/AMGEN%20Inc_%20logo%20on%20meds-by%20Melnikov%20Dmitriy%20via%20Shutterstock.jpg)

Amgen Inc. (AMGN) is a California-based biopharmaceutical company focused on developing and delivering human therapeutics, especially in oncology, inflammation, bone health, and rare diseases. With a market cap of $159.7 billion, it’s known for blockbuster drugs like Prolia, Enbrel, and Repatha.

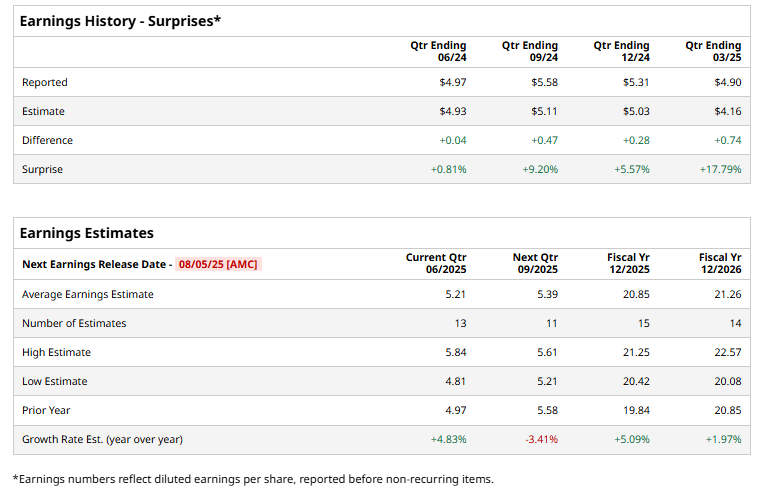

The company is expected to release its fiscal Q2 2025 earnings results after the market closes on Tuesday, Aug. 5. Ahead of this event, analysts expect AMGN to report a profit of $5.21 per share, up 4.8% from $4.97 per share in the prior year's quarter. It has consistently surpassed Wall Street's bottom-line estimates in the past four quarters.

For fiscal 2025, analysts predict AMGN to post EPS of $20.85, reflecting a 5.1% increase from $19.84 in fiscal 2024.

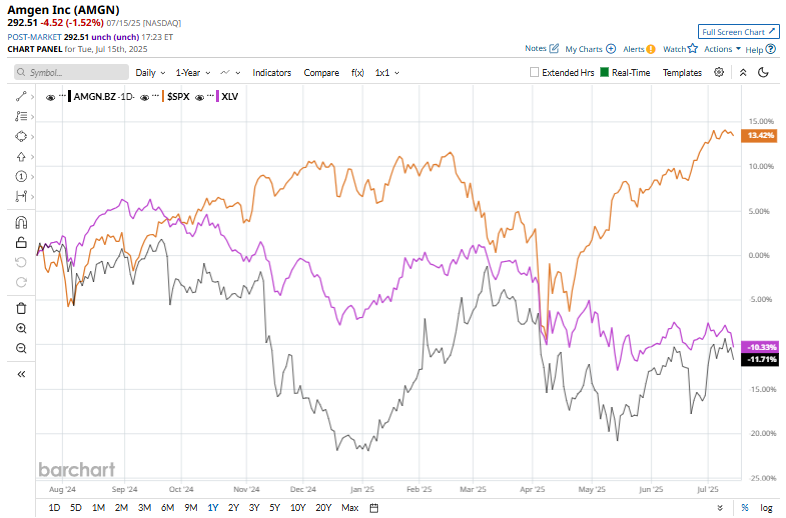

AMGN has declined 11.4% over the past 52 weeks, lagging behind the S&P 500 Index's ($SPX) 10.9% gain and the Health Care Select Sector SPDR Fund's (XLV) 10.3% dip over the same period.

On July 1, Amgen shares rose over 4%, outperforming the S&P 500, after announcing positive Phase 3 trial results for its experimental stomach cancer drug, bemarituzumab. The drug, when combined with chemotherapy, significantly improved overall survival in patients with advanced gastric or gastroesophageal cancers compared to a placebo.

Analysts' consensus rating on AMGN stock is cautiously optimistic, with a "Moderate Buy" rating overall. Out of 32 analysts covering the stock, opinions include 12 "Strong Buys,” two "Moderate Buy," 15 "Holds,” one "Moderate Sell," and two "Strong Sells.” The average analyst price target for AMGN is $315.15, suggesting a potential upside of 7.7% from current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.