Short-seller Culper Research has initiated a short position in DoorDash Inc. (NASDAQ:DASH), alleging in a new report that the company’s financial success is built on a “supply crisis” solution: a “backdoor” system for onboarding unauthorized workers.

Can DASH Not Afford Authorized Workers?

The Oct. 23 report claims DoorDash’s profitability is so fragile that a mere 10-11% increase in Dasher pay would “wipe out the entirety of the Company’s $1.9 billion in 2024 Adj. EBITDA.”

Culper alleges this vulnerability stems from a 2021 decision to drop SSN (Social Security Number) requirements for Dashers, allowing them to sign up with Individual Taxpayer Identification Numbers (ITINs) after an IRS probe into SSN fraud. ITINs do not confer work authorization. Culper claims this practice is “unique to the Company” among its peers.

According to the report, these ITIN holders have become DoorDash’s most crucial workers. Former employees told Culper they are “the most active” and “the people that were really driving performance.” Culper estimates this group, which it claims could be up to 50% of Dashers in markets like New York City, is now responsible for 26% to 57% of all company-wide deliveries.

DASH’s ITIN Workaround ‘Short-Circuited’ Background Check

The report also connects this alleged practice to severe safety lapses, claiming the ITIN system “short-circuited” background checks. It cites recent lawsuits alleging that DoorDash onboarded a Dasher with four prior DUIs who then killed a woman in a drunk driving accident, and another with a recent charge for aggravated assault with a deadly weapon who later attempted to rape a customer.

Furthermore, Culper alleges a former security engineer sued DoorDash in May 2025, claiming he was fired after finding “clusters” of fraudulent Dasher accounts “linked to a broad spectrum of criminal activity, including identity theft, financial fraud, robbery, and tax evasion.”

DoorDash Subject To ‘Undisclosed SEC Investigation’

The short-seller also claims that DoorDash is subject to an “undisclosed SEC investigation,” as per a July 2025 Freedom of Information Act request.

Benzinga has reached out to DoorDash for comment on these allegations but has not received a response. Culper Research holds a short position in DoorDash stock and stands to profit if the share price falls.

DASH closed 1.40% higher at $258.15 per share on Friday. It has risen 51.27% year-to-date and 68.32% over the year.

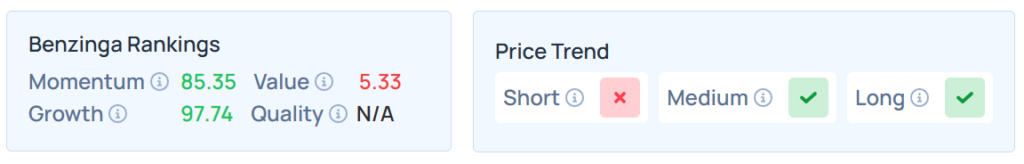

It maintains a stronger price trend over the medium and long terms, but a weak trend in the short term. DASH has a poor value ranking, as per Benzinga’s Edge Stock Rankings. Additional performance details are available here.

On Monday, the futures of the S&P 500, Dow Jones, and Nasdaq 100 indices were trading higher.

Meanwhile, on Friday, the S&P 500 index ended 0.79% higher at 6,791.69, whereas the Nasdaq 100 index rose 1.04% to 25,358.16. On the other hand, Dow Jones advanced 1.01% to end at 47,207.12.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock