There’s a flipside to the market’s biggest ‘pain’ trade against the dollar: emerging-market gains.

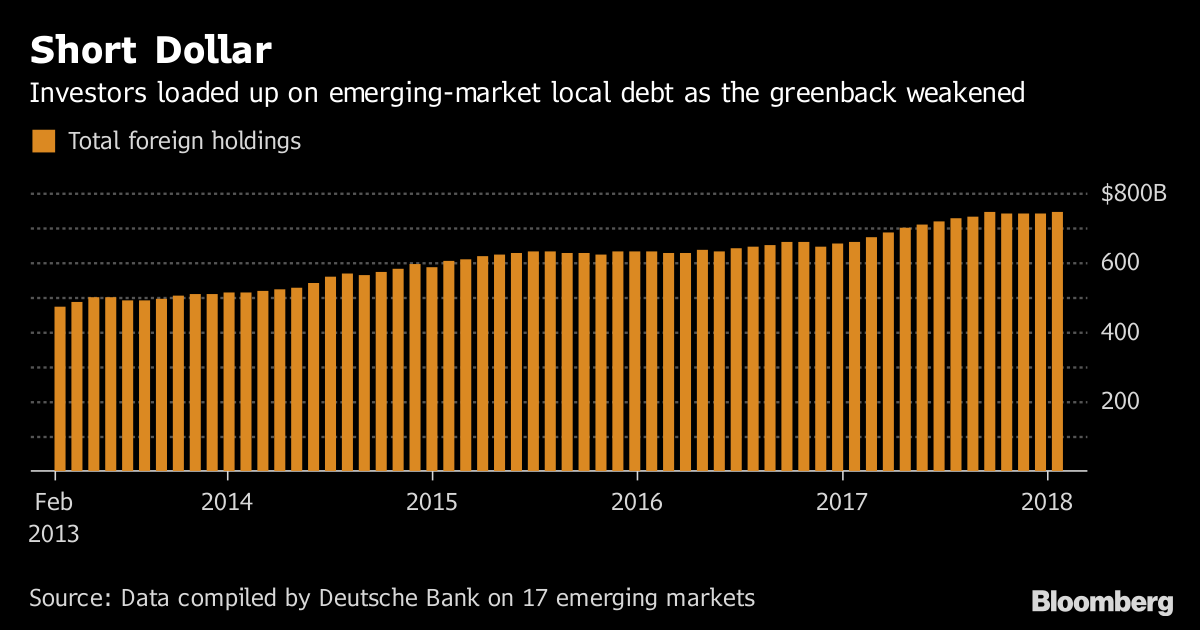

Foreign holdings of local-currency debt of developing nations have swelled to near a record $745 billion, according to data collected by Deutsche Bank AG. With much of their buying at the expense of the greenback, according to this metric investors have never been so exposed to a sudden turnaround in the U.S. currency.

The trade has been lucrative, handing investors returns of more than 13 percent in the past year and a 4.7 percent gain in the first quarter as most risk assets succumbed to losses.

But dollar bulls warn that profits could quickly flip to losses if there is a change in fortunes for the greenback. James Athey, a senior money manager at Aberdeen Standard Investments Ltd. in London, has been reducing emerging-market holdings in anticipation of a dollar rally.

“The dollar is really crucial for a lot of these asset classes and how they perform,” said Athey, whose firm oversees about $800 billion of assets. “Most people who invest in emerging local do so unhedged. Generally they tend to run the duration and currency risk.”

It’s an outlook that puts Athey among a minority of traders who are positioning for dollar strength after five back-to-back quarters of depreciation. Being bearish the dollar is the second-most-crowded trade across financial markets, after long bets on high-flying technology companies, according to a March fund manager survey from Bank of America Merrill Lynch Global Research.

Athey thinks that the majority of investors who are shorting the dollar are overlooking the fact that the supply of the currency is shrinking as the Federal Reserve unwinds its balance sheet. Other dollar bears argue that recent strong U.S. data will give a delayed boost to the greenback versus major currencies such as the euro.

“The short dollar trade is the biggest pain trade in financial markets right now and EM local currency is a natural extension of this,” said Damian Sassower, a fixed-income strategist at Bloomberg Intelligence in New York. “It’s never been this cheap to hedge against a sharp rise in the dollar.”

With more than half of gains on emerging-market local debt derived from currency performance, unhedged foreign holders are at risk of a recovery in the dollar that would whittle down returns, Sassower said.

The damage from a rising dollar could be exacerbated for emerging markets by a corresponding drop in prices for commodities, which typically have an inverse correlation with the greenback. Currencies of developing-nation oil producers have been buoyed in recent months by three quarters of back-to-back gains in crude prices.

"Both EM and commodities have been supported by the weakening dollar," JPMorgan Chase & Co. strategists including Mislav Matejka wrote in an April 3 report. "Therefore, if the dollar stabilizes in the near term, these two groups could struggle to deliver further gains."

To contact the reporter on this story: Natasha Doff in Moscow at ndoff@bloomberg.net.

To contact the editors responsible for this story: Samuel Potter at spotter33@bloomberg.net, Cecile Gutscher, Sid Verma

©2018 Bloomberg L.P.