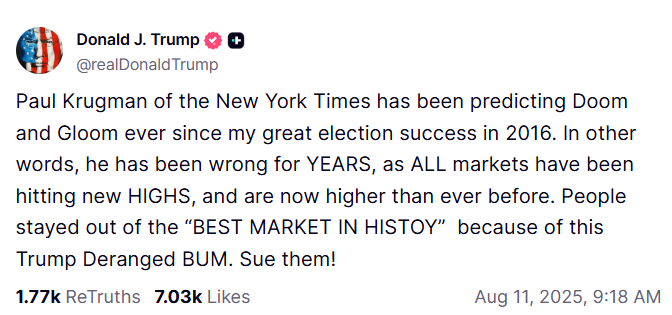

President Donald Trump launched a scathing attack on economist Paul Krugman, accusing him of being “wrong for years” in a new social media post.

What Happened: The President's Truth Social post highlighted the core of their ongoing feud, framing Krugman’s “doom and gloom” economic predictions as a personal vendetta that has misled the public.

According to Trump, Krugman’s long-standing negativity has convinced people to “stayed out of the ‘BEST MARKET IN HISTOY,'” causing them to miss out on significant gains.

The post serves as a direct response to Krugman’s recent criticism. In a Substack post, Krugman had slammed Trump for calling the latest jobs report “rigged.”

The Nobel laureate argued that such an accusation was part of a “paranoid style in American economics,” and a form of projection, noting that “every accusation is a confession.”

Krugman warned that by rejecting unfavorable data, the administration risked creating a “Potemkin economy”—a facade of prosperity that would prevent real problems from being addressed.

Other economists agree that the data, though weak, is credible. Jeffrey Roach, chief economist at LPL Financial, noted that "downward revisions are common during periods of economic slowdowns."

Jamie Cox, managing partner at Harris Financial Group, was more blunt, stating, "Powell is going to regret holding rates steady this week. September is a lock for a rate cut."

Why It Matters: Trump’s response, however, dismisses Krugman's critique entirely, focusing instead on a history of failed predictions.

The President points to the performance of the stock market since his 2016 election, which has “been hitting new HIGHS, and is now higher than ever before.” This economic success, in Trump’s view, completely invalidates Krugman’s bearish outlook.

Over the last five years, the S&P 500 index has soared 89.44%, whereas the Nasdaq 100 index has surged 111.49% in the same period. Meanwhile, the S&P 500 also closed over 20% higher for two consecutive years in 2023 and 2024.

In 2025, on a year-to-date basis, the Nasdaq 100 rose 12.57% and the S&P 500 index was up 8.88% despite slipping into the bear market territory in April. Fueled by Trump’s tariffs, the equities fell in April, but after a brief downturn, the market experienced a stunning resurgence, surpassing the gains of the past two years.

The S&P 500 surged by almost 30% from its low following Liberation Day, reaching new all-time highs, with the Magnificent Seven leading the charge.

Price Action: The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, were higher in premarket on Monday. The SPY was up 0.16% at $638.20, while the QQQ advanced 0.10% to $575.15, according to Benzinga Pro data.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image Via Imagn Images