/Align%20Technology%2C%20Inc_%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

Headquartered in Tempe, Arizona, Align Technology, Inc. (ALGN) has established a global reputation in digital orthodontics and restorative dentistry. Valued at nearly $9.2 billion by market capitalization, its portfolio includes Invisalign clear aligners, iTero intraoral scanners, and exocad CAD/CAM (Computer-Aided Design/Computer-Aided Manufacturing) software.

These offerings are integrated through the Align Digital Platform, which combines advanced software, services, and flexible delivery to provide comprehensive solutions for dental professionals worldwide. The company is scheduled to report its third-quarter fiscal 2025 results on Wednesday, Oct. 29, after the market closes.

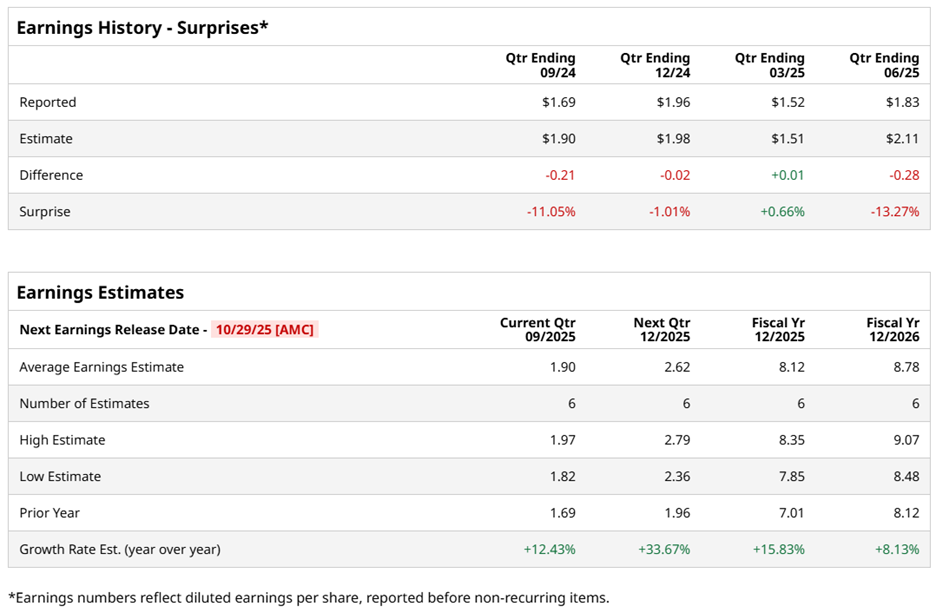

Ahead of the results, Wall Street anticipates the company to report a profit of $1.90 per share on a diluted basis, reflecting a 12.4% year-over-year (YoY) increase from $1.69 per share profit in the same period last year. Yet, the recent record shows some inconsistency. Align missed Street EPS estimates in three of the past four quarters, while surpassing them on just one occasion.

Align’s Q2 stumble wasn’t from one crack but many. Uneven patient case conversion, economic uncertainties including U.S. tariff impacts, and less accessible financing for orthodontic treatments contributed to a softer-than-usual seasonal uptick in case starts.

Now, management is tightening the bolts – streamlining, reallocating, sharpening focus. The playbook for the second half of 2025 is clear – cut costs smartly, boost efficiency, and steady the path toward long-term growth.

Analysts are now projecting continued growth. EPS for fiscal 2025 is expected to rise 15.8% YoY to $8.12, with a further 8.1% annual increase anticipated in fiscal 2026 to $8.78.

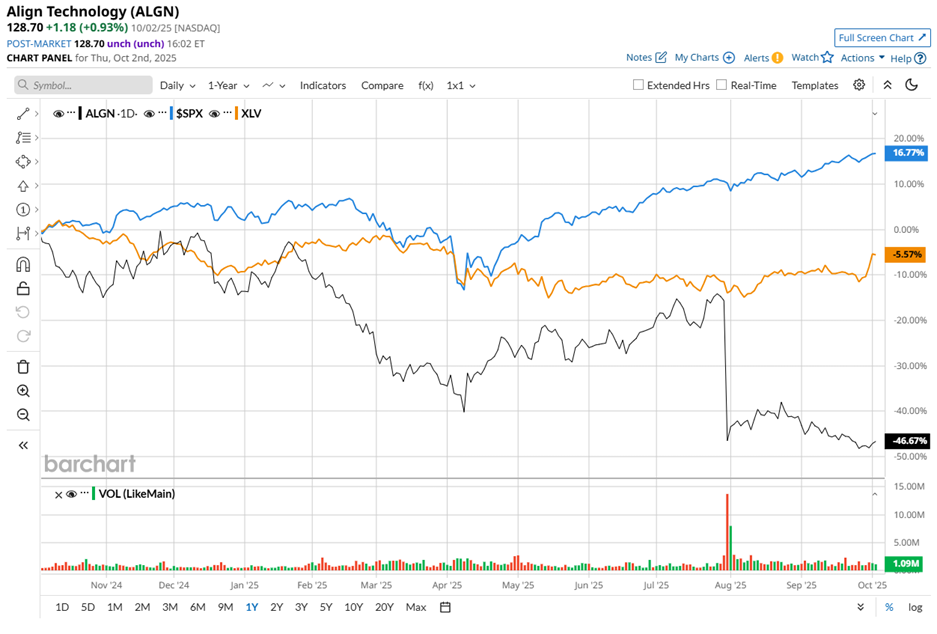

Shares of Align Technology have underperformed relative to the broader market. Over the past 52 weeks, the stock has declined 45.9%, and year-to-date (YTD), it is down 38.3%. Meanwhile, the S&P 500 Index ($SPX) gained 17.6% over the past year and 14.2% in 2025.

Compared with the S&P 500 Healthcare Sector SPDR (XLV), ALGN stock’s performance is mixed. The ETF fell 6.4% over the past 52 weeks, while gaining 4.1% on a YTD basis, contrasting ALGN’s double-digit dip.

ALGN stock has been affected by external pressures. Pomerantz LLP is investigating claims on behalf of investors, examining whether Align and certain officers may have engaged in securities fraud or other unlawful practices. On July 31, news of the probe caused the stock to drop 36.6% intraday.

Despite these headwinds and the weak price action, analysts maintain a cautiously positive outlook. The consensus rating remains a “Moderate Buy.” Among 14 analysts, nine have suggested a “Strong Buy” rating, four recommend a “Hold,” and one calls for a “Moderate Sell.”

The mean price target of $186.33 indicates a 44.8% upside from current levels, while the Street-high price target of $215 suggests the stock could rise as much as 67.1%.