/Hewlett%20Packard%20Enterprise%20Co%20San%20Jose%20campus-by%20Michael%20Vi%20via%20Shutterstock.jpg)

Spring, Texas-based Hewlett Packard Enterprise Company (HPE) is a global edge-to-cloud company that provides solutions allowing customers to capture, analyze, and act upon data seamlessly worldwide. With a market cap of $31 billion, Hewlett Packard Enterprise operates through Server, Hybrid Cloud, Networking, Financial Services, and Corporate Investments & other segments.

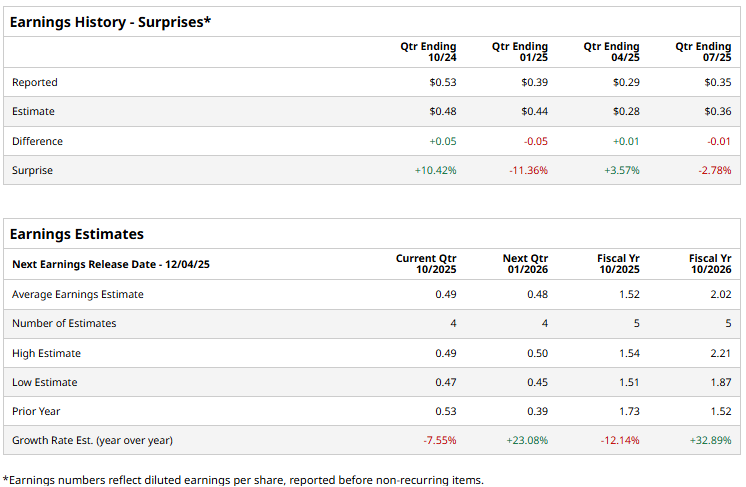

The tech major is expected to announce its fourth-quarter results in early December. Ahead of the event, analysts expect HPE to deliver a profit of $0.49 per share, down a notable 7.6% from $0.53 per share reported in the year-ago quarter. While the company has missed the Street’s bottom-line estimates twice over the past four quarters, it has surpassed the projections on two other occasions.

For the full fiscal 2025, HPE’s earnings are expected to come in at $1.52 per share, down 12.1% from $1.73 per share in 2024. While in fiscal 2026, its earnings are expected to surge 32.9% year-over-year to $2.02 per share.

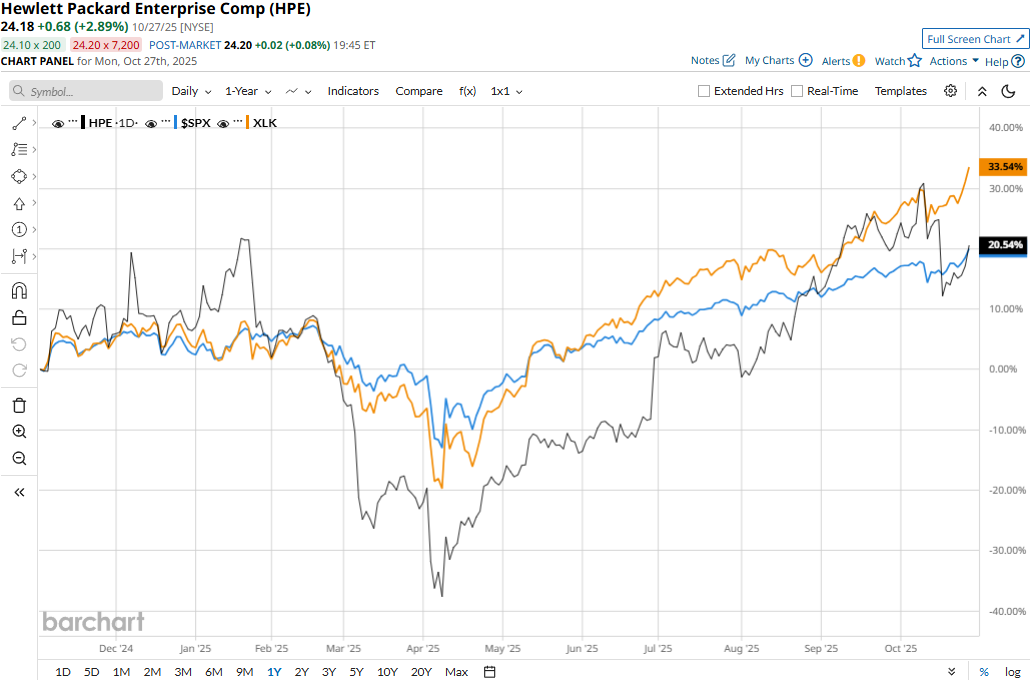

HPE stock prices have gained 24.3% over the past 52 weeks, notably outpacing the S&P 500 Index’s ($SPX) 18.4% returns, but lagging behind the Technology Select Sector SPDR Fund’s (XLK) 29.8% surge during the same time frame.

Hewlett Packard’s stock prices gained 1.5% in the trading session following the release of its mixed Q2 results on Sept. 3. The company completed the acquisition of Juniper Networks and observed strong demand across its portfolio, registering double-digit revenue growth across Server, Hybrid Cloud, and Networking segments. Overall, its topline came in at $9.1 billion, up 18.5% year-over-year and notable above Street’s expectations. However, the company’s margins got squeezed during the quarter, leading to a 4.5% decline in non-GAAP net income to $631 million.

Analysts remain moderately optimistic about the stock’s prospects. HPE has a consensus “Moderate Buy” rating overall. Of the 20 analysts covering the stock, opinions include seven “Strong Buys,” one “Moderate Buy,” and 12 “Holds.” Its mean price target of $26.44 suggests a 9.3% upside potential from current price levels.