Facing a global trade landscape marked by economic uncertainty, Dollar Tree Inc.‘s (NASDAQ:DLTR) leadership has identified escalating tariffs as a primary operational hurdle, implementing a multi-pronged strategy to protect its margins while preserving its low-price reputation.

Check out DLTR’s stock price here.

Tariff Headwinds Impact Trade Environment

In a recent earnings call, CEO Mike Creeden labeled the current trade environment as a significant headwind for the business.

“Tariffs remain a source of ongoing volatility, and operating in an environment where rates change frequently remains one of our largest challenges,” Creeden told analysts on the second quarter earnings call.

The company noted that while tariffs on Chinese goods remain elevated, duties on products from other sourcing hubs like Vietnam, India, and Bangladesh have also risen unexpectedly.

DLTR’s 5-Lever Strategy To Mitigate Traffic Impact

In response, Dollar Tree has deployed what it calls a “five levers” mitigation strategy to absorb the impact.

This agile approach involves aggressively negotiating with suppliers, re-engineering products to reduce costs, shifting the country of origin for manufacturing, discontinuing unprofitable items, and using price increases as a final resort.

“These levers are effective mitigation strategies,” Creeden affirmed, emphasizing the goal is to “achieve the lowest landed cost possible and keep delivering compelling value to our customers.”

The company’s strategic expansion into a multi-price model, offering goods at price points of $1.25, $3, and $5, has proven to be a crucial tool. Creeden said this model “validates multiprice as a structural advantage as we navigate a challenging tariff landscape,” giving the company the flexibility to adjust to cost pressures without disrupting its core value proposition.

Dollar Tree Q2 Earnings Snapshot

Despite these pressures, the company delivered a strong second quarter, with net sales up 12.3% to $4.56 billion, beating the $4.48 billion estimate. The adjusted earnings of 77 cents per share beat the analyst estimate of 41 cents.

The management also credited its proactive strategies for allowing the company to successfully manage costs while attracting a growing number of shoppers, including a surprising influx from higher-income households seeking value.

Dollar Tree raised its fiscal 2025 adjusted earnings guidance from $5.15 to $5.65 to $5.32 to $5.72, compared to the consensus of $5.48. The retailer revised its sales guidance from $18.5 billion to $19.1 billion to $19.3 billion to $19.5 billion, compared to the consensus of $19.12 billion.

Price Action

The stock fell 8.37% on Wednesday and declined 0.029% in after-hours trading. It has risen 33.42% year-to-date and 60.53% over a year.

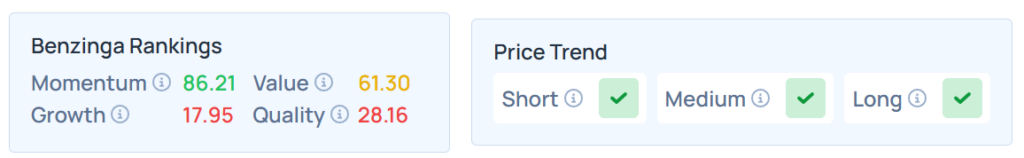

Benzinga’s Edge Stock Rankings indicate that DLTR maintains a stronger price trend in the short, medium, and long terms. However, the stock scores poorly on growth rankings. Additional performance details are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, rose on Wednesday. The SPY was up 0.54% at $643.74, while the QQQ advanced 0.79% to $570.07, according to Benzinga Pro data.

On Thursday, the futures of the S&P 500, Dow Jones, and Nasdaq 100 indices were trading in a mixed manner.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.