Domino’s Pizza (DPZ) is getting burned on Thursday, down 10% at last check. The decline comes after the chain reported earnings before the open.

The shares were down as much as 11.7% at today's low after the pizza giant beat on earnings but missed on revenue expectations. Sales grew 3.7% year over year.

Don't Miss: Walmart Bulls Buy the Earnings Dip. Should You?

In a recent weekly roundup, TheStreet's Action Alerts Plus team wrote that “comparing results between Cheesecake Factory (CAKE), Papa John's (PZZA), and Domino's will tell us if consumers are still trading down to quick service and fast casual dining vs. casual and sit-down dining.”

So far, the reaction across the board is fairly mixed and favoring the downside in these names.

The question now is: Can Domino’s Pizza find its footing with major support nearby?

Trading Domino’s Pizza Stock on Earnings

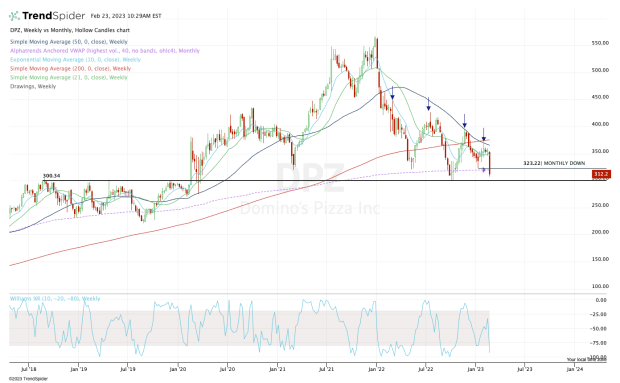

Chart courtesy of TrendSpider.com

For several years, Domino’s Pizza stock was trying to break out over the $300 level.

It finally did so in early 2020 and even the covid-19 pandemic couldn’t undo the strength of the breakout. That’s particularly as many customers were now ordering pizza online.

In any regard, this $300 breakout level wasn’t retested for several years until the fourth quarter of 2022. When it was tested, it was strong support, sending the shares higher by almost $100.

That said, the action in this name has not been healthy.

Notice that it’s currently below all its major weekly moving averages and has been putting in a series of lower highs. Further, it’s trading below the January low near $323 — putting a monthly-down rotation in play.

If Domino’s Pizza stock can regain the monthly VWAP measure and the $323 level, then we could at least see a rebound back toward the gap-fill level at $341, then the 10-week moving average near $350.

On the downside, it’s really as simple as the stock holding $300. If it goes below $300, not a lot of bullish arguments can be made from a technical perspective. But a test of this level is a decent risk/reward setup for buyers.