Valued at a market cap of $433.3 billion, Costco Wholesale Corporation (COST) is a membership-based warehouse retailer that operates a chain of large-format stores offering a wide range of branded and private-label merchandise. The Issaquah, Washington-based company is scheduled to announce its fiscal Q2 earnings for 2026 in the near future.

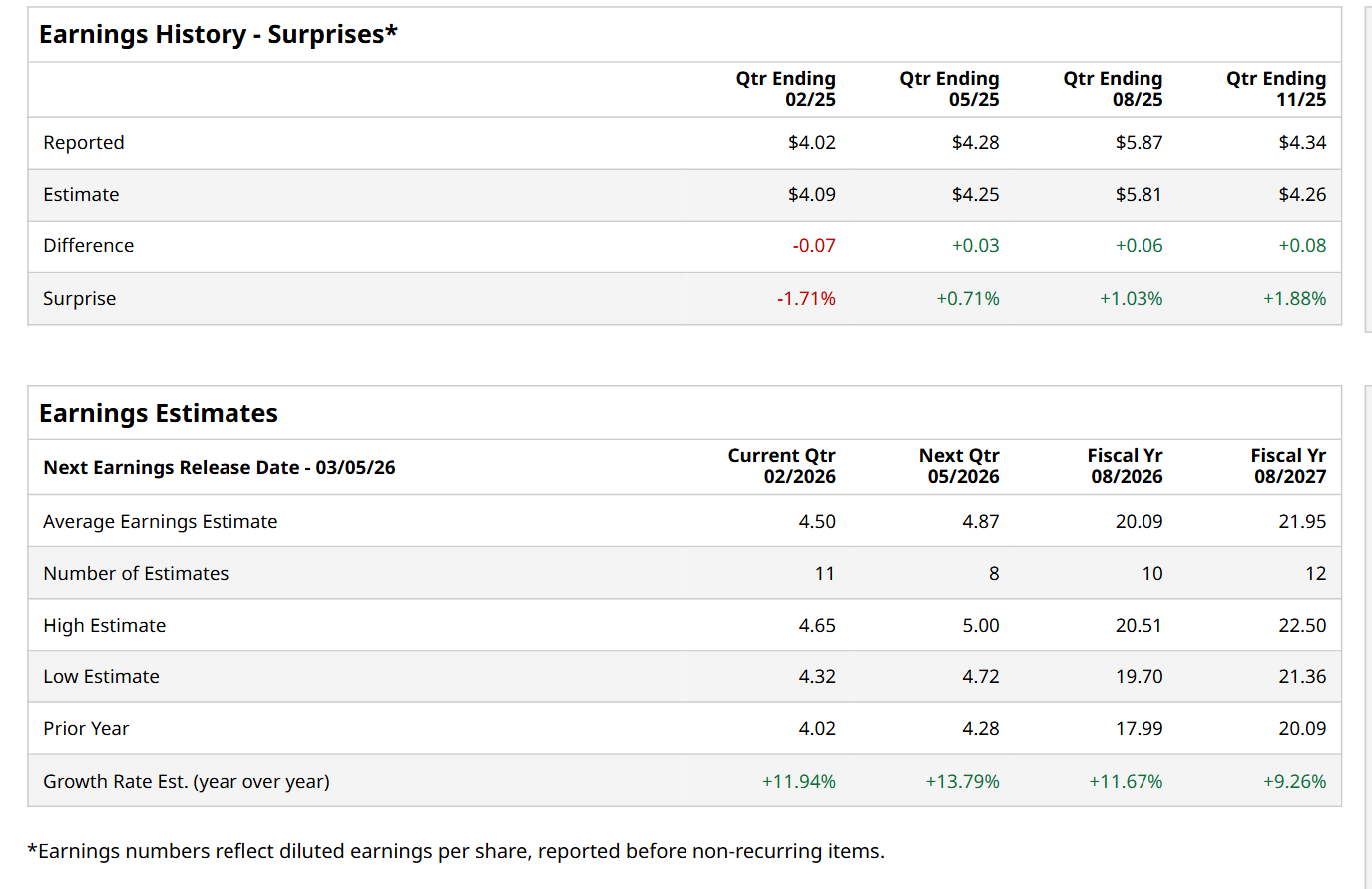

Ahead of this event, analysts expect this discount store operator to report a profit of $4.50 per share, up 11.9% from $4.02 per share in the year-ago quarter. The company surpassed Wall Street’s bottom-line estimates in three of the last four quarters, while missing on another occasion. Its earnings of $4.34 per share in the previous quarter exceeded the forecasted figure by 1.9%.

For fiscal 2026, ending in August, analysts expect COST to report a profit of $20.09 per share, up 11.7% from $17.99 per share in fiscal 2025. Its EPS is expected to further grow 9.3% year-over-year to $21.95 in fiscal 2027.

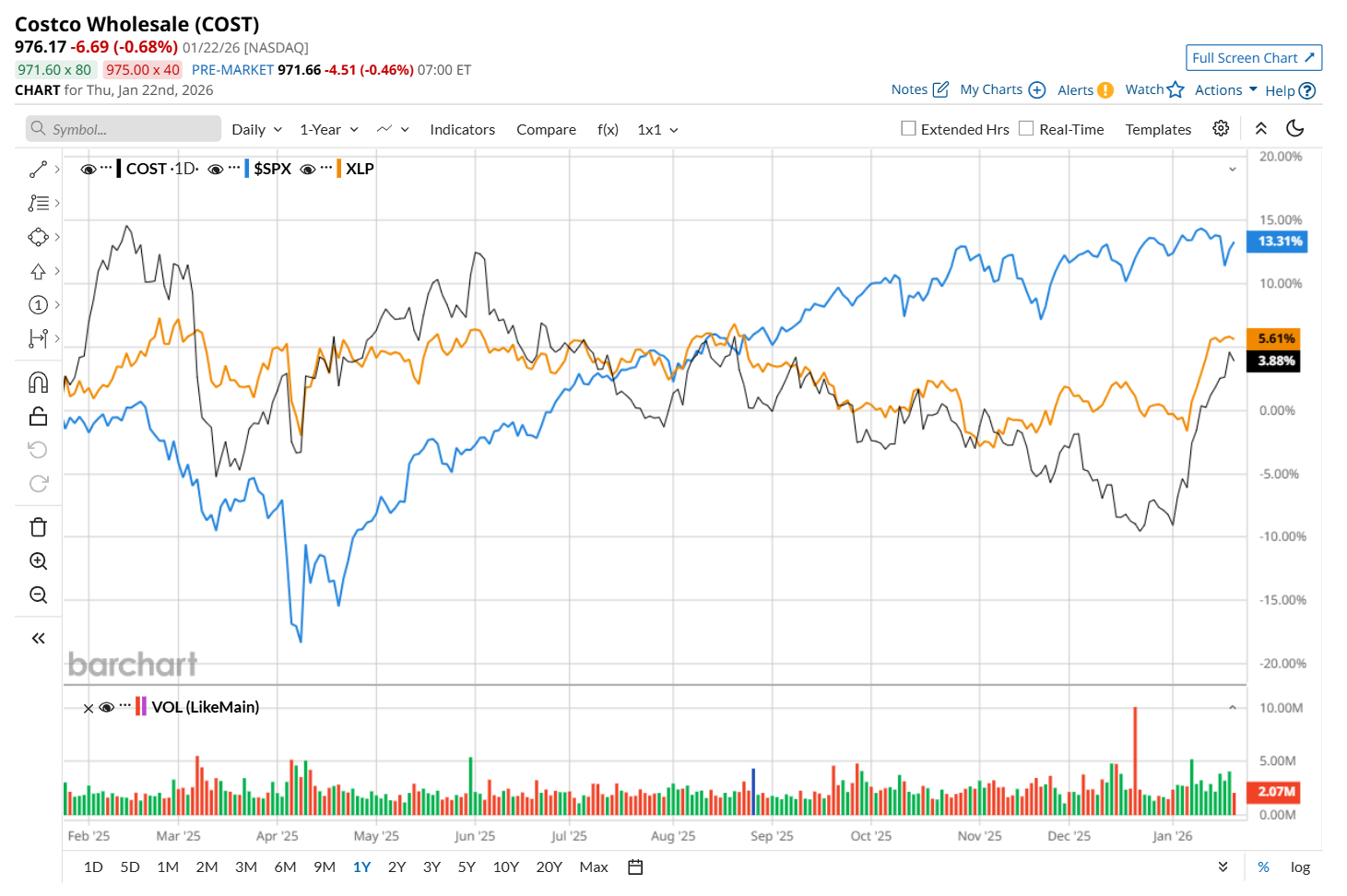

COST has gained 3.3% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 13.6% return and the State Street Consumer Staples Select Sector SPDR ETF’s (XLP) 6.5% uptick over the same time period.

On Dec. 11, COST delivered its Q1 results. The company’s total revenue increased 8.3% year-over-year to $67.3 billion, driven by new warehouse openings, growth in membership fees, productivity enhancement, and increased adoption of digital tools. Moreover, its net income per share came in at $4.50, up 11.4% from the same period last year. Despite these positives, its shares remained muted in the following trading session.

Wall Street analysts are moderately optimistic about COST’s stock, with an overall "Moderate Buy" rating. Among 35 analysts covering the stock, 19 recommend "Strong Buy," four suggest "Moderate Buy,” 11 indicate "Hold,” and one advises a “Strong Sell” rating. The average price target for COST is $1,043.32, indicating a 6.9% potential upside from the current levels.