/Dell%20Technologies%20by%20Poetra_RH%20via%20Shutterstock.jpg)

Round Rock, Texas-based Dell Technologies Inc. (DELL) designs, develops, manufactures, markets, sells, and supports various comprehensive and integrated solutions, products, and services. Valued at $106.7 billion by market cap, the company offers laptops, desktops, tablets, workstations, servers, monitors, printers, gateways, software, storage, and networking products. The tech giant is expected to announce its fiscal third-quarter earnings for 2026 after the market closes on Tuesday, Nov. 25.

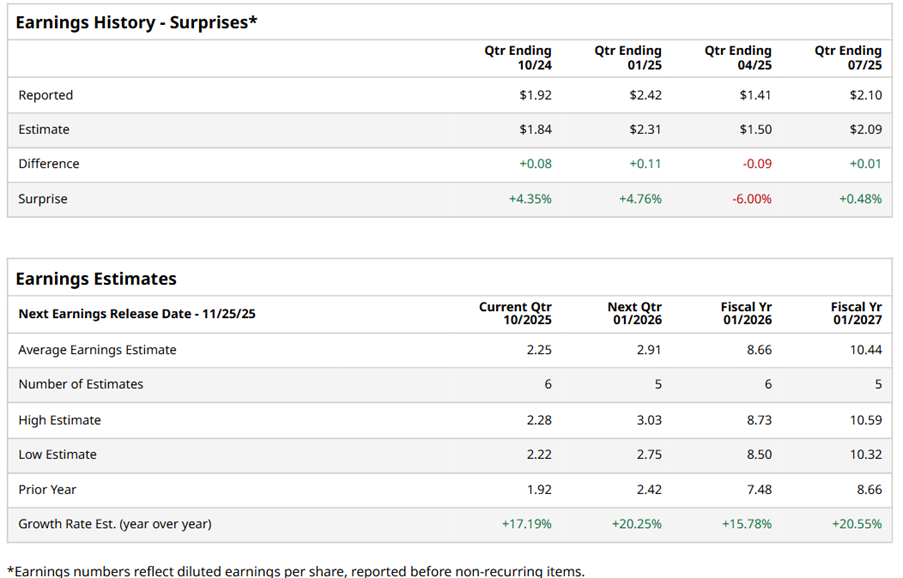

Ahead of the event, analysts expect DELL to report a profit of $2.25 per share on a diluted basis, up 17.2% from $1.92 per share in the year-ago quarter. The company beat the consensus estimates in three of the last four quarters while missing the forecast on another occasion.

For the full year, analysts expect DELL to report EPS of $8.66, up 15.8% from $7.48 in fiscal 2025. Its EPS is expected to rise 20.6% year over year to $10.44 in fiscal 2027.

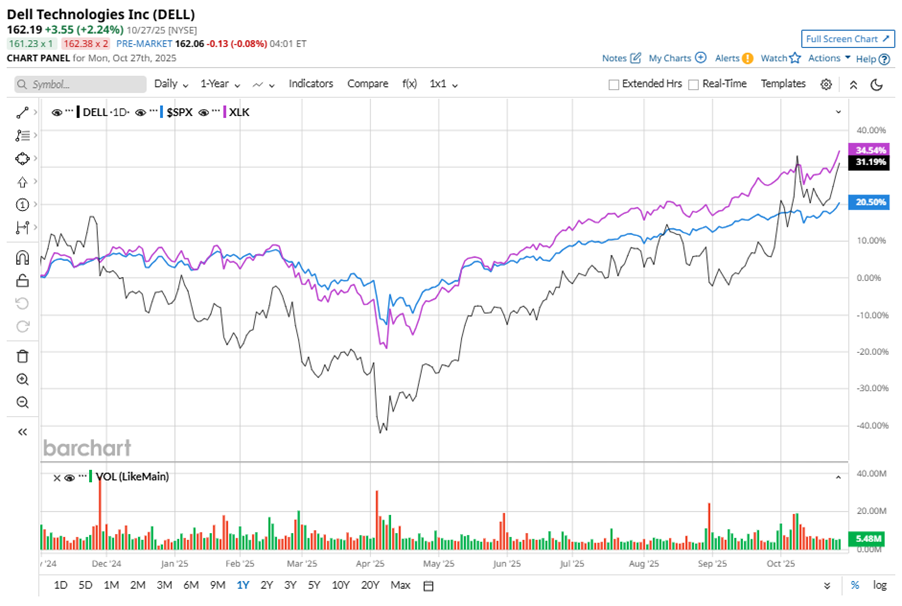

DELL stock has outperformed the S&P 500 Index’s ($SPX) 18.4% gains over the past 52 weeks, with shares up 32.4% during this period. Similarly, it outperformed the Technology Select Sector SPDR Fund’s (XLK) 29.8% gains over the same time frame.

On Oct. 8, Dell announced its latest PowerEdge XR8720t server, which is set to revolutionize the tech landscape with its ability to handle demanding telecom and edge workloads on a single platform. This innovative solution is expected to simplify infrastructure and pave the way for AI-driven tasks. The news sent its shares soaring by over 9%, ahead of its global release in Q1 2026.

On Aug. 28, DELL reported its Q2 results, and its shares closed down by 8.9% in the following trading session. Its adjusted EPS of $2.32 topped Wall Street expectations of $2.31. The company’s revenue was $29.8 billion, beating Wall Street forecasts of $29.3 billion. The company expects full-year revenue of $105 billion to $109 billion.

Analysts’ consensus opinion on DELL stock is bullish, with a “Strong Buy” rating overall. Out of 22 analysts covering the stock, 15 advise a “Strong Buy” rating, two suggest a “Moderate Buy,” and five give a “Hold.” DELL’s average analyst price target is $164.95, indicating a potential upside of 1.7% from the current levels.