Dollar General Corporation (NYSE:DG) reported better-than-expected second-quarter results and raised its FY2025 guidance on Thursday.

The company posted net sales of $10.72 billion, up 5.1% year-over-year, slightly ahead of the consensus estimate of $10.69 billion. Earnings came in at $1.86 per share, topping the Street’s estimate of $1.57.

CEO Todd Vasos said, "Looking ahead, we believe we have ample opportunity to drive growth and further improve our operating and financial performance."

Dollar General said it is raising its financial expectations for 2025, primarily to reflect its outperformance in the second quarter and its improved outlook for the second half of the year, while also considering the potential for uncertainty related to consumer behavior.

The company increased fiscal 2025 earnings guidance from $5.20-$5.80 per share to $5.80-$6.30, compared to the consensus of $5.75. The company raised the sales guidance from $42.12 billion-$42.52 billion to $42.36 billion-$42.65 billion compared to the consensus of $42.43 billion.

Dollar General shares gained 0.5% to close at $111.71 on Thursday.

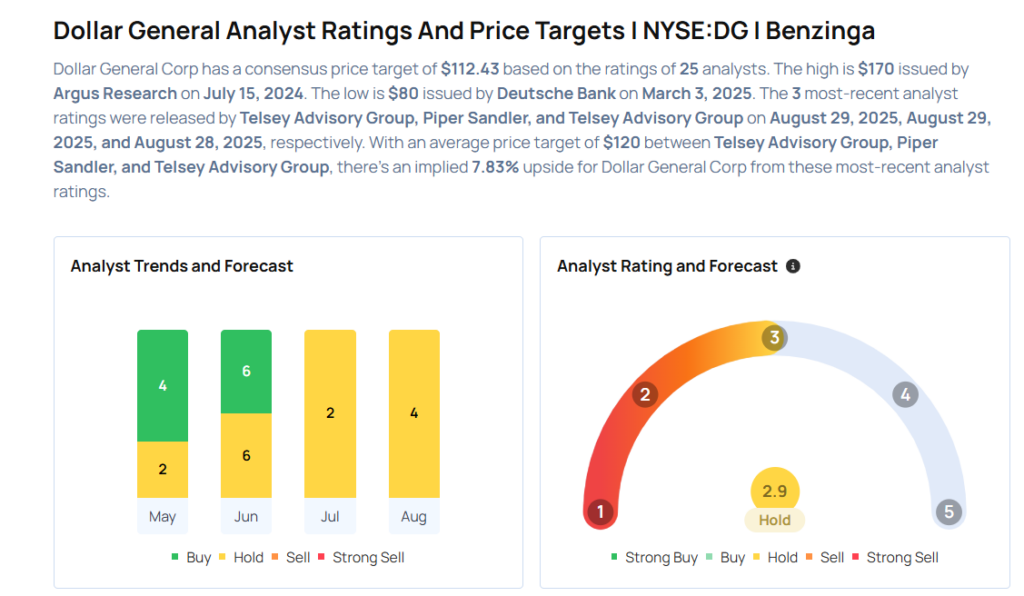

These analysts made changes to their price targets on Dollar General following earnings announcement.

- Piper Sandler analyst Peter Keith maintained Dollar General with a Neutral and raised the price target from $115 to $117.

- Telsey Advisory Group analyst Joseph Feldman maintained the stock with a Market Perform and boosted the price target from $120 to $123.

Considering buying DG stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock