/International%20Business%20Machines%20Corp_%20logo%20on%20storage%20rack-by%20Nick%20N%20A%20via%20Shutterstock.jpg)

Headquartered in Armonk, New York, International Business Machines Corporation (IBM) is a powerhouse weaving software, consulting, infrastructure, and financing into a global tapestry of digital innovation. Valued at nearly $268 billion, its software arsenal boasts hybrid cloud and artificial intelligence (AI) platforms, while its consulting arm dives deep into industry-specific strategy and operations.

When it comes to infrastructure, IBM offers a range of solutions, including on-premises and cloud solutions, lifecycle services, and client financing, creating a seamless ecosystem for businesses seeking to modernize and accelerate their AI-powered transformation. As per the preliminary schedule set by IBM, the tech giant is slated to release its fiscal 2025 third-quarter earnings by the end of October.

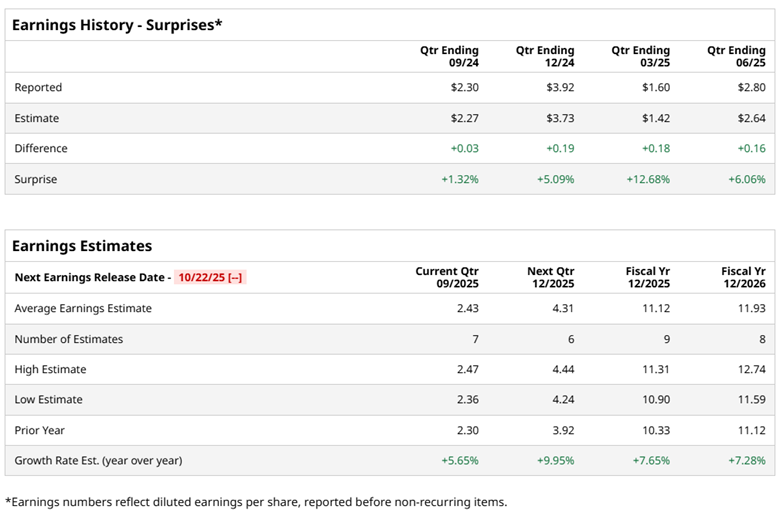

Ahead of the results, analysts on Wall Street are whispering about a profit of $2.43 per share on a diluted basis, nudging 5.7% above last year’s $2.30 per share. This would not be a shocker for IBM, as the company has topped EPS estimates in each of the past four quarters like clockwork. The momentum from Q2 2025 is still fresh.

Revenue hit $16.98 billion, outpacing expectations of $16.59 billion, a 7.7% year-over-year surge. Adjusted EPS came in at $2.80, beating the forecast of $2.64, and a solid 15.2% jump from the same quarter last year. Free cash flow also flexed its muscles, generating $4.8 billion, prompting IBM to raise its full-year outlook beyond $13.5 billion. Analysts are backing the trajectory. Diluted EPS for fiscal 2025 is projected to rise 7.7% year-over-year to $11.12, with another 7.3% growth expected in fiscal 2026, reaching $11.93.

Meanwhile, IBM shares have been stealing the spotlight, consistently outpacing the broader market. Over the past 52 weeks, the stock has climbed 29.5%, and year-to-date it has jumped 31.2%. The S&P 500 Index ($SPX), by contrast, managed 17.8% over the same year and 14.2% YTD, leaving IBM clearly in the lead.

The story gets even more compelling against the S&P 500 Technology Sector SPDR’s (XLK) gains. The ETF soared 27.8% in the last 52 weeks and popped off 22.5% year-to-date.

In fact, on Sept 25, IBM shares jumped further 5.2% after the company unveiled the world’s first-known quantum-enabled algorithmic trading partnership with HSBC Holdings plc (HSBC). The collaboration proves that quantum computers can tackle real-world financial challenges, with IBM’s quantum systems boosting bond trade prediction accuracy by up to 34% over classical methods. The breakthrough cements IBM’s position at the forefront of the quantum revolution in financial services.

Analyst sentiment remains steady, with a consensus rating of “Moderate Buy” holding strong for the past three months. Among 22 analysts, seven are waving the “Strong Buy” flag, one sticks with “Moderate Buy,” 12 advise to “Hold”, and two caution with a “Strong Sell.” IBM already trades above its mean price target of $282.20. Meanwhile, the Street-high target of $350 implies a 21.4% upside.

.jpg?w=600)