Valued at $24.6 billion by market cap, Atmos Energy Corporation (ATO) is one of the largest fully regulated natural gas-only utilities in the U.S., serving over 3.3 million customers across eight states through its distribution and pipeline & storage segments. The Dallas, Texas-based company operates more than 79,000 miles of distribution pipelines and over 5,700 miles of transmission pipelines, along with several underground storage facilities.

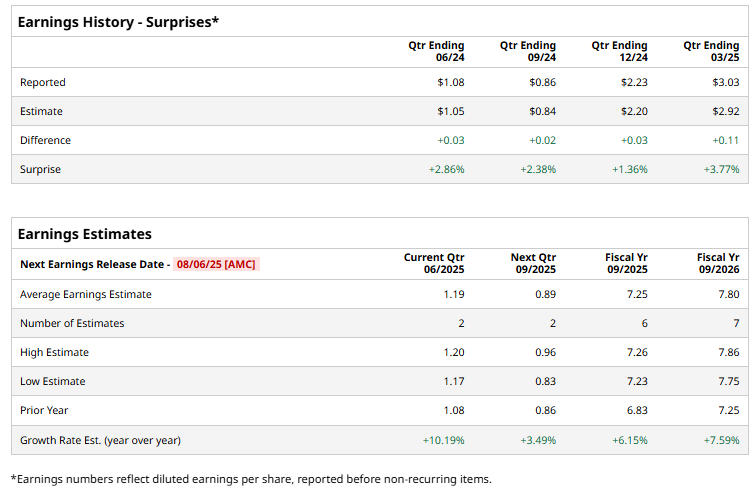

ATO is set to deliver its third-quarter results after the markets close on Wednesday, Aug. 6. Ahead of the event, analysts expect the utility giant to report an adjusted EPS of $1.19, up 10.2% from $1.08 reported in the year-ago quarter. Moreover, the company has surpassed the Street’s bottom-line expectations in each of the past four quarters, which is admirab.

For the current year, ATO is expected to report an adjusted EPS of $7.25, marking a 6.2% increase from $6.83 reported in fiscal 2024.

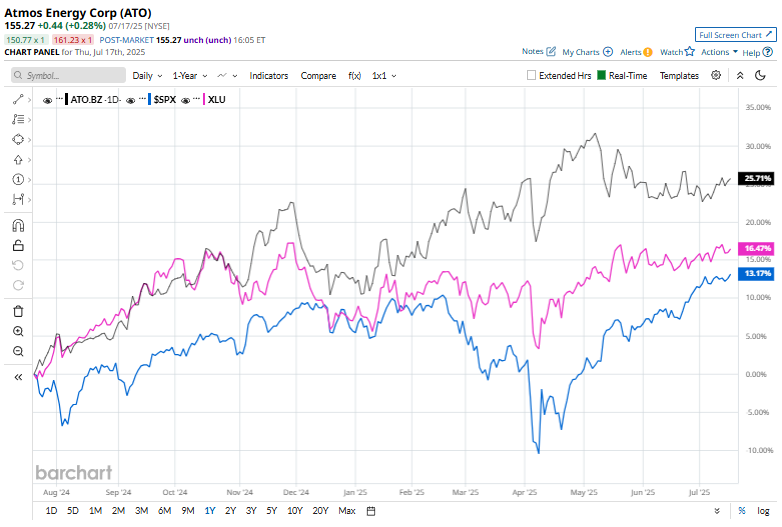

ATO shares have soared 24.6% over the past 52 weeks, outperforming the S&P 500 Index’s ($SPX) 12.7% returns and the Utility Select Sector SPDR Fund’s (XLU) 17.5% gains during the same time frame.

On May 7, ATO shares rose marginally after reporting its Q2 results. Its revenue rose 18.4% year-over-year to $1.95 billion and net income stood at $486 million, driving EPS up to $3.03. Additionally, both its Distribution and Pipeline & Storage segments saw solid growth, while capital expenditures totaled $839.7 million for the quarter, focused primarily on safety and system reliability.

Atmos also raised its full-year EPS guidance to $7.20–$7.30 and increased its dividend by 8.1%, reflecting continued operational momentum and regulatory success.

The consensus view on ATO stock remains moderately optimistic, with a “Moderate Buy” rating overall. Of the 14 analysts covering the stock, opinions include six “Strong Buys,” one “Moderate Buy,” and seven “Holds.” ATO’s mean price target of $160.82 indicates a 3.6% upswing from the current market prices.