With a market cap of $33.9 billion, DuPont de Nemours, Inc. (DD) is a global leader in technology-based materials, ingredients, and solutions, serving diverse markets such as electronics, transportation, construction, health and wellness, food, and worker safety. The company operates through its ElectronicsCo and IndustrialsCo segments, offering advanced materials aligned with high-growth market trends.

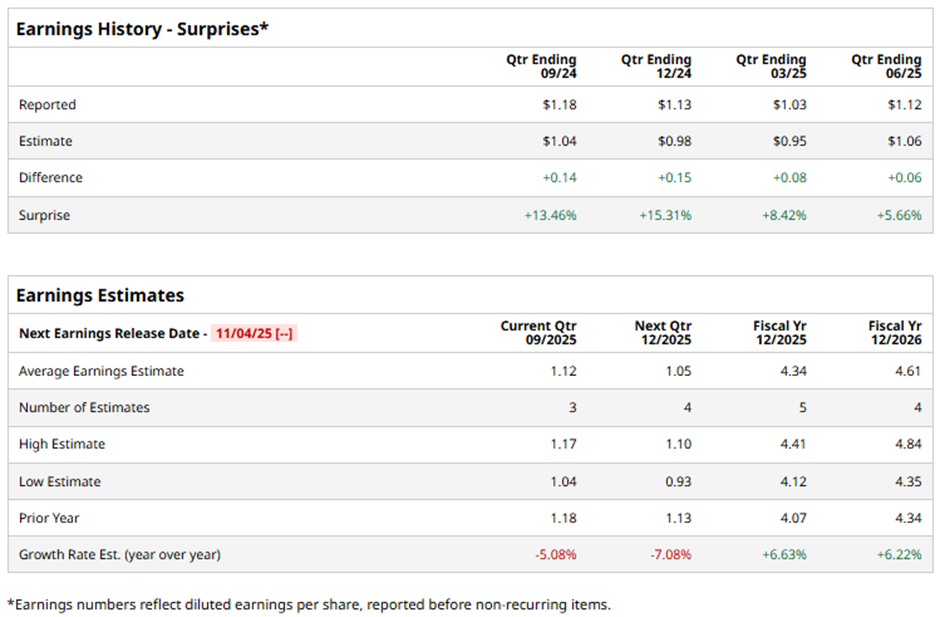

The Wilmington, Delaware-based company is slated to announce its fiscal Q3 2025 results next month. Ahead of this event, analysts expect DD to report an adjusted EPS of $1.12, a 5.1% decline from $1.18 in the year-ago quarter. However, it has surpassed Wall Street's earnings expectations in the past four quarters.

For fiscal 2025, analysts forecast the specialty chemicals maker to report adjusted EPS of $4.34, marking a rise of 6.6% from $4.07 in fiscal 2024.

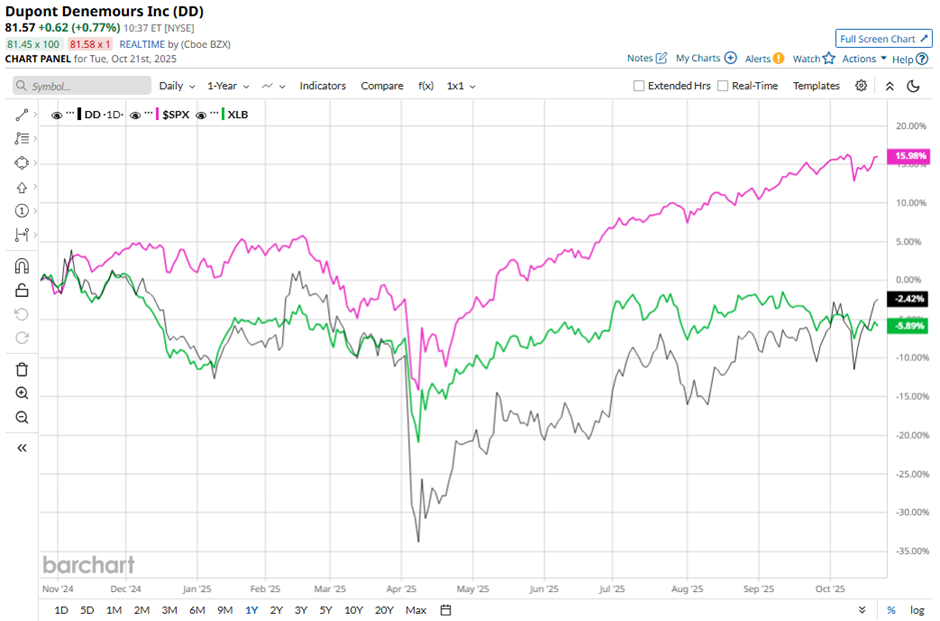

Shares of DuPont de Nemours have dropped 4.5% over the past 52 weeks, underperforming the broader S&P 500 Index's ($SPX) 14.9% gain. Nevertheless, the stock’s decline was less severe than the Materials Select Sector SPDR Fund's (XLB) 9.1% decrease over the same time frame.

Shares of DuPont rose 2.4% on Aug. 5 after the company reported Q2 2025 adjusted EPS of $1.12 and revenue of $3.26 billion, topping forecasts. Strong demand in its electronics segment, with sales rising to $1.2 billion, and healthcare growth helped offset weakness in construction markets. DuPont also issued Q3 guidance above expectations, forecasting $1.15 per share in profit and $3.3 billion in revenue, while lowering its expected 2025 tariff hit to $20 million.

Analysts' consensus view on DD stock is moderately optimistic, with an overall "Moderate Buy" rating. Among 17 analysts covering the stock, 12 suggest a "Strong Buy," one gives a "Moderate Buy," three recommend a "Hold," and one has a "Strong Sell." The average analyst price target for DuPont de Nemours is $91.93, indicating a potential upside of 12.7% from the current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.