/Huntington%20Bancshares%2C%20Inc_%20logo%20on%20building-by%20jetcityimage%20via%20iStock.jpg)

Columbus, Ohio-based Huntington Bancshares Incorporated (HBAN) is a multi-state diversified regional bank holding company for the Huntington National Bank. Valued at $25.9 billion by market cap, Huntington provides commercial, consumer, and mortgage banking services, offering various financial products to corporations and individuals.

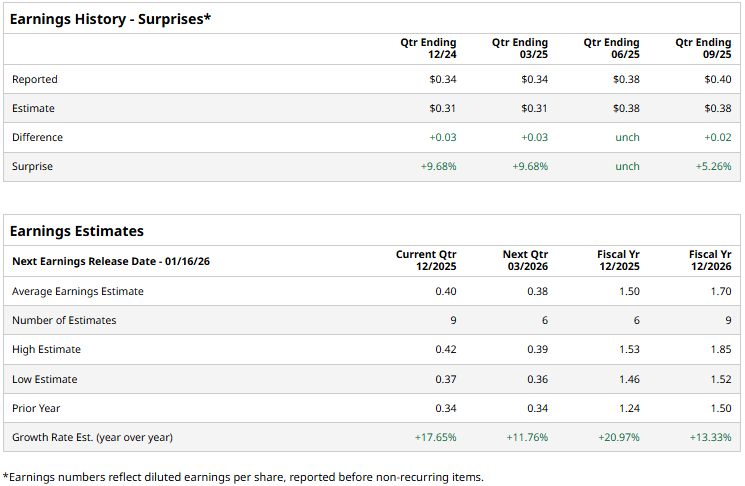

The banking major is expected to announce its fourth-quarter results before the market opens on Friday, Jan. 16. Ahead of the event, analysts expect HBAN to report an adjusted profit of $0.40 per share, up 17.7% from $0.34 per share reported in the year-ago quarter. Further, the company has a robust earnings surprise history. It has met or surpassed the Street’s bottom-line estimates in each of the past four quarters.

For the full fiscal 2025, HBAN is expected to deliver an adjusted EPS of $1.50, up 21% from $1.24 reported in 2024. In fiscal 2026, its earnings are expected to further grow 13.3% year-over-year to $1.70 per share.

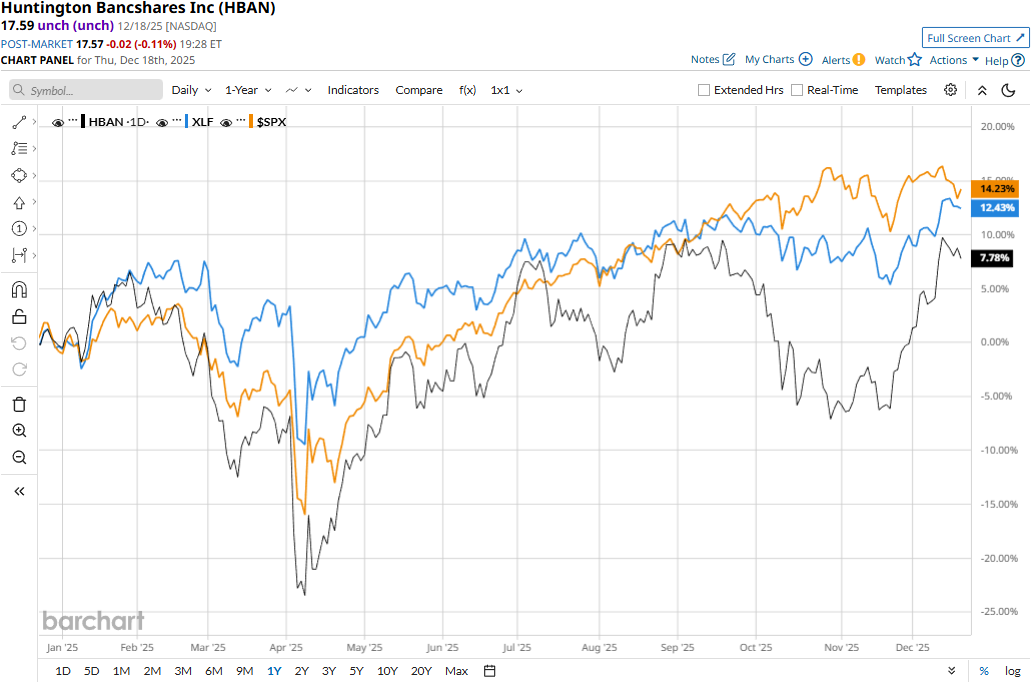

HBAN’s stock prices have gained 10.6% over the past three months, notably underperforming the S&P 500 Index’s ($SPX) 15.4% surge and the Financial Services Select Sector SPDR Fund’s (XLF) 14.5% returns during the same time frame.

Huntington Bancshares’ stock prices observed a marginal uptick in the trading session following the release of its Q3 results on Oct. 17. The company observed a notable 7.6% year-over-year growth in interest on loans and leases to $2.1 billion. Overall, the company’s interest income inched up 1.7% year-over-year to $2.6 billion. On a more positive note, HBAN reported a notable drop in interest expenses, leading to a 11.2% growth in net interest income to $1.4 billion. Meanwhile, its non-interest income surged 20.1% year-over-year to $628 million.

Overall, the company’s topline came in at $2 billion, up 13.8% year-over-year. Moreover, the company’s net income soared 25.2% year-over-year to $602 million, beating Street’s expectations.

Analysts maintain a positive outlook on the stock. HBAN has a consensus “Moderate Buy” rating among the 23 analysts covering it. That’s based on 16 “Strong Buys,” one “Moderate Buy,” five “Holds,” and one “Strong Sell.” Its mean price target of $19.89 suggests a 13.1% upside potential from current price levels.