Houston, Texas-based Camden Property Trust (CPT) owns, manages, develops, repositions, redevelops, acquires, and constructs multifamily apartment communities. Valued at $12.2 billion by market cap, it owns and operates 172 properties containing 58,250 apartment homes across the U.S. The leading apartment REIT is expected to announce its fiscal second-quarter earnings for 2025 after the market closes on Thursday, Jul. 31.

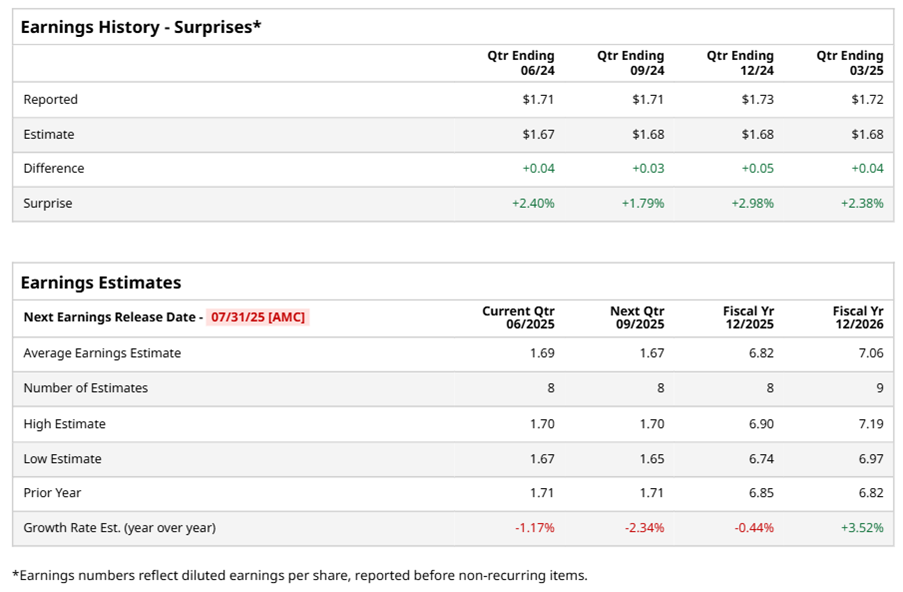

Ahead of the event, analysts expect CPT to report an FFO of $1.69 per share on a diluted basis, down 1.2% from $1.71 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s FFO estimates in its last four quarterly reports.

For the full year, analysts expect CPT to report FFO of $6.82 per share, down marginally from $6.85 per share in fiscal 2024. However, its FFO is expected to rise 3.5% year over year to $7.06 per share in fiscal 2026.

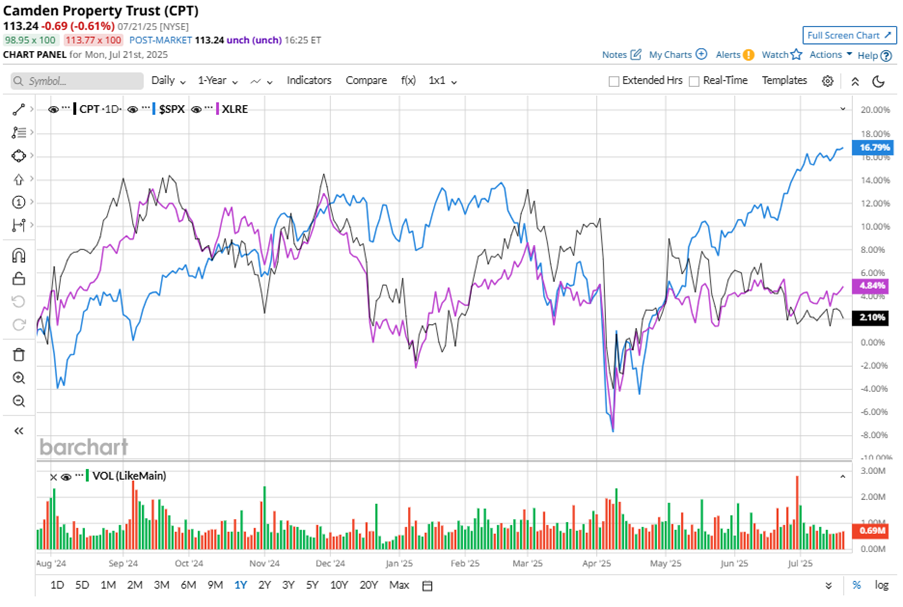

CPT stock has underperformed the S&P 500 Index’s ($SPX) 14.5% gains over the past 52 weeks, with shares up marginally during this period. Similarly, it underperformed the Real Estate Select Sector SPDR Fund’s (XLRE) 3.7% gains over the same time frame.

CPT's underperformance is attributed to a high supply of rental units in specific markets, resulting in increased competition and limiting rent growth. The company also faces competition from other housing options. Additionally, high debt burden and elevated interest rates are hindering CPT’s growth potential.

On May 1, CPT reported its Q1 results, and its shares closed up more than 5% in the following trading session. Its core FFO of $1.72 per share exceeded Wall Street expectations of $1.68 per share. The company’s revenue was $390.6 million, topping Wall Street forecasts of $388 million. For Q2, CPT expects its core FFO to be in the range of $1.67 to $1.71 per share.

Analysts’ consensus opinion on CPT stock is reasonably bullish, with an overall “Moderate Buy” rating. Out of 25 analysts covering the stock, eight advise a “Strong Buy” rating, one suggests a “Moderate Buy,” 14 give a “Hold,” and two recommend a “Strong Sell.” CPT’s average analyst price target is $128.40, indicating a potential upside of 13.4% from the current levels.