A super-savvy mum who first started shopping in charity shops and at car boot sales when her children were small and she was broke now pays her family’s food bills by expertly buying and re-selling second-hand clothes and crockery online.

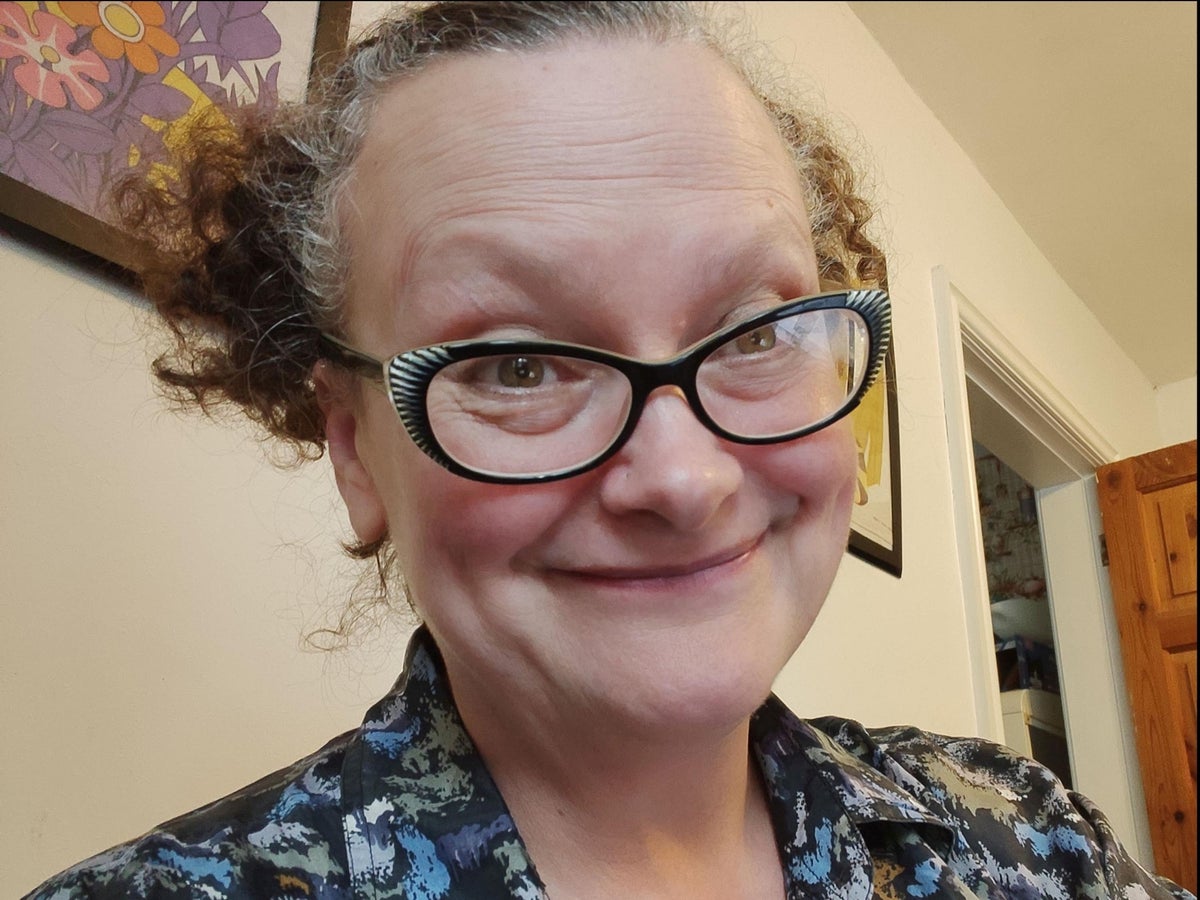

Having struggled to make ends meet during the 2008 UK recession – sometimes finding herself with just 50p to last several days – Tess Bolton-Gould, 54, is doing everything she can to ensure her family are financially secure as Britain faces a cost of living crisis.

The frugal mum of two, who lives near Halifax, West Yorkshire, normally spends £40-£50 weekly on food and is able to cover that and some utility costs by reselling second-hand goods online.

Tess, who is sharing her top tips for living on a budget, uses a strict weekly food plan and grows her own vegetables to make meals for as little as 30p per person for herself and husband, Sam Bolton-Gould, 54, who works in IT, and their two sons, aged 18 and 15, who Tess did not wish to name.

Also dabbling in dumpster-diving to keep costs down, Tess said: “Living frugally means even in times when it has been really difficult, we have managed to stay out of debt or only have very minimal debt in emergency situations.

“We have been able to save up an emergency fund of £3,000 now, so that if the car breaks down or something happens, we have the money we need to fix it.”

Though the family are more financially secure now, Tess says her household income is still “significantly below the national average” – which is £31,400 a year according to the ONS – and she is super careful with her cash to make it stretch as far as possible.

She said: “It’s so important to be careful with every penny that you earn because you work hard for your money and it’s amazing how quickly your spending adds up.”

Remembering how she was affected during the 2008 recession, when her boys were aged one and four, Tess said: “There were many times we had 50p in the purse to last us a few days and it was very stressful to live life like that.”

She added: “Shopping in charity shops and car boot sales for school uniform or toys for the kids became a way to manage.”

Dumpster diving in skips also yielded some useful bargains.

“When I used to live in the city, in Hull, you’d always drive past skips,” she said. “I think one of my eldest son’s first words he learned was ‘SKIP!’ as we drove past.

“I would always see them outside people’s houses and ask if I could take a look.

“When the kids were little, I found a plastic slide in one skip and a garden sandpit in another – all in perfect condition.”

The habit of checking skips as she passes them has stuck with Tess.

“Quite recently, I was looking through a skip behind some shops and I found a huge box of homemade soaps – I couldn’t believe it!” she said.

But savvy Tess soon realised she could do more than save money by spending less – she could actually make cash by reselling her car boot sale and charity shop finds, and she has become expert at it over the years.

I sit down at the start of the week and write down every meal there will be and then generate the shopping list from the meal plan.

“When the boys were small, I would only have a fiver or £10 available, and I would buy some bits like a nice blouse or jumper which I could flip online through eBay and make £20,” she said.

“Now, I go to a car boot sale or charity shop with £80 or £90, spend half or all of it, and then re-sell what I find on eBay or Facebook Marketplace.

“Last week, I spent £72 on vintage clothes, jewellery and crockery and I made £750.”

She added: “Once you take away the cost of postage and packaging, the eBay fees and PayPal fees, that works out as about £500 – but it’s still really good.”

Tess, who also shares her frugal tips three times a week on her YouTube channel, Tess – Frugal Living, which she started in 2017, can now easily spot a bargain.

She said: “I’ve always been interested in antiques and collectibles and vintage items so I can spot a vintage dress hanging up in a charity shop across the room or a 1950s jug hiding on the shelf.”

When it comes to food shopping, Tess has also figured out how to stick to a budget.

“Meal planning is key really. If I go to a supermarket without a shopping list, I will pick up all sorts and not actually get anything I can make a meal from.

“So I sit down at the start of the week and write down every meal there will be and then generate the shopping list from the meal plan.”

Generally sticking to between £40-£50 every week and shopping in Asda, Tess said she can feed her family of four for £11 per person.

“I will always be looking at buying the most basic and value brand, so getting the 20p spaghetti and not the £1.20 fancy spaghetti and then trying to find ways of getting as much veg in as I can – like tinned tomatoes or basic onions to keep the price down.

“A classic in our house is basic penne pasta, with a tub of the cheapest cream cheese, sweetcorn and some onion, which will feed four for £1.23.”

And she added: “I like to buy bags of frozen chicken thighs which I will airfry and use in stir fries or rice dishes with vegetables and then use the bones left over to make a stock for soup or stew.”

While Tess doesn’t have a big garden, she makes use of the space she does have to grow her own vegetables.

“It’s amazing what you can do with a few pots,” she said.

“Wilko do a really good seed sale at the end of summer with fruit and vegetable packets for 25p a pack.

“I always get packets of tomatoes, and grow things like kale, cucumbers, lettuce and courgettes.

“Things like spring onions and herbs don’t take up too much space, or salad cress only needs a bit of tissue paper to grow.”

With energy bills set to spiral, Tess is also looking at keeping her family’s energy use as low as possible.

“I’m genuinely really worried about what’s going to happen in October with the fuel bills.

“Ours has already doubled from £125 a month to £240 and if the increase is what’s predicted, it’s going to be about £440 pounds a month – that is insane.”

I've stopped watching the TV - I just watch it on my phone instead because it's cheaper.

She added: “We are turning everything off at the socket except for the fridge freezer and we are avoiding using the hot tap wherever possible.

“I’ve been collecting free firewood from skips or on Facebook Marketplace for our multi-fuel stove, so I will be using that mostly for heating.”

And Tess has other energy-saving plans too.

“We have hot water bottles that we will use to keep warm, or under our feet at desks while we work.

“We’ve stopped using the oven anymore and I just use a pressure cooker or air fryer instead, because they use less energy than an electric oven.

“And I’ve stopped watching the TV – I just watch it on my phone instead because it’s cheaper.”

Tess’s top Ten Frugal Tips

- Write out your budget (all your income and expenses) and keep track of it every month.

- Focus on Wants vs Needs – If you’re short of money, don’t buy anything you don’t need.

- Plan your meals for the week and write a shopping list from that plan – stick to it.

- Set a food budget and work within it.

- Turn things off at the socket when not in use – don’t leave them on standby.

- Turn the thermostat down on your heating and hot water.

- If you need help, and there is help available, take it. There’s no shame in going to a food bank or claiming benefits to which you are entitled.

- See what you can pick up for free – Facebook groups are great for this.

- Batch cook once a week and then just re-heat daily to reduce fuel use.

- Heat the person, not the house – wear layers, use hot water bottles.