/Fastenal%20Co_%20logo%20and%20chart-by%20T_Schneider%20via%20Shutterstock.jpg)

Winona, Minnesota-based Fastenal Company (FAST) engages in the wholesale distribution of industrial and construction supplies in North America and internationally. Valued at approximately $54.6 billion by market cap, Fastenal offers various industrial and construction-related products through its company-owned stores.

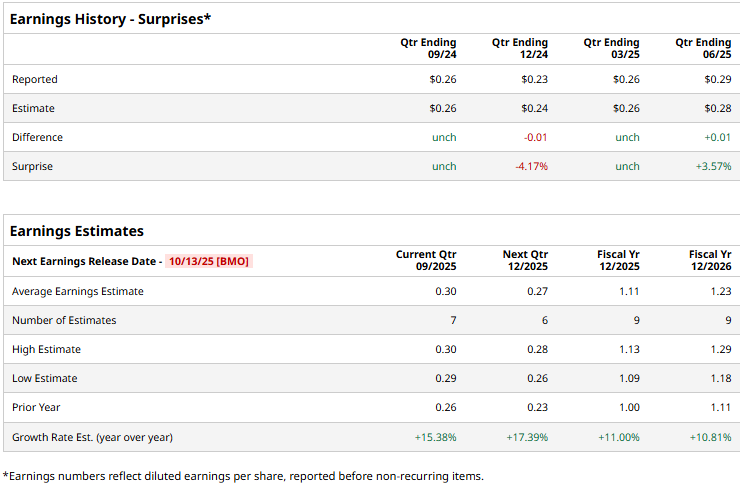

The industrial sector giant is expected to release its third-quarter results before the market opens on Monday, Oct. 13. Ahead of the event, analysts expect FAST to deliver an adjusted EPS of $0.30, up 15.4% from $0.26 reported in the year-ago quarter. The company has a mixed earnings surprise history. While it has met or surpassed the Street’s bottom-line estimates thrice over the past four quarters, it has missed the projections on one other occasion.

For the full fiscal 2025, analysts expect FAST to deliver an EPS of $1.11, up 11% from $1 reported in 2024. Meanwhile, in fiscal 2026, its earnings are expected to grow 10.8% year-over-year to $1.23 per share.

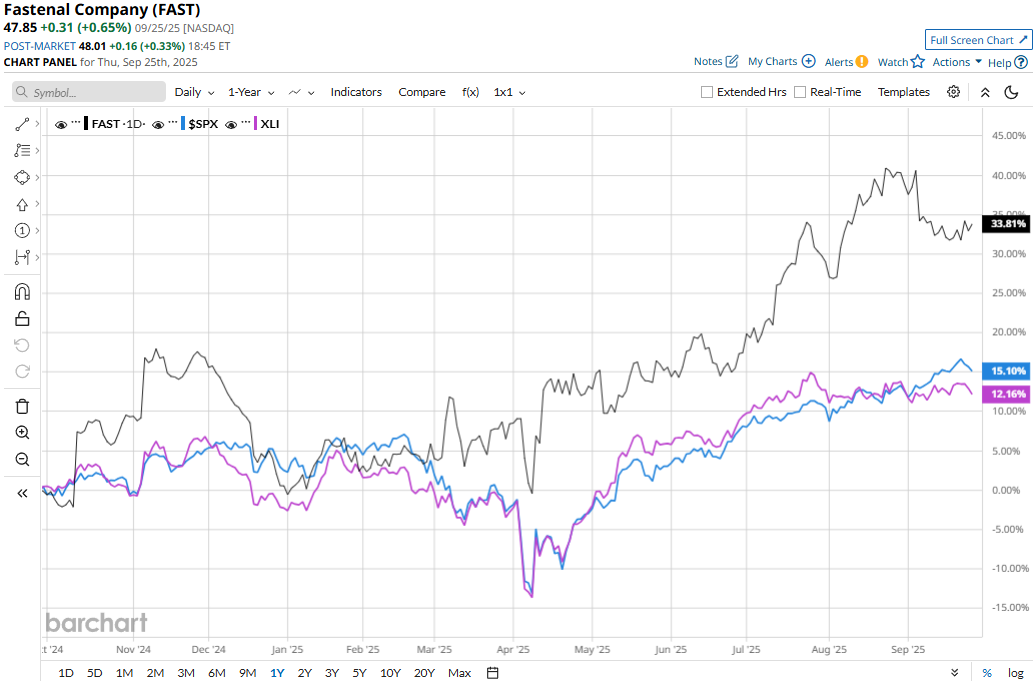

Fastenal’s stock prices have soared 35.3% over the past 52 weeks, outpacing the S&P 500 Index’s ($SPX) 15.4% gains and the Industrial Select Sector SPDR Fund’s (XLI) 12.9% returns during the same time frame.

Fastenal’s stock prices gained 4.2% in the trading session following the release of its better-than-expected Q2 results on Jul. 14. Although market conditions have remained soft in recent times, the company’s results benefited from improved customer contract signings over the past quarters. The company’s topline for the quarter surged 8.6% year-over-year to $2.1 billion, surpassing the Street’s expectations by 88 bps. Furthermore, Fastenal’s EPS for the quarter increased by an impressive 12.7% year-over-year to $0.29, exceeding the consensus estimates by 3.6%.

However, analysts remain cautious about the stock’s prospects, and FAST maintains a consensus “Hold” rating overall. Of the 16 analysts covering the stock, opinions include four “Strong Buys,” 11 “Holds,” and one “Strong Sell.” As of writing, the stock is trading slightly above its mean price target of $46.40.