/Lululemon%20Athletica%20inc_%20logo%20on%20shop%20by-%20FinkAvenue%20via%20iStock.jpg)

2025, so far, has been a painful year for shareholders of Lululemon Athletica (LULU). The stock has tumbled 51.9% year-to-date, a steep decline that reflects not only slowing U.S. sales, but also a shifting landscape across the entire athletic apparel space. Consumers have grown cautious about discretionary spending, especially in performance wear, and Lululemon has struggled to keep up with changing tastes.

During the last earnings call, Lululemon’s management said that its products, which once set trends, are now seen as predictable, with new casual and social pieces failing to excite shoppers. Customer visits and purchase frequency have slowed, a sign that the product pipeline isn’t delivering the same spark it used to.

External pressures have compounded the problem. Competition from both premium rivals and emerging challengers has intensified, and tariff changes have weighed on profitability. A significant share of Lululemon’s U.S. online orders is fulfilled from Canada, previously shielded by the $800 de minimis threshold. With that protection eliminated, Lululemon’s margins came under significant pressure.

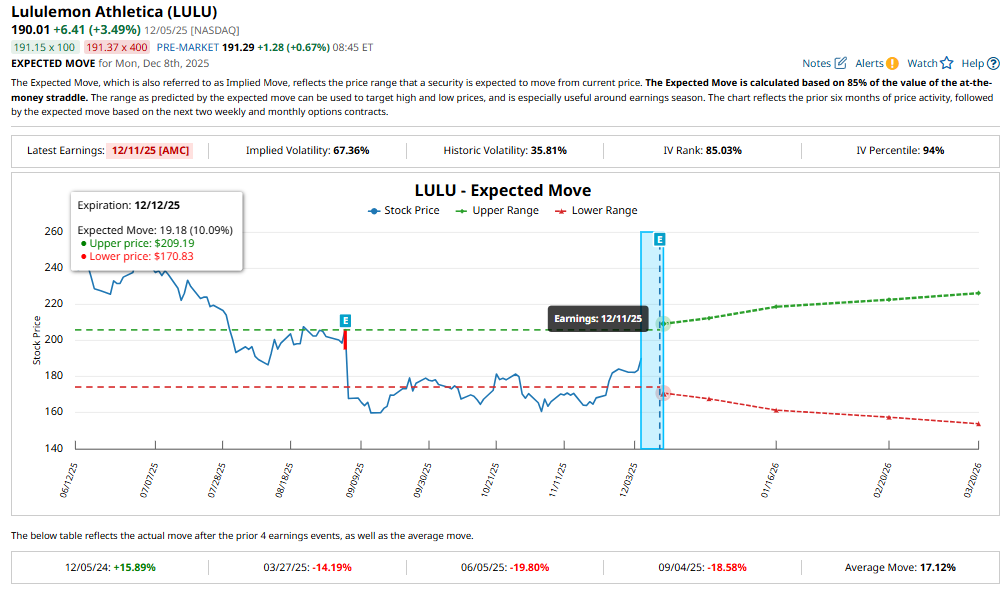

However, LULU stock is gaining positive momentum ahead of its Q3 earnings on Dec. 11. LULU stock has gained about 10.7% over the past month. Despite this recent uptick, investors should remain cautious. Historically, Lululemon shares have declined following earnings announcements in each of the last three quarters. Currently, options traders are pricing in a potential post-earnings move of around 10.1% in either direction, which is below the stock’s average four-quarter movement of 17.1%.

Lululemon Faces Slower Growth and Margin Pressure in Q3

Lululemon’s third-quarter results are expected to reflect ongoing challenges, as the company navigates cost pressures and slowing demand. Management is working to offset these headwinds through pricing adjustments, vendor negotiations, and cost-cutting initiatives, but these measures will likely take time to boost its financials.

Revenue growth is anticipated to slow sequentially. Lululemon projects Q3 revenue in the range of $2.47 billion to $2.5 billion, representing a 3% to 4% increase year-over-year. This marks a deceleration compared to the 7% growth the company delivered in the first half of fiscal 2025. While new store openings may provide some support, lingering softness in the U.S. market could weigh on overall sales.

Lululemon’s margins are expected to remain under pressure. Gross margin for the quarter is projected to decline roughly 410 basis points compared with Q3 2024, driven primarily by higher tariffs, the removal of the de minimis exemption, and continued investment in its distribution center project. The combined impact of tariffs and the de minimis exemption is estimated to reduce margins by about 230 basis points. Additionally, markdowns due to seasonal clearance activity could further squeeze profitability.

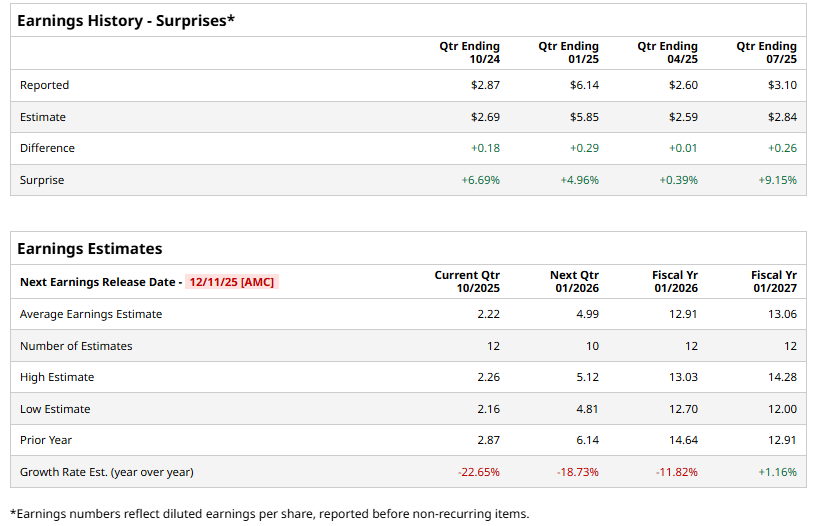

As a result, Lululemon’s management expects third-quarter earnings per share (EPS) in the range of $2.18 to $2.23, reflecting a 22% to 24% decline compared with the prior year. Analysts currently forecast EPS of $2.22 for the quarter, down 22.7% year-over-year. Despite these near-term headwinds, Lululemon has a history of surpassing expectations, having exceeded analysts’ EPS forecasts in the last four consecutive quarters.

Is Lululemon Stock a Buy Now?

Lululemon stock has taken a significant hit so far this year, which has driven its earnings multiple lower. LULU stock is trading at a forward price-earnings ratio of 14.2x. Historically, this looks like a bargain for a company that has delivered impressive growth in the past and has one of the most powerful brands in activewear.

However, demand in North America, particularly in the U.S., has softened for Lululemon, and rising costs are putting pressure on the company’s profitability. These headwinds, along with increasing competition, suggest that LULU stock is unlikely to register a quick rebound. Reflecting this cautious sentiment, Wall Street analysts are maintaining a “Hold” consensus rating on Lululemon shares ahead of earnings.