/The%20Figma%20app%20on%20a%20smartphone%20screen%20by%20Photo%20Agency%20via%20Shutterstock.jpg)

The S&P Information Technology sector ($SRIT) has shown strong growth in 2025, gaining 13.41% in the past three months. This performance outpaces the broader S&P 500 index ($SPX), which rose 9.13% over the same period. The growth is mainly due to companies spending more on software. According to Statista, global enterprise-software revenue is expected to grow by nearly 5% each year through 2030, driven by increased use of artificial intelligence (AI) and cloud technology.

This backdrop helps explain why investors are considering if Figma’s (FIG) recent stock drop offers a good buying opportunity. Figma, a cloud-based design platform, went public in July with an initial price of $33 a share.

Following the IPO, the stock surged over 250%, reaching above $140 on its first trading day. Since then, shares have fallen sharply, dropping 60% and sliding further after the company’s second-quarter earnings report.

Despite reporting a strong 41% year-over-year (YoY) revenue increase to nearly $250 million and reaching profitability, concerns about lockup expirations and valuation pressures have weighed on FIG stock. Is today’s share price a smart entry point or just a pause before more losses? Let's find out.

Breaking Down Figma’s Financial Performance

Figma is a well-known collaborative design platform used by millions of people to create, prototype, and deliver digital products smoothly. The company makes most of its money through subscription software that appeals not only to designers and developers but also to marketers and business users as it continues to add new features.

After reaching over $140 shortly after its debut, the shares have since dropped about 60%. This includes a sharp 31.8% decline in the last month and a steep 18.8% fall just in the past five days.

Looking at valuations, Figma’s forward price-to-earnings (P/E) ratio is an unusually high 183x compared to the sector average of around 23x. This means investors still expect strong growth, even though the stock price has pulled back. The latest earnings per share showed a small loss of $0.04, which adds pressure for the company to deliver strong future growth to justify these expectations.

Figma’s second-quarter 2025 financial results show a mix of signals but mostly highlight its strength. Revenue jumped 41% YoY to about $249.6 million, showing the company is still growing despite a tough market. Operating income was modest at $2.1 million with a slim 1% margin, while non-GAAP operating income rose to $11.5 million, a healthier 5% margin.

Cash flow remains strong; operating cash flow was $62.5 million with a 25% margin, and adjusted free cash flow stayed solid at $60.6 million, or a 24% margin. Net income was $28.2 million, with non-GAAP net income at $19.8 million. The company also holds a strong cash balance of $1.6 billion, giving it plenty of room to invest in growth and innovation.

The Core Drivers Powering Figma’s Growth

In its latest quarterly update, Figma shared details about two important acquisitions that are already changing what the platform can do. Modyfi adds advanced animation and motion-design tools directly into Figma’s vector editor. This makes it easier for designers to build richer, interactive prototypes all within the platform, helping to keep more of the creative process under one roof.

Another key acquisition is Payload, which is a headless content management system. Payload lets development teams manage and deliver dynamic content straight from Figma to production-ready applications. This close connection between design and live content delivery supports Figma’s goal of moving beyond a simple design tool toward a full collaborative product development platform.

Figma’s Q2 report shows this strategy is gaining traction. Over 80% of customers used at least two Figma products in the quarter, and nearly two-thirds used three or more. This level of cross-product adoption highlights how users are becoming more integrated into the ecosystem.

Looking forward, Figma plans to launch AI-powered features such as Figma Make, which turns prompts directly into prototypes; Figma Draw for better vector illustration; Figma Sites, a tool for building websites without coding; and Figma Buzz to create marketing assets automatically. These innovations aim to attract new groups, like marketers, small business owners, and non-design collaborators. Expanding into these adjacent markets could open up new revenue opportunities and widen Figma’s customer base.

Analyst Insights and What Lies Ahead

The company expects third-quarter revenue to come in between $263 million and $265 million, which would represent about 33% growth compared to last year at the midpoint. For the full year 2025, revenue is forecasted to reach between $1.021 billion and $1.025 billion, showing a strong 37% increase over 2024. Non-GAAP operating income is projected to fall between $88 million and $98 million, suggesting the company is improving its efficiency as it grows.

Analyst coverage of Figma is still limited but provides useful insights. Piper Sandler recently started covering FIG stock with an “Overweight” rating and a price target of $85. This implies about a 10% upside from the current share price near $77 and reflects a cautious but positive view on Figma as a fast-growing SaaS company that is still working on fully monetizing its growing lineup of products.

Brent Bracelin from Piper Sandler offers a strong long-term outlook, predicting that annual recurring revenue could triple to more than $3 billion by 2030, while free cash flow margins move closer to 30%. This forecast points to significant growth potential, but the stock’s short-term price swings may test the patience of investors.

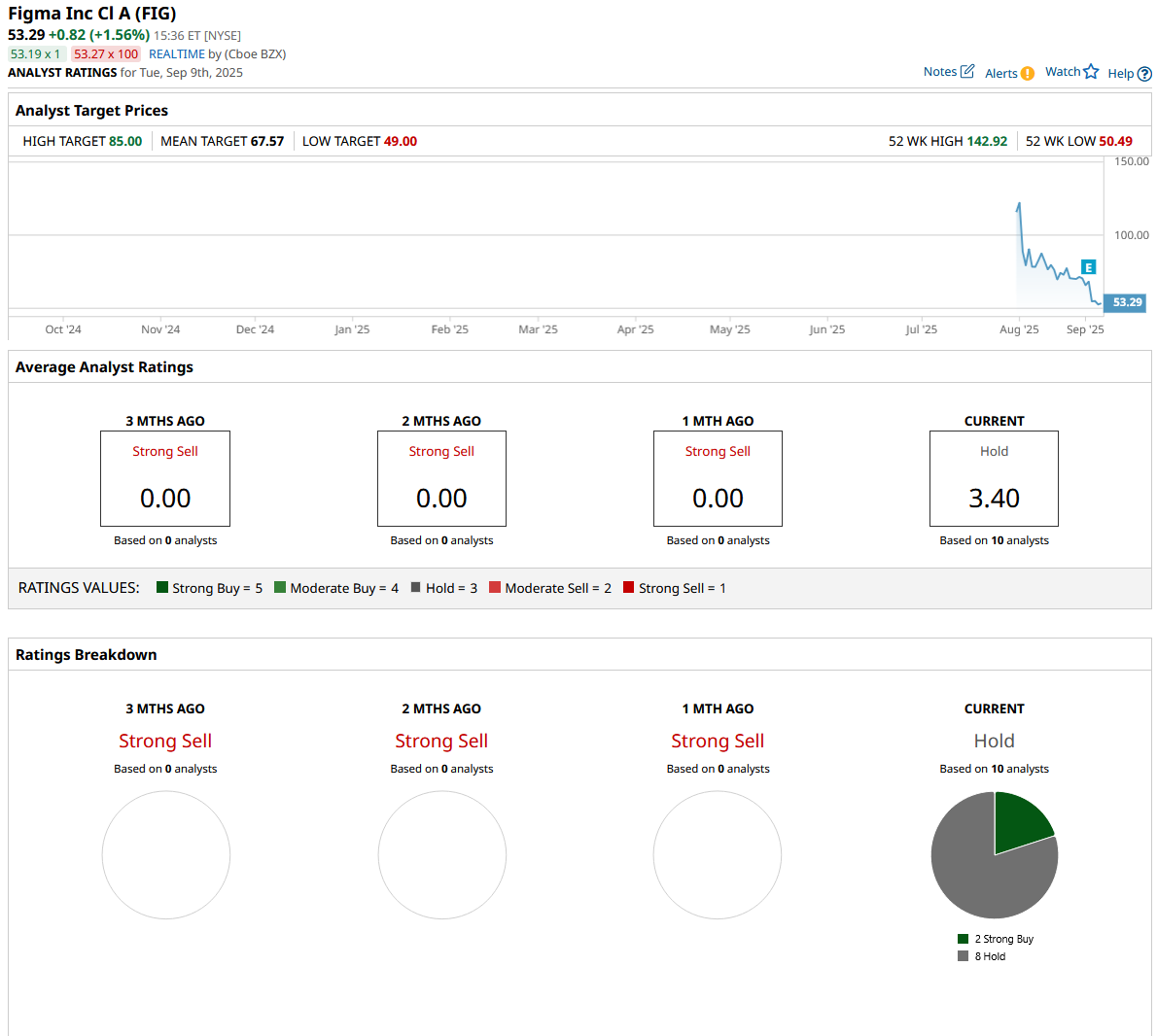

For the broader market consensus. All 10 analysts surveyed currently rate Figma a consensus “Hold,” with an average price target of $67.57. That suggests a potential upside of roughly 27% from current levels.

Conclusion

After plunging 60% from its highs and facing near-term pressures like lockup expiries, FIG stock looks like a classic “buy the dip” opportunity, but with caution. The company’s strong revenue growth, expanding product ecosystem, and solid cash flow provide a solid foundation for a potential recovery. However, lofty valuations and cautious analyst ratings suggest the ride won’t be smooth. Most likely, shares will continue to experience volatility as Figma executes its ambitious growth plans. For patient investors believing in its long-term vision, this dip could be a chance to enter ahead of a possible rebound, but short-term swings should be expected.