/Dominos%20Pizza%20Inc%20delivery%20by-%20Bjoern%20Wylezich%20via%20iStock.jpg)

Domino's Pizza (DPZ) announced strong Q2 results this morning, showing free cash flow FCF up over 31% YoY with a high FCF margin. DPZ stock is undervalued here, worth over 21% more, or $566.00 per share. Shorting OTM puts is a way to buy in cheaply.

DPZ is lower at $464.76 in midday trading. That is well off its high point of $497.52 on May 19.

It presents a unique buy-in opportunity for value investors. This article will show that, based on its FCF margin history and a 3.9% FCF yield metric, it could be worth 21% more at $566.45. And it could be worth much more based on its historic dividend yield metrics.

Domino's Pizza Strong Results

Monday morning, July 21, Domino's Pizza reported that its revenue rose +4.3% YoY and U.S. same-store sales growth was up 3.4% (int'l rose +2.4%).

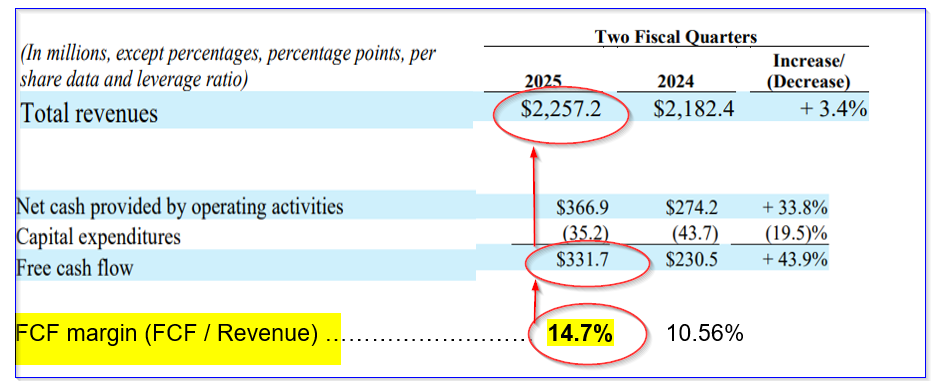

More importantly, Domino's showed strong free cash flow (FCF) performance. It generated $331.7 million in FCF over the past 2 quarters, up 43.9% YoY. Moreover, in Q2 it generated $167.3 million in FCF, up +1.81% from Q2, according to Stock Analysis.

This is important since it shows that Domino's has now generated two quarters with over 14% FCF margins (i.e., FCF/revenue). In Q2, its FCF margin was 14.61% and in Q1, it made a 14.78% FCF margin, according to Stock Analysis. In the past 2 quarters, that average was 14.7%, as seen from data on page 2 of its Q2 earnings release (see table below).

That implies that Domino's is squeezing large amounts of cash out of its operations. As a result, we can project higher FCF for the company over the next 12 months (NTM).

Forecasting FCF

Analysts project 2025 sales will be $4.94 billion and $5.27 billion in 2026. That means its NTM sales forecast is $5.1 billion. So, applying the 14.7% FCF margin:

$5.1b x 0.147 = $750 million FCF

That is +22% higher than the trailing 12 months (TTM) FCF of $613.2 million, according to Stock Analysis.

In other words, DPZ stock could be significantly undervalued if this occurs. But how much?

Target Price Based on FCF

One way to value DPZ stock using this FCF forecast is to use a FCF yield metric. For example, DPZ's market cap today is $15.778 billion (based on 33.9489 million shares outstanding at $464.76).

That implies that its TTM FCF of $613.2 million represents 3.886% of its market value (i.e., a 3.9% FCF yield).

Therefore, we can apply that metric (assuming the same valuation lasts over the next 12 months) to our FCF forecast:

$750m NTM FCF / 0.039 = $19.231 billion mkt value

That is +21.88% higher than today's $15.778 billion market cap. In other words, DPZ could be worth 21.9% more over the next 12 months:

$464.76 x 1.2188 = $566.45 target price

There are other ways to value DPZ stock. One way is to use its historic dividend yield.

Target Price Using Dividend Yield

For example, right now, based on Domino's quarterly $1.74 dividend per share (DPS), its annual yield is 1.50%:

$1.74 x 4 = $6.96/$464.76 = 0.01497 = 1.50%

But historically, based on Morningstar's calculations, its average yield has been lower at 1.02% over the last 5 years. Yahoo! Finance says it's been 1.08%. So, using this higher average we can estimate where DPZ should trade if it reverts to this mean yield:

$6.96 DPS / 0.0108 = $644.44 target price

That provides an investor with a potential upside of +39% from today's price.

Another way to value the stock is to use analysts' target prices.

Target Price Using Analysts' Projections

Analysts surveyed by Barchart have a mean price target of $509.55, and Yahoo! Finance reports that 32 analysts have an average of $505.35.

Similarly, Stock Analysis reports that 23 analysts have a price average of $486.83, but AnaChart's survey of 26 analysts is $514.19.

So, the mean analyst survey price is $503.98, or +8.4% over today's price.

Summary of Price Targets

So, using these three valuation methods, we can estimate its price target at:

FCF Yield target ………. $566.45

Dividend Yield ………… $644.44

Analysts' targets …….. $503.98

Average Price Target … $571.62, or +22.9% higher than today

The bottom line here is that DPZ stock looks deeply undervalued. One way to play this is to set a lower buy-in price by shorting out-of-the-money (OTM) put options.

Shorting OTM Puts

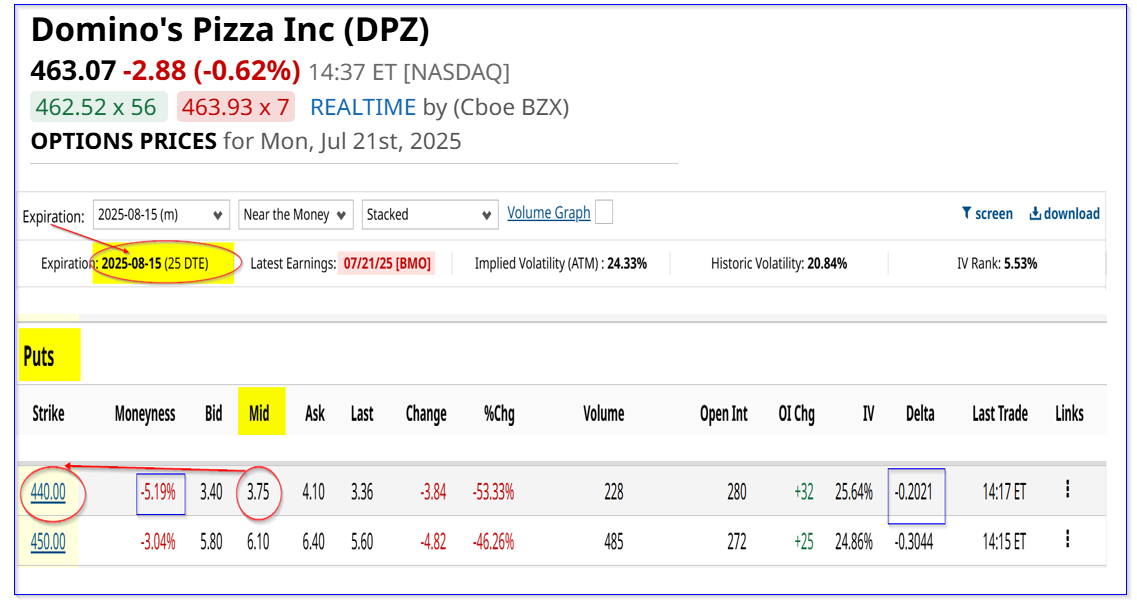

For example, the August 15 expiration period shows that the $440.00 strike price put option, 4.8% below today's price, has a $3.75 premium. That provides a short seller an immediate yield of 0.852% (i.e., $3.75/$440.00).

Moreover, the 450.00 strike price put has a $6.10 premium. A short seller can make an immediate yield of 1.1356% (i.e., $6.10/$450.00).

As a result, using a 50/50 mix of these two strike prices, an investor could set a lower buy-in of $445 and make 1.111% on average ($4.925/$445) over the next 25 days.

That sets a buy-in that is about 4.3% below today's price and provides a good breakeven of just $440.07 per share (i.e., $445-$4.93). That is over 5.3% below today's price, so it provides good downside protection to investors.

Moreover, note that the delta ratio, i.e., the risk of this strike price being assigned based on historical variance, is low at between 20% and 30%.

The bottom line here is that DPZ stock looks deeply undervalued, and one way to set a good buy-in point is to short OTM puts.