/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)

Salesforce's (CRM) 25% decline in 2025 has allowed investors to buy the dip and gain exposure to a quality company at a lower multiple. However, investors should carefully weigh the company's artificial intelligence (AI) transition challenges against its improving fundamentals before diving in.

Salesforce's recent struggles reflect structural challenges beyond typical market volatility. Revenue growth has stagnated in single digits for four consecutive quarters, with the latest 10% increase barely meeting expectations.

The core CRM market is showing signs of saturation. At the same time, AI automation threatens its traditional service agent model—a dynamic that CEO Marc Benioff acknowledges has already reduced internal workloads by 30-50%.

The disappointing guidance, despite beating earnings estimates, suggests that management lacks visibility into near-term catalysts. While Agentforce has secured 6,000 paid deals, Wells Fargo analyst Michael Turrin notes it's "not significant enough to move the needle" given Salesforce's scale.

However, the selloff in CRM stock may have created an attractive entry point. The company's enterprise value-to-free cash flow ratio has reached a 10-year low, suggesting that the tech stock has overcorrected.

Salesforce demonstrated operational discipline by expanding margins ahead of schedule following activist pressure while maintaining its innovation pipeline through the $8 billion acquisition of Informatica.

The $20 billion share buyback expansion signals management confidence, and Agentforce represents a technological differentiation rather than "repackaged ChatGPT," according to Benioff.

How Did Salesforce Stock Perform in Fiscal Q2?

Salesforce's "Customer Zero" approach demonstrates tangible benefits from its AI strategy. The company has processed 1.5 million customer support conversations through agents, achieving a 77% resolution rate while maintaining equivalent customer satisfaction scores to those of human interactions.

After years of letting prospects go uncontacted, Salesforce's new sales agents have engaged tens of thousands of inbound leads in just seven weeks, setting appointments and closing deals. This represents scalable revenue generation that traditional CRM couldn't achieve.

The company's entry into IT Service Management (ITSM) represents a growth vector. Built natively into Slack, with one million customers worldwide, this democratizes enterprise software that has traditionally served high-end markets.

Unlike legacy ITSM providers with limited customer bases, Salesforce can leverage its massive Slack ecosystem for rapid adoption.

Moreover, the Data Cloud business has achieved $7 billion in annual revenue, with 140% year-over-year (YoY) customer growth and a 326% increase in data access. When half of the Fortune 500 companies already use Data Cloud, the foundation for AI monetization is substantial.

Management expects operating cash flow to grow between 12% and 13% to reach $15 billion by the end of the year. Its $20 billion buyback authorization expansion, combined with disciplined M&A through acquisitions like Regrello, demonstrates balanced capital allocation.

What is the CRM Stock Price Target?

Analysts tracking CRM stock forecast revenue to increase from $38 billion in fiscal 2025 (ended in January) to $60 billion in fiscal 2030. In this period, adjusted earnings are forecast to expand from $10.20 per share to $18 per share.

Today, Salesforce stock is priced at 21 times forward earnings, which is higher than its 10-year average of 63 times. If CRM stock continues to trade at 21x earnings, it could gain more than 50% over the next four years.

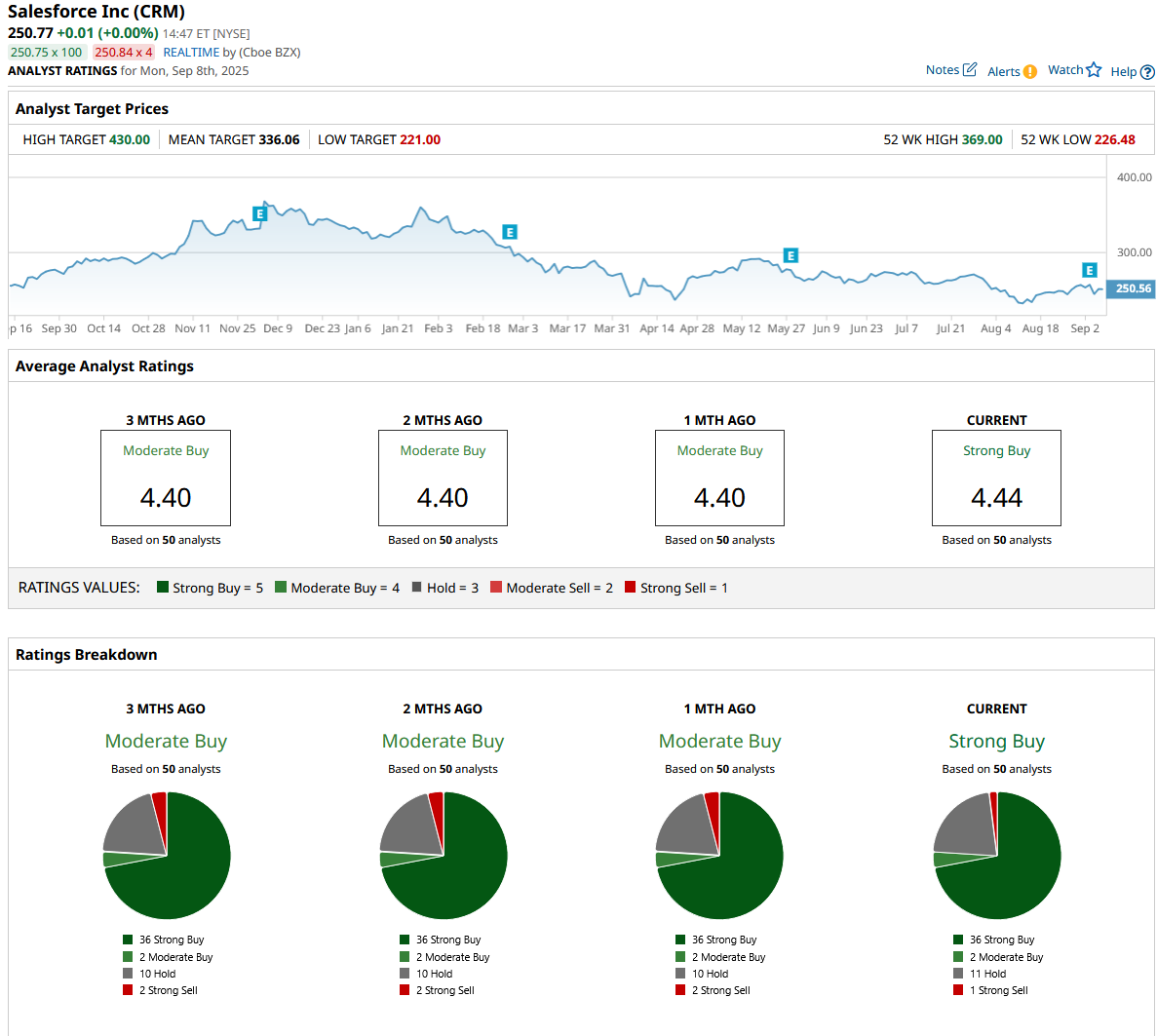

Out of the 50 analysts covering CRM stock, 36 recommend “Strong Buy,” two recommend “Moderate Buy,” 11 recommend “Hold,” and one recommends “Strong Sell.” The average CRM stock price target is $336, above the current trading price of $251.

While growth deceleration creates near-term headwinds, Salesforce's operational transformation, expanding addressable market, and strong cash generation position it for sustained outperformance. The company is successfully transitioning from a traditional SaaS provider to an "agentic enterprise" platform, creating competitive moats that justify premium valuations over time.