/CME%20Group%20Inc%20Chicago%20office-by%20JHVEPhoto%20via%20iStock.jpg)

Valued at $95.4 billion by market cap, CME Group Inc. (CME) is the world's largest and most diverse derivatives marketplace, operating major exchanges such as the Chicago Mercantile Exchange (CME) and the Chicago Board of Trade (CBOT). The company, headquartered in Chicago, Illinois, provides crucial platforms for trading futures and options across a wide range of asset classes, including interest rates, energy, and equity indexes.

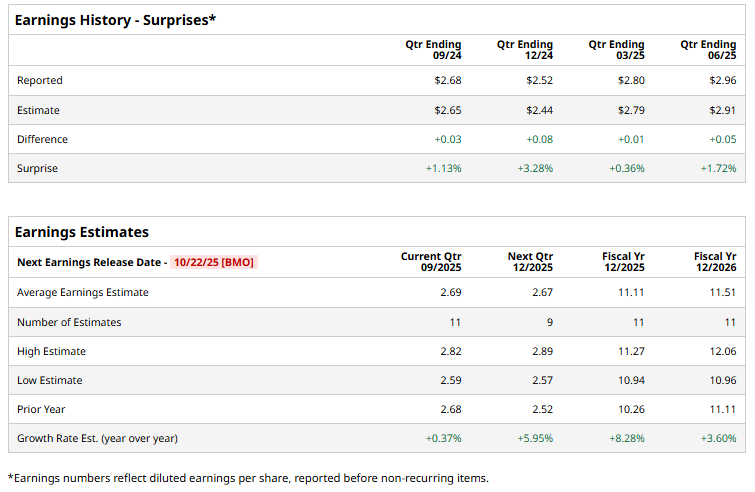

The leading derivatives marketplace is expected to announce its fiscal third-quarter earnings for 2025 before the market opens on Wednesday, Oct. 22. Ahead of the event, analysts expect CME to report a profit of $2.69 per share on a diluted basis, up marginally from $2.68 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the full year, analysts expect CME to report EPS of $11.11, up 8.3% from $10.26 in fiscal 2024. Its EPS is expected to rise 3.6% year over year to $11.51 in fiscal 2026.

CME shares have soared 18% over the past year, surpassing the S&P 500 Index’s ($SPX) 17.8% gains and the Financial Select Sector SPDR Fund’s (XLF) 19.7% gains over the same time frame.

On Sept. 25, CME Group stock rose by more than 1% because Citigroup Inc. (C) upgraded its rating on the stock from "Neutral" to "Buy" and increased the price target to $300.

Analysts’ consensus opinion on CME stock is moderately bullish, with a “Moderate Buy” rating overall. Out of 20 analysts covering the stock, six advise a “Strong Buy” rating, two suggest a “Moderate Buy,” nine give a “Hold,” one recommends a “Moderate Sell,” and two advocate a “Strong Sell.” CME’s mean price target of $308 suggests an upside potential of 11.3% from the prevailing price levels.