/Jack%20Henry%20%26%20Associates%2C%20Inc_%20website%20and%20logo%20on%20phone-by%20T_Schneider%20via%20Shutterstock.jpg)

Monett, Missouri-based Jack Henry & Associates, Inc. (JKHY) operates as a fintech company that connects people and financial institutions through technology solutions and payment processing services that reduce the barriers to financial health. With a market cap of $11.1 billion, Jack Henry operates through Core, Payments, Complementary, and Corporate & Other segments.

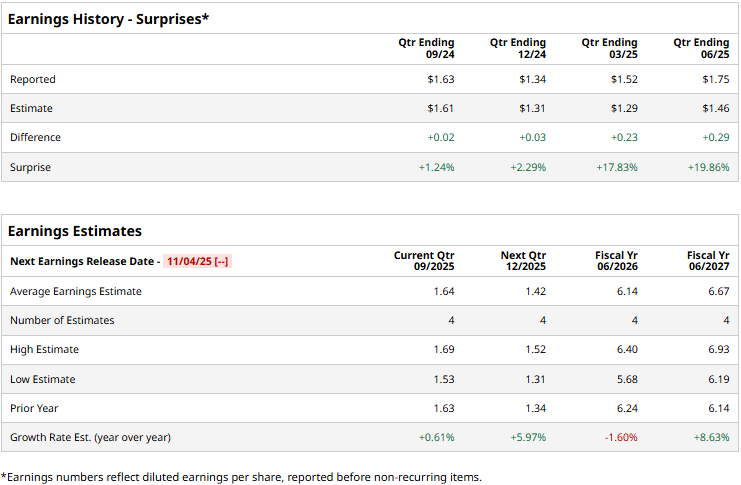

The fintech giant is set to announce its first-quarter results after the market close on Tuesday, Nov. 4. Ahead of the event, analysts expect JKHY to report a non-GAAP profit of $1.64 per share, marginally up from $1.63 per share reported in the year-ago quarter. On a more positive note, the company has surpassed analysts’ earnings expectations in each of the past four quarters.

For the full fiscal 2026, JKHY is expected to deliver an adjusted EPS of $6.14, down 1.6% from $6.24 in fiscal 2025. In fiscal 2027, its earnings are expected to surge 8.6% year-over-year to $6.67 per share.

JKHY stock prices have plunged 16.7% over the past 52 weeks, notably underperforming the S&P 500 Index’s ($SPX) 14.8% gains and the Technology Select Sector SPDR Fund’s (XLK) 24.8% surge during the same time frame.

Jack Henry’s stock prices observed a marginal uptick in the trading session following the release of its better-than-expected Q4 results on Aug. 19. The company ended the year on a strong note, registering record revenues and operating income for the fiscal year 2025. Its strong Q4 sales wins for core, complementary, and payment solutions, along with its ongoing success winning larger financial institutions, have solidified the company’s operational base for 2026.

JKHY reported a solid 9.9% surge in overall revenues to $615.4 million, beating the Street’s expectations by 1.5%. Its adjusted EPS for the quarter soared 26.4% year-over-year to $1.75, surpassing the consensus estimates by a staggering 19.9%.

Analysts remain cautious about JKHY’s prospects. The stock has a consensus “Hold” rating overall. Of the 17 analysts covering the stock, opinions include three “Strong Buys,” 12 “Holds,” and two “Strong Sells.” Its mean price target of $175.33 suggests a 13.1% upside potential from current price levels.