Valued at $109.1 billion by market cap, Altria Group, Inc. (MO) is a leading tobacco company headquartered in Richmond, Virginia. Altria owns prominent brands such as Marlboro, Black & Mild, and Copenhagen and operates through segments including smokeable products, oral tobacco, and wine.

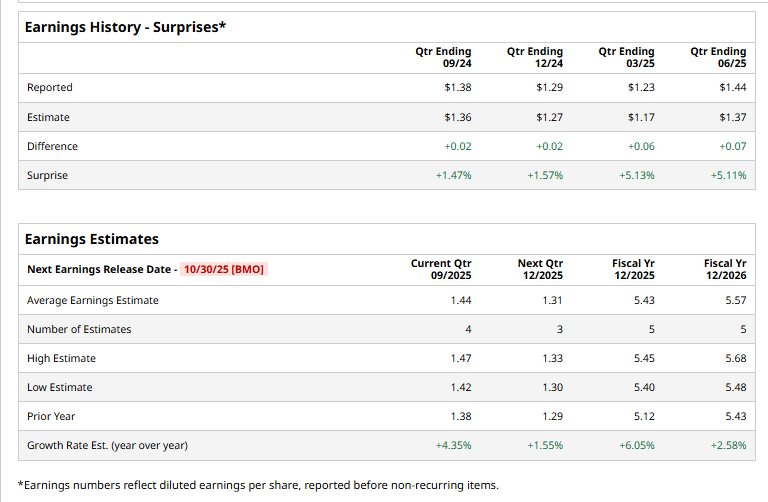

Altria Group is ready to release its third-quarter results before the markets open on Thursday, Oct. 30. Ahead of the event, analysts expect MO to report an adjusted EPS of $1.44, up 4.4% from $1.38 reported in the year-ago quarter. The company has surpassed Street’s bottom-line estimates in all of the past four quarters.

For fiscal 2025, MO is expected to deliver an adjusted EPS of $5.43, up 6.1% from $5.12 reported in fiscal 2024.

Over the past 52 weeks, MO shares have climbed 31.2%, outperforming both the S&P 500 Index’s ($SPX) 13.4% return and the Consumer Staples Select Sector SPDR Fund’s (XLP) 3.5% fall during the same time frame.

On October 9, Bank of America Securities analyst Lisa Lewandowski reaffirmed a “Buy” rating on Altria Group. Following the news, MO shares climbed 1.3% in the next trading session.

The consensus view on Altria is neutral with a “Hold” rating overall. Of the 15 analysts covering the MO stock, four recommend “Strong Buy,” nine advise “Hold,” one advocates “Moderate Sell,” and the remaining analyst gives a “Strong Sell” rating. The stock currently trades slightly above its mean price target of $62.27.