/DaVita%20Inc%20logo%20on%20building-by%20JHVEPhoto%20via%20iStock.jpg)

DaVita Inc. (DVA), headquartered in Denver, Colorado, provides kidney dialysis services to patients with chronic kidney failure. Valued at $9 billion by market cap, the company operates kidney dialysis centers and provides related lab services in outpatient dialysis centers. The kidney care giant is expected to announce its fiscal third-quarter earnings for 2025 after the market closes on Wednesday, Oct. 29.

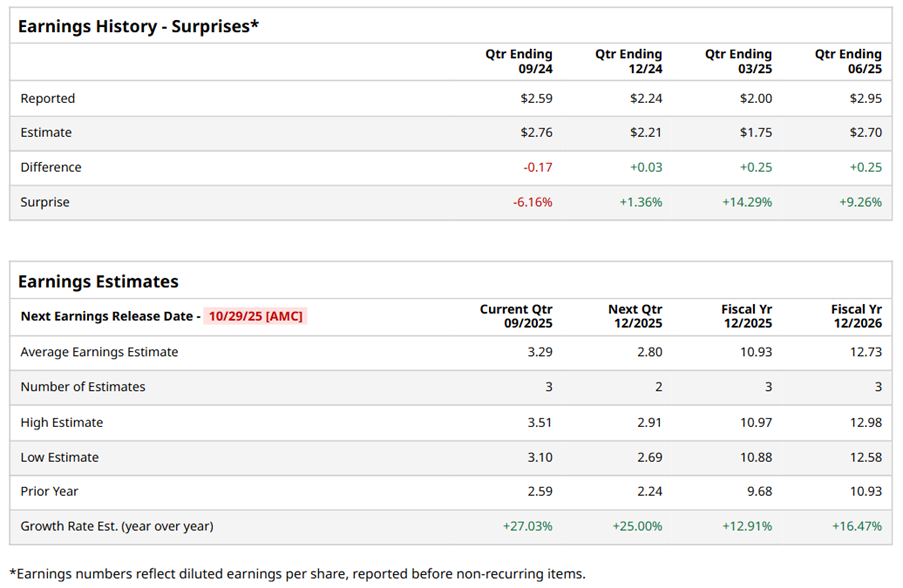

Ahead of the event, analysts expect DVA to report a profit of $3.29 per share on a diluted basis, up 27% from $2.59 per share in the year-ago quarter. The company beat the consensus estimates in three of the last four quarters while missing the forecast on another occasion.

For the full year, analysts expect DVA to report EPS of $10.93, up 12.9% from $9.68 in fiscal 2024. Its EPS is expected to rise 16.5% year over year to $12.73 in fiscal 2026.

DVA stock has considerably underperformed the S&P 500 Index’s ($SPX) 13.5% gains over the past 52 weeks, with shares down 24% during this period. Similarly, it underperformed the Health Care Select Sector SPDR Fund’s (XLV) 7.2% losses over the same time frame.

DVA's underwhelming performance can be chalked up to a notable year-over-year dip in normalized non-acquired treatment, which fell short of expectations. This downturn, coupled with a squeeze on adjusted operating margins, has dampened the stock's prospects.

On Aug. 5, DVA reported its Q2 results, and its shares closed down more than 9% in the following trading session. Its revenue totaled $3.4 billion, up 6.1% year over year. The company’s adjusted EPS came in at $2.95, up 47.5% from the previous quarter.

Analysts’ consensus opinion on DVA stock is cautious, with a “Hold” rating overall. Out of nine analysts covering the stock, one advises a “Strong Buy” rating, seven give a “Hold,” and one recommends a “Moderate Sell.” DVA’s average analyst price target is $150.86, indicating a potential upside of 20.4% from the current levels.