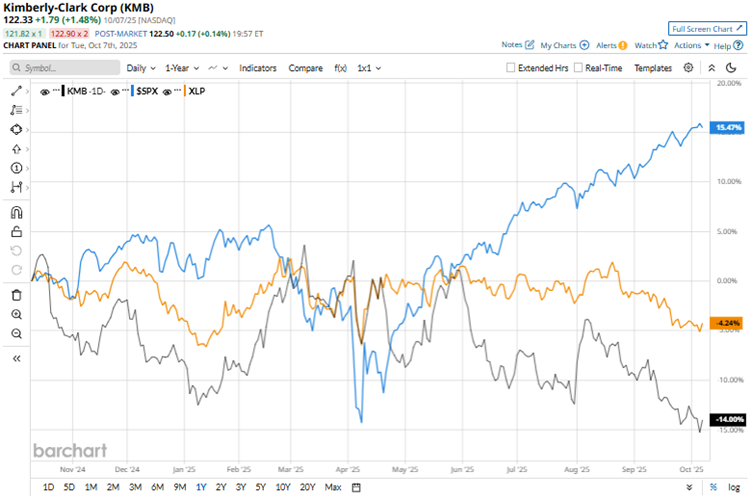

Kimberly-Clark’s stock has been underperforming the broader market over the past year. Over the past 52 weeks, the stock has lost 13.1%, while it is down 6.7% year-to-date (YTD). On the other hand, the broader S&P 500 Index ($SPX) has gained 17.9% and 14.2% over the same periods, respectively.

The company is categorically placed in the consumer staples sector due to the defensive nature of its business. Comparing it with the Consumer Staples Select Sector SPDR Fund (XLP), we see that the ETF has dropped 3.1% over the past 52 weeks and has marginally declined YTD. Therefore, Kimberly-Clark underperformed its sector over these periods.

On Aug. 1, Kimberly-Clark reported its second-quarter results, which were better than expected but still showed some weakness. Its net sales decreased 1.6% YOY to $4.16 billion. Its revenue growth was subdued due to adverse impacts of about 4.4% from the divestiture of the Personal Protective Equipment part and the exit of the company’s private label diaper business in the U.S. Its adjusted EPS was $1.92, down 2% YOY but higher than the $1.68 that Wall Street analysts were expecting. The stock rose 4.8% intraday on Aug. 1.

Wall Street analysts have been soundly bullish about Kimberly-Clark’s prospects. Among the 20 analysts covering the stock, it has a consensus rating of “Moderate Buy” overall. The overall rating has improved from “Hold” three months ago to “Moderate Buy.” The configuration of the ratings is more bullish than it was three months ago, with five “Strong Buy” ratings now, up from four. The stock also has one “Moderate Buy” rating, 13 “Holds,” and one “Strong Sell” rating.

The mean price target of $141.11 indicates a 15.4% upside from current levels, while the Street-high price target of $162 implies a 32.4% upside.