/Bio-Techne%20Corp%20logo%20and%20data-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Bio-Techne Corporation (TECH), headquartered in Minneapolis, Minnesota, develops, manufactures, and sells life science reagents, instruments, and services for the research, diagnostics, and bioprocessing markets. Valued at $9.3 billion by market cap, the company specializes in proteins, cytokines, growth factors, immunoassays and small molecules. The leading life sciences reagents and instruments company is expected to announce its fiscal first-quarter earnings for 2026 in the near term.

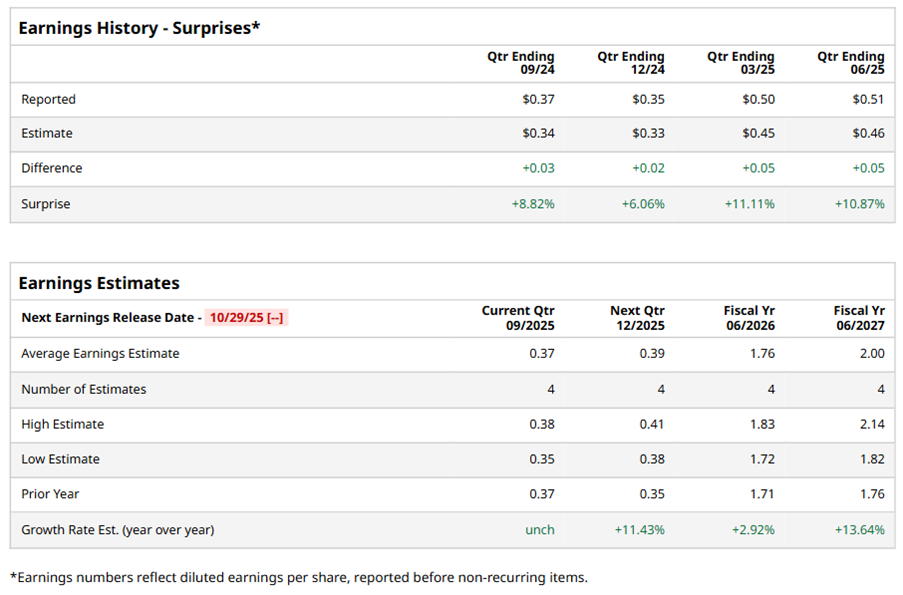

Ahead of the event, analysts expect TECH to report a profit of $0.37 per share on a diluted basis, unchanged from the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the full year, analysts expect TECH to report EPS of $1.76, up 2.9% from $1.71 in fiscal 2025. Its EPS is expected to rise 13.6% year over year to $2 in fiscal 2027.

TECH stock has significantly underperformed the S&P 500 Index’s ($SPX) 14.4% gains over the past 52 weeks, with shares down 18.7% during this period. Similarly, it underperformed the Health Care Select Sector SPDR Fund’s (XLV) 7.8% losses over the same time frame.

On Aug. 6, TECH shares closed down by 8.7% after reporting its Q4 results. Its adjusted EPS of $0.53 surpassed Wall Street expectations of $0.50. The company’s revenue was $317 million, exceeding Wall Street forecasts of $315.4 million.

Analysts’ consensus opinion on TECH stock is bullish, with a “Strong Buy” rating overall. Out of 16 analysts covering the stock, 11 advise a “Strong Buy” rating, one suggests a “Moderate Buy,” and four give a “Hold.” TECH’s average analyst price target is $66.77, indicating a potential upside of 11.9% from the current levels.