Detroit, Michigan-based DTE Energy Company (DTE) engages in regulated and unregulated energy businesses. With a market cap of $29.1 billion, DTE Energy generates electricity through coal-fired plants, hydroelectric pumped storage, and nuclear plants, as well as wind and solar assets.

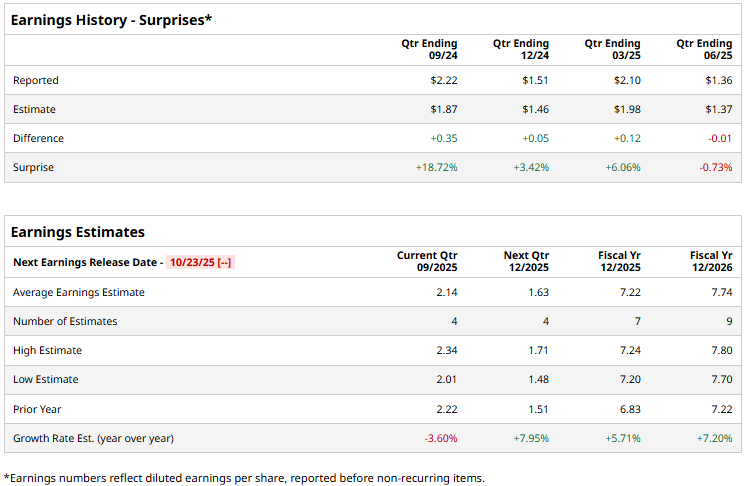

The utilities giant is expected to announce its third-quarter results before the market opens on Thursday, Oct. 23. Ahead of the event, analysts expect DTE to deliver an adjusted profit of $2.14 per share, down 3.6% from $2.22 per share reported in the year-ago quarter. The company has a mixed earnings surprise history. While it surpassed the Street’s bottom-line estimates thrice over the past four quarters, it missed the projections on one other occasion.

For the full fiscal 2025, DTE is expected to deliver an adjusted EPS of $7.22, up 5.7% from $6.83 in 2024. In fiscal 2026, its earnings are expected to grow 7.2% year-over-year to $7.74 per share.

DTE stock prices have gained 11.6% over the past 52 weeks, outperforming the Utilities Select Sector SPDR Fund’s (XLU) 10.4% returns, but lagging behind the S&P 500 Index’s ($SPX) 17.2% surge during the same time frame.

DTE Energy’s stock prices observed a marginal dip in the trading session following the release of its mixed Q2 results on Jul. 29. The company observed a massive growth in non-utility operations and a notable increase in utility operations sales, leading to an 18.9% year-over-year surge in overall revenues to $3.4 billion, exceeding the consensus estimates by a large margin. However, the company’s margins remained under pressure, leading to a 4.9% year-over-year decline in operating earnings per share to $1.36, missing the Street’s expectations by a marginal 73 bps.

Meanwhile, the company remains on track to invest $4.4 billion into its utilities infrastructure in 2025 to improve supply reliability and transition towards cleaner energy sources.

Analysts remain optimistic about the stock’s prospects. DTE maintains a consensus “Moderate Buy” rating overall. Among the 18 analysts covering the stock, opinions include eight “Strong Buys,” one “Moderate Buy,” and nine “Holds.” Its mean price target of $147.54 suggests a modest 4.1% upside potential from current price levels.