/Cboe%20Global%20Markets%20Inc_%20logoon%20phone-by%20Piotr%20Swat%20via%20Shutterstoc.jpg)

Chicago, Illinois-based Cboe Global Markets, Inc. (CBOE) operates as one of the largest stock exchange operators by volume in the U.S. and a leading market globally for ETP trading. With a market cap of $24.8 billion, the company operates through Options, North American Equities, Europe and Asia Pacific, Futures, Global FX, and Digital segments.

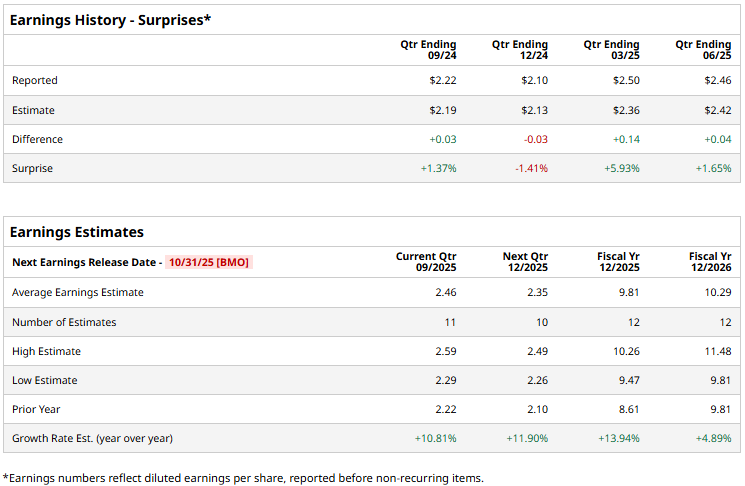

The financial sector giant is gearing up to announce its third-quarter results before the markets open on Friday, Oct. 31. Ahead of the event, analysts expect Cboe to report an adjusted profit of $2.46 per share, up 10.8% from $2.22 per share reported in the year-ago quarter. While the company has missed the Street’s bottom-line projections once over the past four quarters, it has surpassed the projections on three other occasions.

For fiscal 2025, analysts expect Cboe to report an adjusted EPS of $9.81, up 13.9% from $8.61 in fiscal 2024. In fiscal 2026, its adjusted earnings are expected to grow 4.9% year-over-year to $10.29 per share.

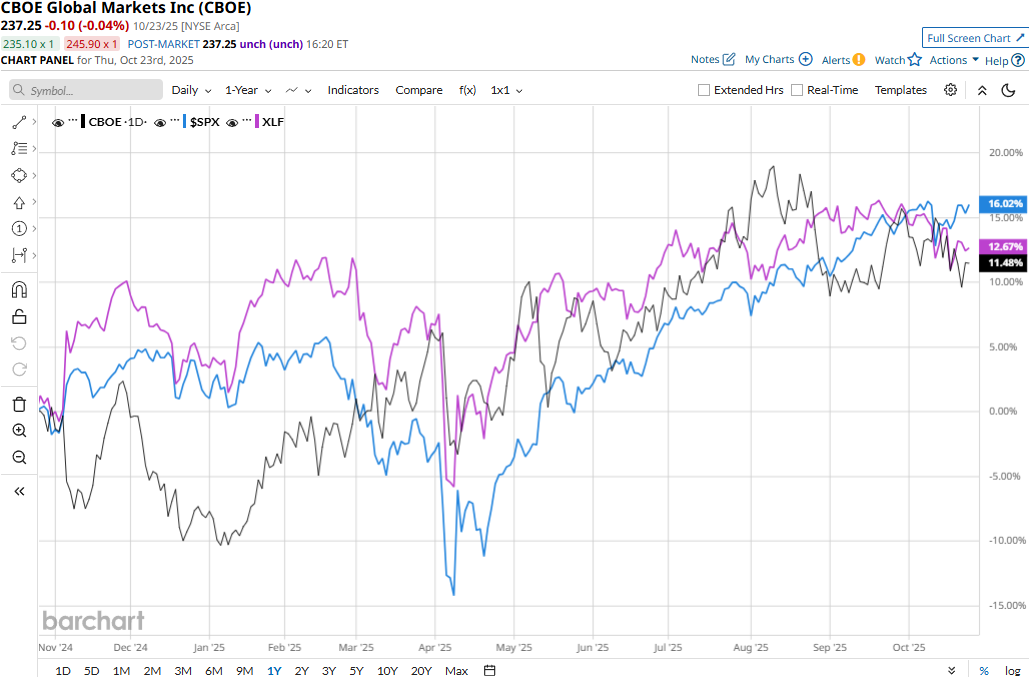

CBOE stock prices have gained 11.1% over the past 52 weeks, lagging behind the Financial Select Sector SPDR Fund’s (XLF) 11.5% gains and the S&P 500 Index’s ($SPX) 16.2% surge during the same time frame.

Cboe Global Markets’ stock prices gained 2.8% in the trading session following the release of its impressive Q2 results on Aug. 1. The company observed double-digit topline growth across derivatives, data vantage, and cash and spot markets, leading to a solid 14.3% year-over-year surge in net revenues to $587.3 million, exceeding the Street expectations by 2.6%. Moreover, the company observed 14% growth in adjusted net income to $257.8 million, and its adjusted EPS of $2.46 surpassed the consensus estimates by 1.7%.

Analysts remain cautious about the stock’s prospects. Cboe has a consensus “Hold” rating overall. Of the 18 analysts covering the Cboe stock, opinions include three “Strong Buys,” one “Moderate Buy,” 12 “Holds,” and two “Strong Sells.” Its mean price target of $248.20 suggests a modest 4.6% upside potential from current price levels.

.png?w=600)