Valued at a market cap of $32 billion, The Estée Lauder Companies Inc. (EL) is a global leader in prestige beauty, known for its extensive portfolio of skincare, makeup, fragrance, and hair care brands. Headquartered in New York City, the company operates in over 150 countries and territories, targeting both high-end and emerging beauty markets.

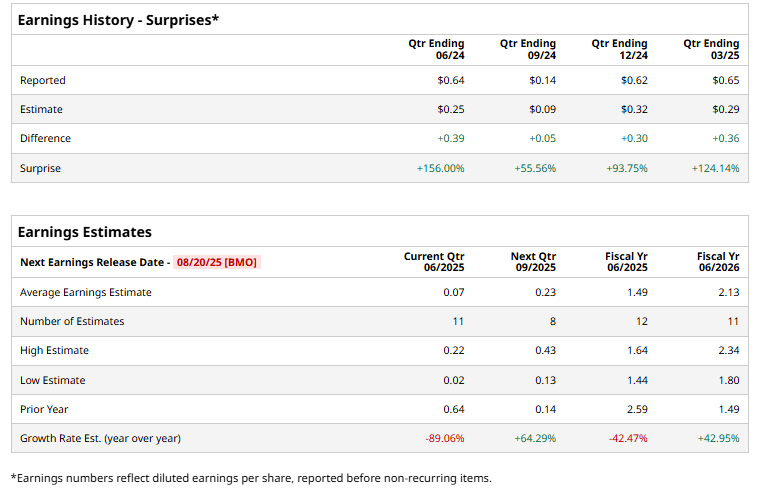

It is scheduled to announce its fiscal Q4 earnings before the market opens on Wednesday, Aug. 20. Ahead of this event, analysts expect this cosmetics giant to report a profit of $0.07 per share, down 89.1% from $0.64 per share in the year-ago quarter. On the bright side, the company has consistently beaten Wall Street’s earnings estimates in each of the last four quarters, which is admirable.

For fiscal 2025, analysts expect EL to report a profit of $1.49 per share, down 42.5% from $2.59 in fiscal 2024. Nonetheless, its EPS is expected to rebound in fiscal 2026 and grow by 43% year over year to $2.13.

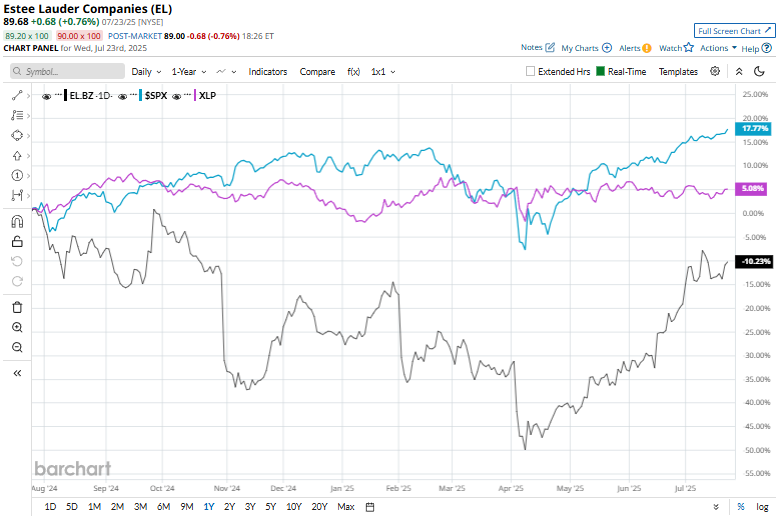

EL has fallen 10.3% over the past 52 weeks, significantly underperforming both the S&P 500 Index's ($SPX) 14.5% surge and the Consumer Staples Select Sector SPDR Fund’s (XLP) 4.9% rise over the same time frame.

On Jul. 27, Estée Lauder shares rose nearly 1.3%, outperforming the flat S&P 500. The uptick followed an analyst upgrade from HSBC Holdings plc (HSBC) Erwan Rambourg, who raised his rating from "Hold" to "Buy" and significantly increased the price target from $80 to $99.

Wall Street analysts are cautious about EL’s stock, with a "Hold" rating overall. Among 24 analysts covering the stock, four recommend "Strong Buy," one indicates a “Moderate Buy,” and 19 suggest “Hold” rating. While EL currently trades significantly above its mean price target of $77.86, its Street-high target of $110 implies an upswing potential of 22.7% from the current market prices.