Pittsburgh, Pennsylvania-based EQT Corporation (EQT) produces, gathers, and transports natural gas and natural gas liquids to utilities, industrial buyers, and marketers. Valued at a market cap of $33.2 billion, the company also provides marketing services, contractual pipeline capacity management services, and is involved in risk management and hedging activities. It is expected to announce its fiscal Q3 earnings for 2025 after the market closes on Tuesday, Oct. 21.

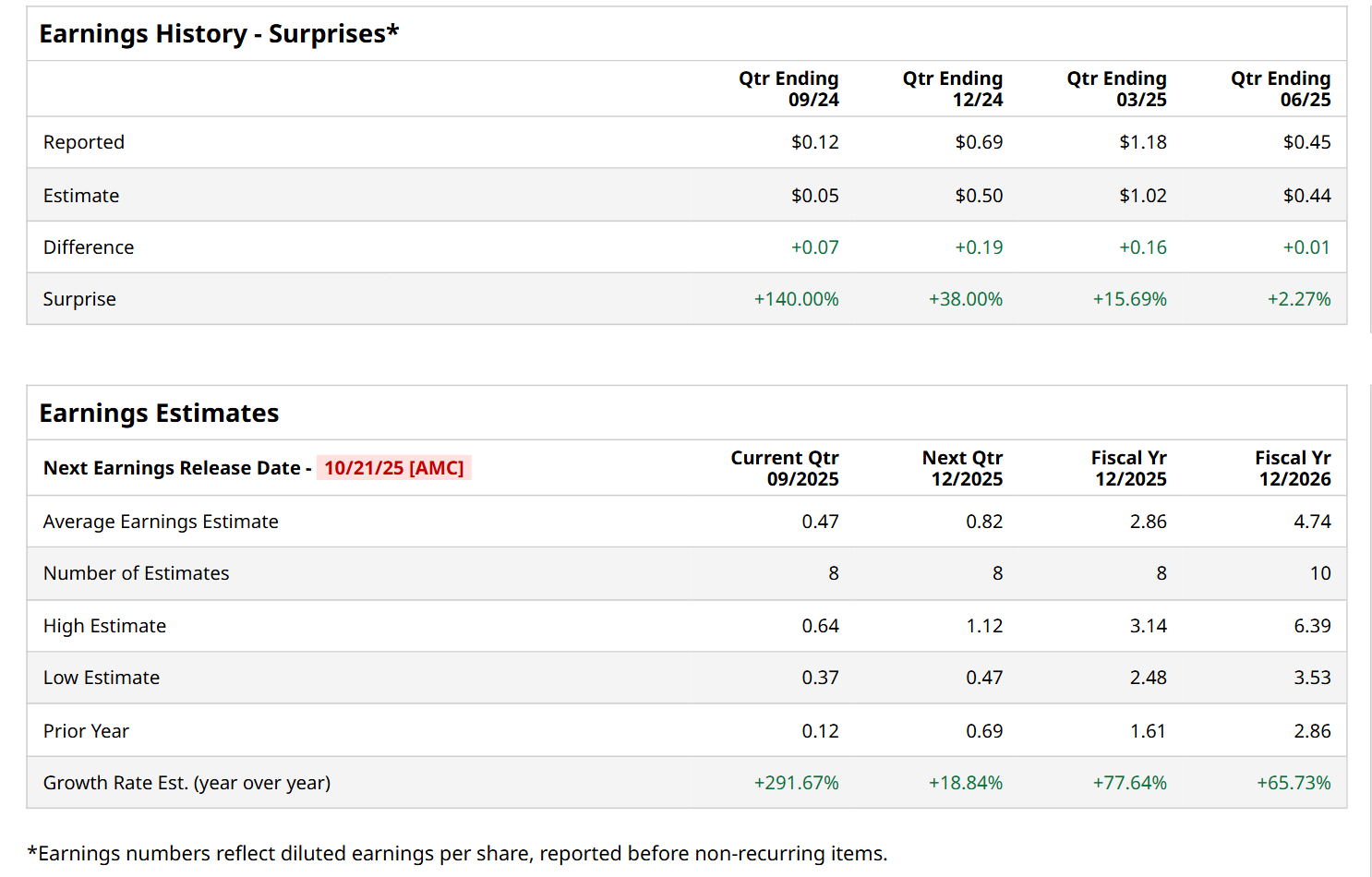

Before this event, analysts expect this energy company to report a profit of $0.47 per share, up by a staggering 291.7% from $0.12 per share in the year-ago quarter. The company has a promising trajectory of consistently beating Wall Street’s bottom-line estimates in each of the last four quarters. Its earnings of $0.45 per share in the previous quarter outpaced the consensus estimates by 2.3%.

For the current fiscal year, ending in December, analysts expect EQT to report a profit of $2.86 per share, representing a notable 77.6% increase from $1.61 per share in fiscal 2024. Furthermore, its EPS is expected to grow 65.7% year-over-year to $4.74 in fiscal 2026.

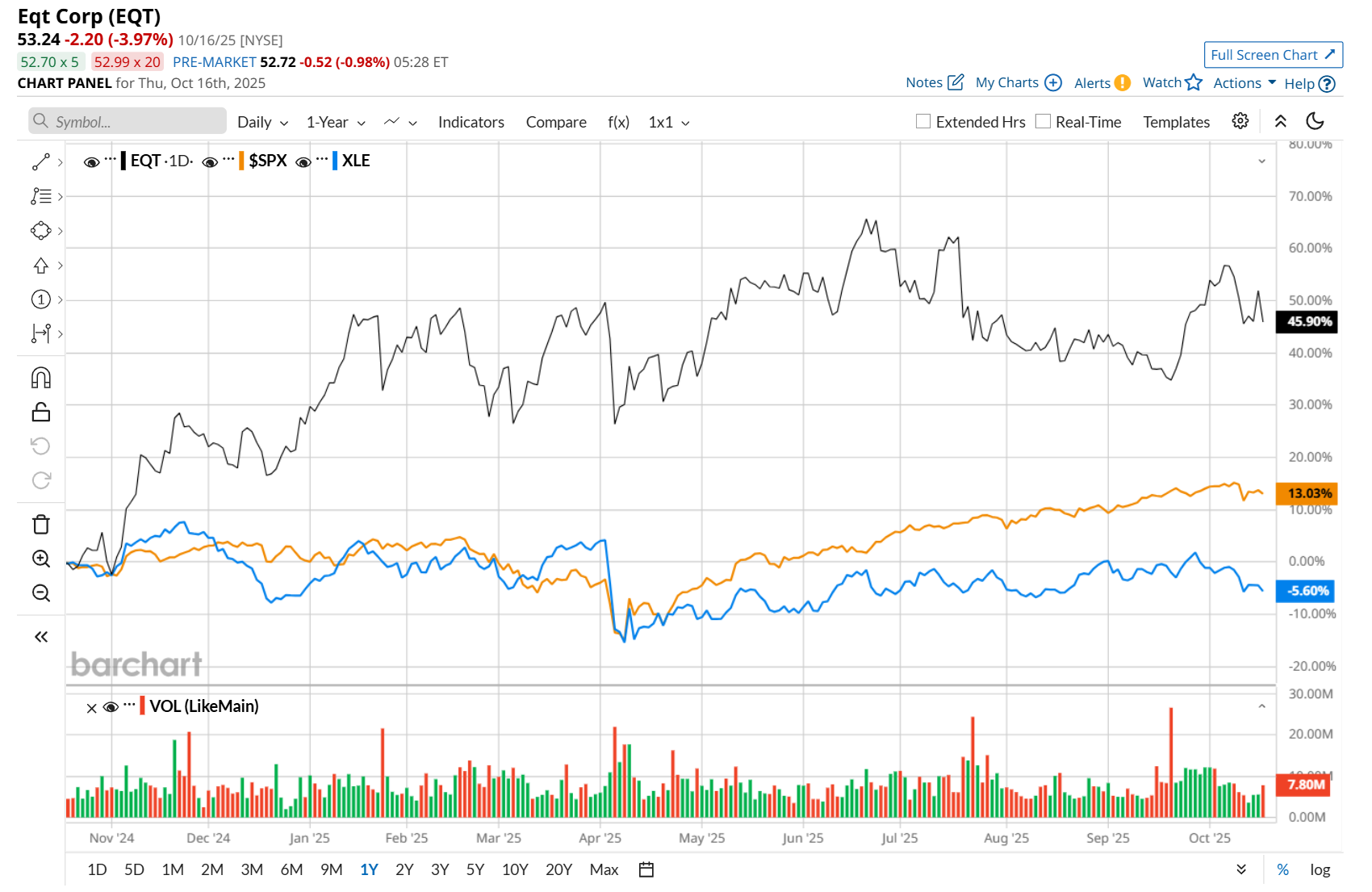

EQT has surged 45.2% over the past 52 weeks, considerably outpacing both the S&P 500 Index's ($SPX) 13.5% uptick and the Energy Select Sector SPDR Fund’s (XLE) 5.5% drop over the same time frame.

On Jul. 22, EQT reported its Q2 results. The company’s quarterly revenue came in at $2.6 billion, up by a strong 168.5% from the year-ago quarter, with natural gas, natural gas liquids and oil sales growing by 91.2%. Its robust top-line growth was supported by higher sales volume and increased average realized prices. Moreover, on the earnings front, its adjusted EPS of $0.45 notably improved from an adjusted loss of $0.08 recorded in the year-ago quarter and came in 2.3% ahead of the consensus estimates. However, despite these positives, its shares plunged 4.4% in the following trading session.

Wall Street analysts are highly optimistic about EQT’s stock, with an overall "Strong Buy" rating. Among 26 analysts covering the stock, 19 recommend "Strong Buy," one indicates a "Moderate Buy,” and six suggest "Hold.” The mean price target for EQT is $64, indicating a 20.2% potential upside from the current levels.