Dividend Aristocrats have paid out increasing dividends for 25 years or more - and you don’t earn that distinction by simply being a run-of-the-mill company. No, Dividend Aristocrats are the poster child for financial strength, solid foundations, shareholder-centric policy, and, of course, consistent income.

Of course, there’s a tradeoff. To maintain that streak of increases, the company must balance earnings with payouts. You can’t pay out too much and leave nothing for the company to grow further. On the other hand, a company paying too little may not be noticed by most dividend investors.

That’s why, in this article, I’m focusing on Dividend Aristocrats that can balance high yields while still retaining a portion of their earnings for capex.

How I Came Up With The Following Stocks

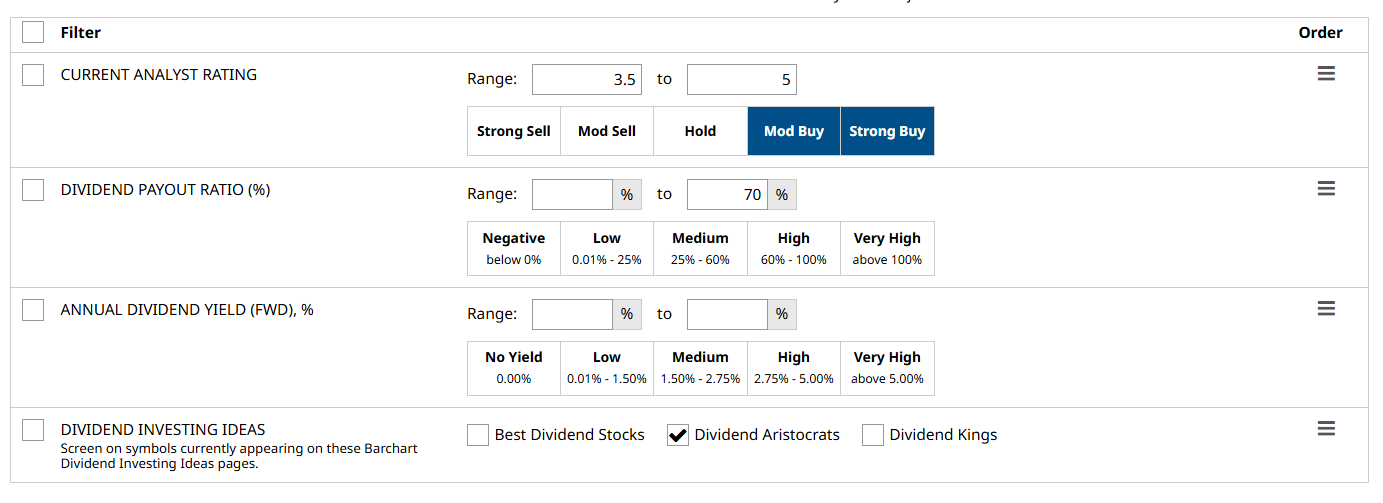

On Barchart’s Stock Screener Tool, I used the following filters:

- Current Analysts Rating: 3.5 (Moderate Buy) to 5 (Strong Buy). The scores displayed here represent the average of all scores from Wall Street analysts covering the stock.

- Dividend Payout Ratio: 70% or less. The dividend payout ratio is the percentage of a company’s after-tax earnings that it allocates to pay shareholders. 70% is the absolute highest I will consider for non-REIT stocks; any higher, and this puts the company at risk of propping up an unsustainable dividend policy. In my experience, this typically results in significant dividend cuts and substantial stock price declines, which I’d like to avoid for long-term portfolios.

- Annual Dividend Yield (Forward): Left blank so I can arrange the results accordingly.

- Dividend Investing Ideas: Dividend Aristocrats. Barchart has made it easier to look for investing opportunities with the expanded Investing Ideas filter. Now, they include “Investing Ideas,” “Dividend Investing Ideas,” and “Technical Investing Ideas,” which users can use to narrow down their searches.

With these filters in place, I ran the screen and got 41 results, arranged from highest to lowest yields.

Now, let’s talk about the top three, starting with number one:

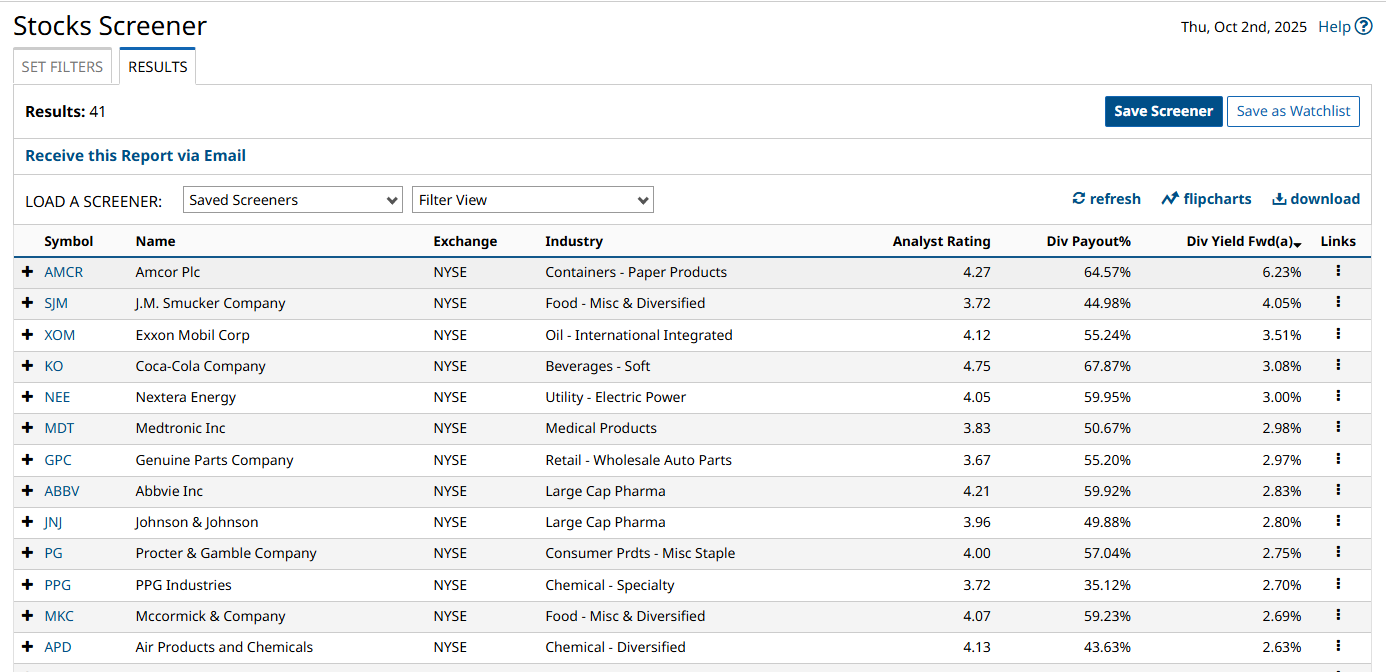

Amcor plc (AMCR)

We’re kicking off this list with a recognizable player in the packaging industry. Amcor offers a diverse range of packaging products for the food, beverage, healthcare, personal care, gardening, outdoor solutions, and industrial sectors, as well as specialized containers with tailored technical specifications.

Amcor currently pays 12.70 cents quarterly, which translates to a 50.8-cent annually, and an approx. 6.2% yield. Even more impressively, the company maintains a 64.57% dividend payout ratio, which means it has more room for dividend increases in the future, provided, of course, that it maintains or increases its earnings.

Meanwhile, a consensus among 15 analysts rates AMCR stock a “Moderate Buy” with an average score of 4.27.

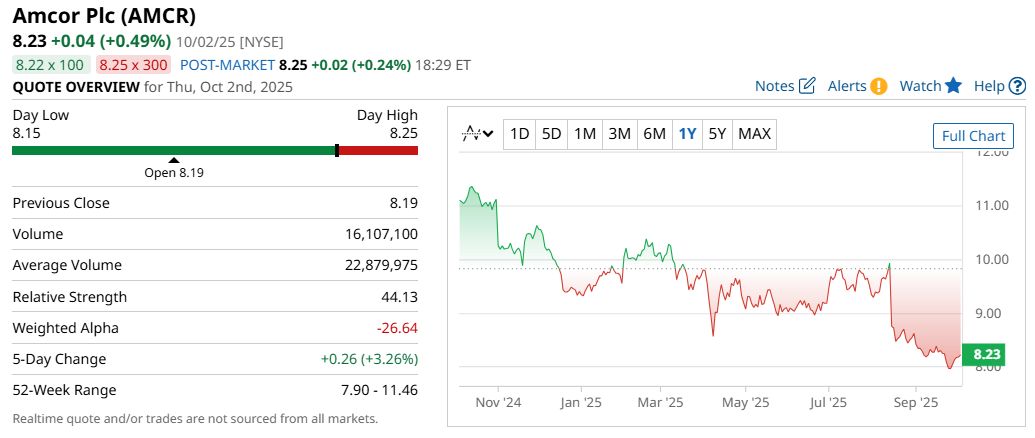

J.M. Smucker Company (SJM)

Next up is J.M. Smucker, also known as just Smucker, a consumer-packaged goods company. Smucker produces some of the most well-known food brands in the world, including Jif Peanut Butter, Folgers and Dunkin Coffee, Carnation, Hostess (a recent acquisition), Robin Hood, as well as pet brands like Milk-Bone, Meow Mix, and Milo’s Kitchen. The company has a significant presence in North America and also distributes its products internationally.

Smucker’s quarterly payout was recently hiked to $1.10, bringing its annual rate to $4.40 and its forward yield to around 4%. It also has the lowest dividend payout ratio on this list at 44.98% - allowing it ample resources to reinvest in itself while still rewarding shareholders.

Now, SJM has a “Moderate Buy” rating based on a consensus among 18 analysts, but this represents the lowest average score on the list at 3.72. While not a certain dealbreaker, you might be interested in monitoring those scores.

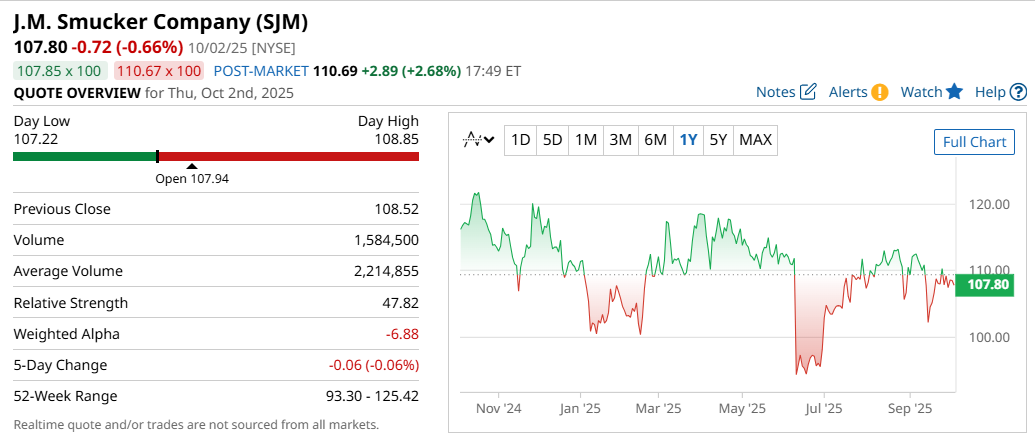

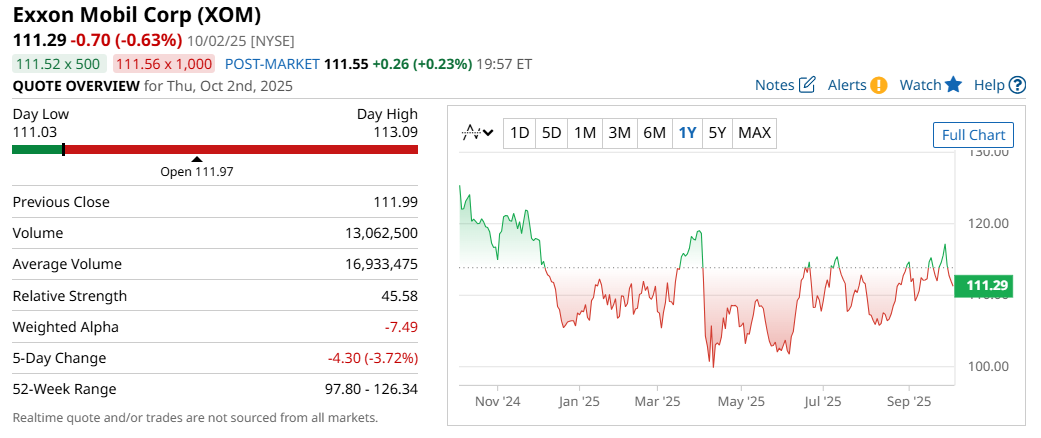

Exxon Mobil Corp (XOM)

Last on the list is Exxon Mobil, a major international energy company primarily involved in the exploration, production, refining, and marketing of oil, natural gas, and petroleum products. Exxon operates through several brands, which include Exxon, Mobil, Esso, and XTO, across nearly 56 countries.

Currently, the company pays 99 cents per share, per quarter, reflecting a $3.96 annual forward rate and around a 3.5% yield. They also have a healthy 55.24% dividend payout ratio, meaning there's lots of room to grow that dividend.

Meanwhile, a consensus among 26 analysts rates XOM stock a “Moderate Buy” with an average score of 4.12.

Final Thoughts

Nobody says you have to fill your long-term portfolio with low-yielding stocks. These Dividend Aristocrats offer high yields while maintaining relatively decent payout ratios, which works well for investors seeking a balance between high yields and reliable income that one could expect to increase.

However, nothing is set in stone; these companies may suffer from decreasing demand, bad news, or experience fluctuating earnings that can affect their stock price and dividend consistency. As always, the key to successful income investing is due diligence.