/Ball%20Corp_%20%20jar%20by-%20duckycards%20via%20iStock.jpg)

Westminster, Colorado-based Ball Corporation (BALL) supplies aluminum packaging products for the beverage, personal care, and household products industries. Valued at a market cap of $12.9 billion, the company specializes in aluminum beverage containers, aluminum aerosol packaging, and other metal packaging products, with a strong focus on innovation and environmental sustainability. It is expected to announce its fiscal Q3 earnings for 2025 before the market opens on Tuesday, Nov. 4.

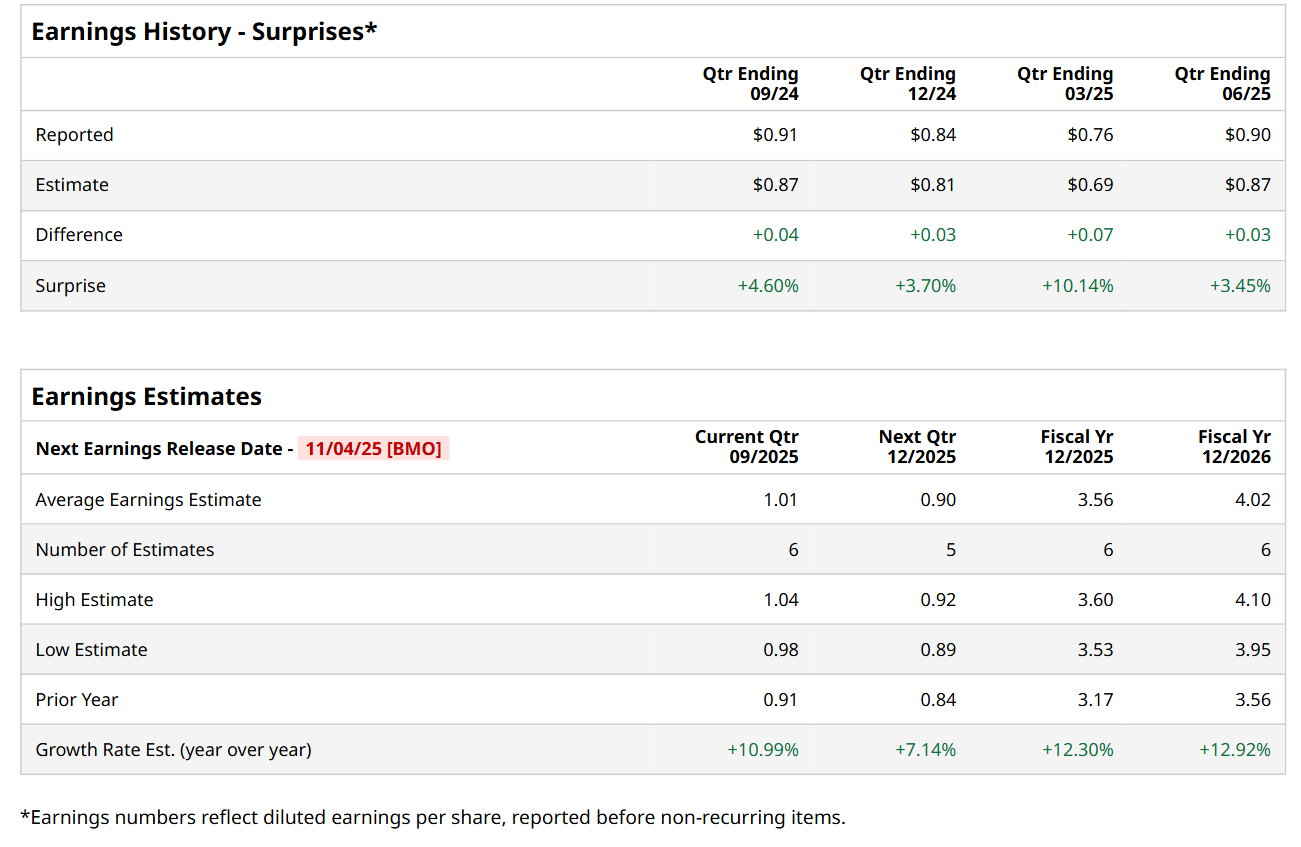

Before this event, analysts expect this packaging company to report a profit of $1.01 per share, up 11% from $0.91 per share in the year-ago quarter. The company has a promising trajectory of consistently beating Wall Street’s bottom-line estimates in each of the last four quarters. Its earnings of $0.90 per share in the previous quarter outpaced the consensus estimates by 3.5%.

For fiscal 2025, analysts expect BALL to report a profit of $3.56 per share, up 12.3% from $3.17 per share in fiscal 2024. Its EPS is expected to further grow 12.9% year-over-year to $4.02 in fiscal 2026.

Shares of BALL have declined 27.9% over the past 52 weeks, considerably underperforming both the S&P 500 Index's ($SPX) 13.4% return and the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 19.1% rise over the same time frame.

On Aug. 5, BALL reported better-than-expected Q2 results. The company’s revenue increased 12.8% year-over-year to $3.3 billion, surpassing consensus estimates by 6%. Meanwhile, its comparable EPS of $0.90 advanced 21.6% from the prior-year quarter and came in 3.5% ahead of analyst estimates. Additionally, BALL raised its fiscal 2025 comparable EPS growth guidance, now expecting it to be between 12% and 15%. However, despite this upbeat performance, its stock price dropped 5.8% after the earnings release.

Wall Street analysts are moderately optimistic about BALL’s stock, with a "Moderate Buy" rating overall. Among 14 analysts covering the stock, five recommend "Strong Buy," two indicate "Moderate Buy," six suggest "Hold,” and one advises a "Strong Sell” rating. The mean price target for BALL is $61.92, indicating a 30.1% potential upside from the current levels.