Domino’s Pizza Inc. (NASDAQ:DPZ) reported mixed results for the second quarter on Monday.

The pizza giant reported second-quarter revenue of $1.15 billion, beating the analyst consensus estimate of $1.14 billion. The company reported earnings per share (EPS) of $3.81, falling short of the consensus estimate of $3.93.

Russell Weiner, Domino's CEO on Monday said, "In the U.S., both delivery and carryout grew, driving meaningful market share gains within the U.S. pizza QSR category. We are now fully rolled out on the two largest aggregators and offer all the major crust types, including stuffed crust. With what we believe are best-in-class unit economics, the largest advertising budget, a robust supply chain, and a rewards program that is bigger than ever, our business is well-positioned."

Domino’s shares slipped 0.8% to close at $462.24 on Monday.

These analysts made changes to their price targets on Domino’s following earnings announcement.

- Bernstein analyst Danilo Gargiulo maintained Domino’s Pizza with a Market Perform rating and raised the price target from $460 to $490.

- Benchmark analyst Todd Brooks maintained the stock with a Buy and raised the price target from $535 to $540.

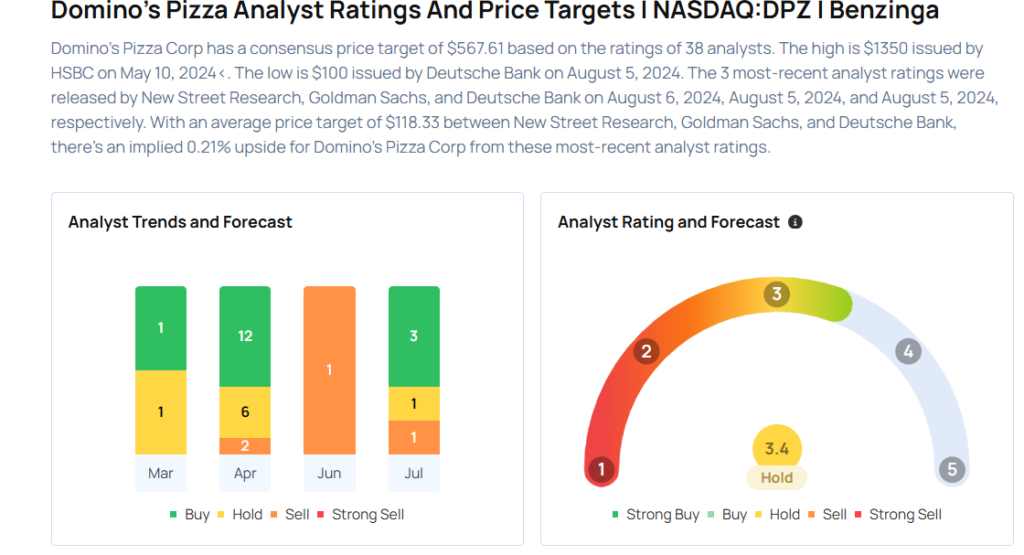

Considering buying DPZ stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock