Indianapolis, Indiana-based Corteva, Inc. (CTVA) is an agriculture company that provides farmers with a comprehensive portfolio of seed and crop protection solutions to maximize productivity and promote sustainable farming practices. Valued at a market cap of $42.1 billion, the company is expected to announce its fiscal Q3 earnings for 2025 after the market closes on Tuesday, Nov. 4.

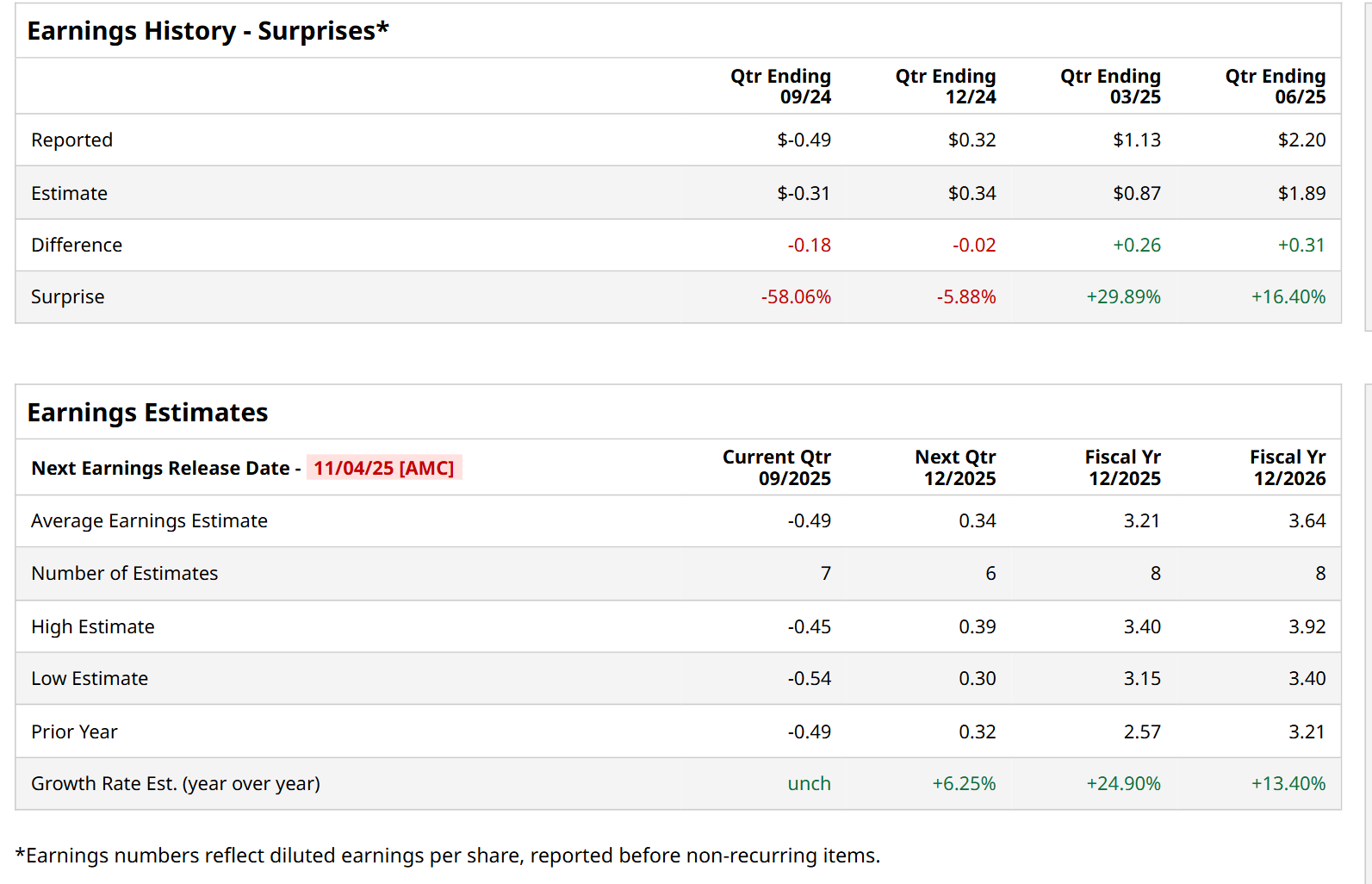

Before this event, analysts expect this agriculture company to report a loss of $0.49 per share, in line with the year-ago quarter. The company has surpassed Wall Street’s bottom-line estimates in two of the last four quarters, while missing on two other occasions. Its earnings of $2.20 per share in the previous quarter outpaced the consensus estimates by a notable margin of 16.4%.

For fiscal 2025, analysts expect Corteva to report a profit of $3.21 per share, representing a 24.9% increase from $2.57 per share in fiscal 2024. Furthermore, its EPS is expected to grow 13.4% year-over-year to $3.64 in fiscal 2026.

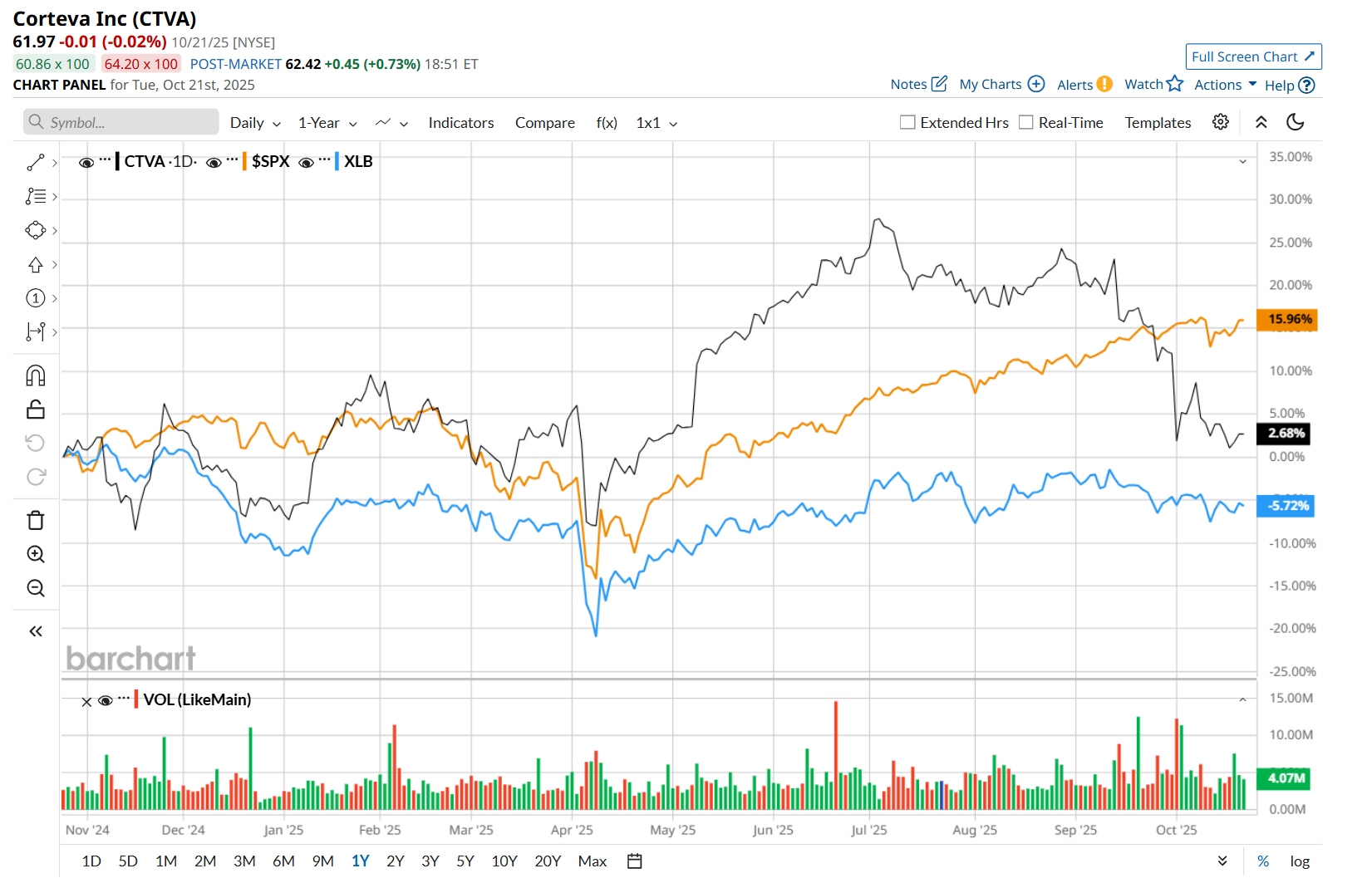

CTVA has gained 4.6% over the past 52 weeks, lagging behind the S&P 500 Index's ($SPX) 15.1% uptick over the same time frame. However, it has outpaced the Materials Select Sector SPDR Fund’s (XLB) 8.6% drop over the same time period.

Corteva posted stronger-than-expected Q2 results on Aug. 6. Due to gains across all regions, the company’s net sales advanced 5.6% year-over-year to $6.5 billion, surpassing consensus estimates by 3.4%. Moreover, its operating EPS of $2.20 improved 20.2% from the year-ago quarter, exceeding analyst expectations by a notable margin of 16.4%. Additionally, CTVA raised its fiscal 2025 guidance, reflecting strong first-half performance. It now expects operating EPS to be in the range of $3 to $3.20, and net sales to be between $17.6 billion and $17.8 billion. However, despite the upbeat results and guidance, its shares plunged marginally in the following trading session.

Wall Street analysts are highly optimistic about CTVA’s stock, with an overall "Strong Buy" rating. Among 22 analysts covering the stock, 15 recommend "Strong Buy," two indicate "Moderate Buy,” and five suggest "Hold.” The mean price target for Corteva is $79.42, indicating a 28.2% potential upside from the current levels.

.png?w=600)