/Franklin%20Resources%2C%20Inc_%20franklin-by%20luril%20Garmash%20via%20iStock.jpg)

Valued at a market cap of $11.9 billion, Franklin Resources, Inc. (BEN) is a global investment management firm headquartered in San Mateo, California. Founded in 1947, the company operates in over 150 countries and offers a wide range of investment solutions, including equity, fixed income, multi-asset, and alternative strategies.

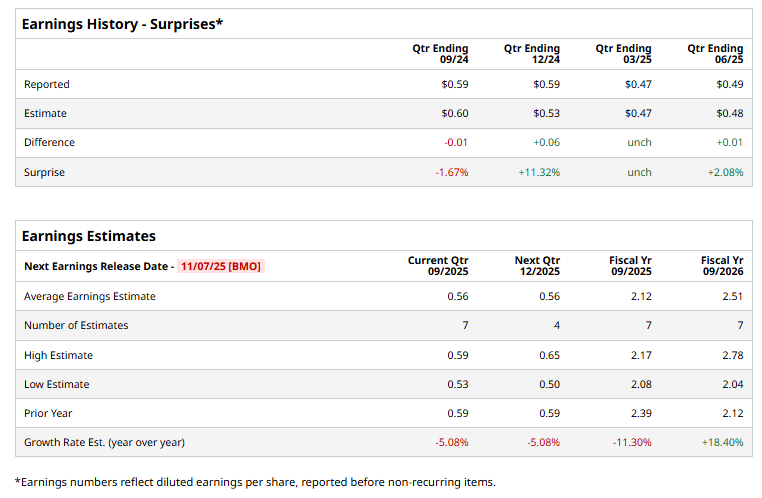

BEN is expected to announce its fiscal Q4 2025 earnings results before the market opens on Friday, Nov. 7. Ahead of this event, analysts expect the company to report adjusted earnings of $0.56 per share, down 5.1% from $0.59 per share in the year-ago quarter. The company has surpassed or met Wall Street's earnings estimates in three of the last four quarters while missing on another occasion.

For fiscal 2025, analysts expect the investment manager to report an adjusted EPS of $2.12, down 11.3% from $2.39 in fiscal 2024. However, EPS is anticipated to grow 18.4% year-over-year to $2.51 in fiscal 2026.

Shares of Franklin Resources have risen 12.5% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 14.7% gain and the Financial Select Sector SPDR Fund's (XLF) 13.5% return over the same period.

On Oct. 10, Franklin Resources shares fell 4.1% after Evercore ISI analyst Glenn Schorr reiterated a “Sell” rating with a $23 price target.

Analysts' consensus view on Franklin Resources’ stock is cautious, with an overall “Hold” rating. Among 13 analysts covering the stock, three recommend "Strong Buy," five "Holds," one suggests "Moderate Sell," and four "Strong Sells." As of writing, BEN is trading above the average analyst price target of $25.17.

.jpg?w=600)