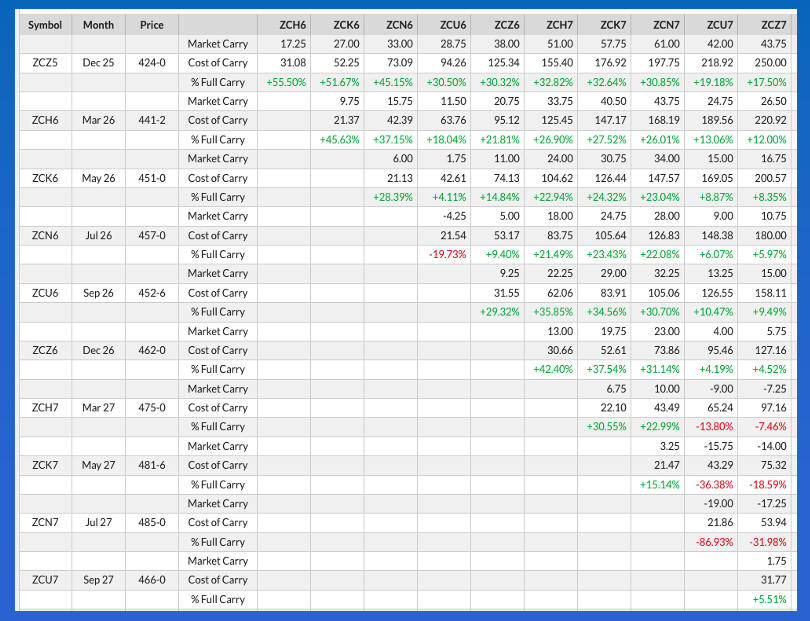

Did Tyson Foods’ announced plans to “stop using high fructose corn syrup and other ingredients in its branded products” change the long-term investment outlook for the US corn market? That was the key question we were left to ponder over the weekend. The announcement was posted on the company’s website last Monday (September 15), and when the trading week was through the December corn futures contract closed at $4.24, down 6.0 cents for the week, while the December-March futures spread closed at a carry of 17.25 cents and covered 55.5% calculated full commercial carry. In other words, there was not a dramatic shift in the market structure last week.

What I mean by this is the corn market did not show signs of a move to a demand market, in this case demand destruction as opposed to the demand increase associated with the US Energy Policy Act of 2005 that included higher Renewable Fuels Standards. By definition, a demand market creates a longer-term change in price expectation. When demand is increased, a higher price range is created. When demand is decreased, the market moves to a lower price range.

Let’s start with the commercial positioning in the corn market. If the announcement from Tyson had been a Black Swan event – something unforeseen that changed the dynamics of the market – corn’s futures spreads is where we would first look.

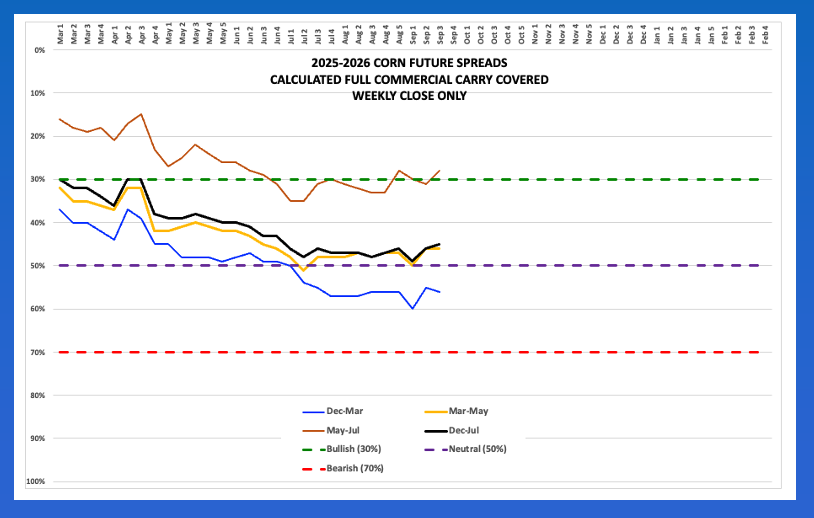

- As mentioned, the Dec-March spread closed last Friday covering a still neutral 56% versus the previous Friday’s settlement covering 55%. However, this reflects move immediate-term demand in relation to new supplies coming in as harvest continues to progress.

- The 2025-2026 marketing year Dec-July forward curve closed at a carry of 33.0 cents and covered 45% calculated full commercial carry as compared to the previous week’s 46%. Again, this does not indicate the commercial side sees the expected decrease in demand for US corn creating a significant change in the market’s fundamentals over the coming year.

- The Dec25-Dec26 futures spread closed last Friday at a carry of 38.0 cents, well off its low daily close of 49.5 cents carry from August 12. Investors like to watch this spread as an, but not the, indicator of this year’s fundamentals versus the next marketing year.

- And finally, the Nov26 soybean/Dec26 corn futures spread closed at 2.32 (Nov26 soybeans divided by Dec26 corn), continuing to favor more corn acres planted next spring, albeit early in our 6-month tracking period from September through February.

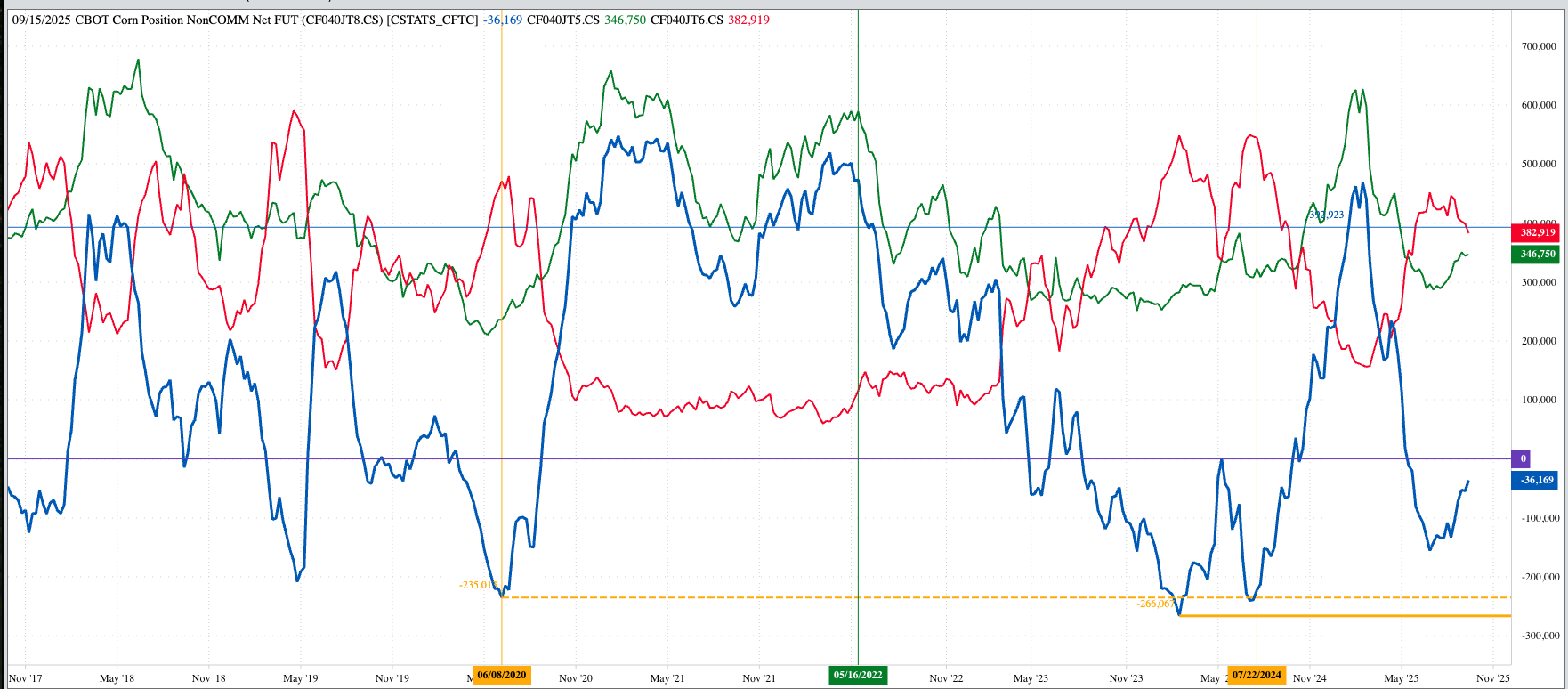

On the noncommercial side:

- The latest CFTC Commitments of Traders report (legacy, futures only) showed Watson held a net-short futures position of 36,169 contracts as of Tuesday, September 16. This was a decrease of 18,075 contracts from the previous week.

- This leaves the door open to continued short-covering over the coming weeks, despite the ongoing harvest, given the longer-term supply and demand situation is bullish. More on this in a moment.

- If using a Dec-only fund to invest in the market, the long-term December (ZCZ25) continuous monthly chart continues to show an uptrend that began at the end of August 2024 with another technical buy signal completed at the end of August 2025.

- The bottom line, at least for the noncommercial side, is that funds would be expected to move to a net-long futures position similar to what was reported from the summer of 2024 through the winter of 2025.

Last but certainly not least, the May26-July26 futures spread:

- The May-July futures spread closed last Friday at a carry of only 6.0 cents and covered 28% calculated full commercial carry, as compared to the previous Friday’s settlement covering 31%

- This tells us there is a growing concern on the commercial side over supplies in relation to demand next spring is growing. Why?

- Planting season tends to bring a slowdown in supplies moving off farm to terminals or end users.

- The 2025 crop may not be as large as USDA’s imaginary numbers say it is, and/or

- Demand over the next year is expected to be larger than USDA’s latest guess.

As for the bottom line on the commercial side, the National Corn Index was priced last Friday at $3.82. This is well below both the 5-year and 10-year end of September average prices of $4.78 and $4.03 respectively, again telling us immediate supplies are abundant in relation to demand, based on the simple economic Law of Supply and Demand. However, from a seasonal standpoint the Index tends to post its low weekly close in late September before moving higher through next May. I don’t see anything in the structure of the market that would change that seasonal tendency.

So, did the announcement by Tyson Foods change the long-term investment outlook for the US corn market? After doing a little digging, it is expected to erase “a few million bushels of demand”. The 3% number that was being talked about last week was if ALL corn syrup demand went away. Given all this, my answer would be no, the investment outlook for corn has not been changed. Based on what the market is showing us in late September 2025.