/Zebra%20Technologies%20Corp_%20logo%20on%20building-by%20Michael%20Vi%20via%20Shutterstock.jpg)

With a market cap of $16.3 billion, Zebra Technologies Corporation (ZBRA) is a global leader in enterprise asset intelligence, providing automatic identification and data capture (AIDC) solutions such as mobile computing, RFID, barcode printing, and workflow automation. The company serves industries worldwide with hardware, software, services, and cloud-based solutions.

Shares of the Lincolnshire, Illinois-based company have lagged behind the broader market over the past 52 weeks. ZBRA stock has dipped 7.8% over this time frame, while the broader S&P 500 Index ($SPX) has gained 15.1%. Moreover, shares of the company have decreased 17% on a YTD basis, compared to SPX's 9.9% rise.

Looking closer, the barcode scanner maker stock has also underperformed the Technology Select Sector SPDR Fund's (XLK) return of 18.9% over the past 52 weeks.

Shares of Zebra Technologies tumbled 11.4% on Aug. 5 despite Q2 2025 adjusted EPS of $3.61 beating estimates and rising 13.5% year-over-year, and revenue of $1.3 billion topping forecasts and growing 6.2%. Investors reacted negatively to weaker segmental performance in Asset Intelligence & Tracking, where revenues of $418 million missed the consensus, and to margin pressure as cost of sales rose 7.8% to $677 million.

For the fiscal year ending in December 2025, analysts expect ZBRA's EPS to grow 8.2% year-over-year to $12.81. The company's earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing on another occasion.

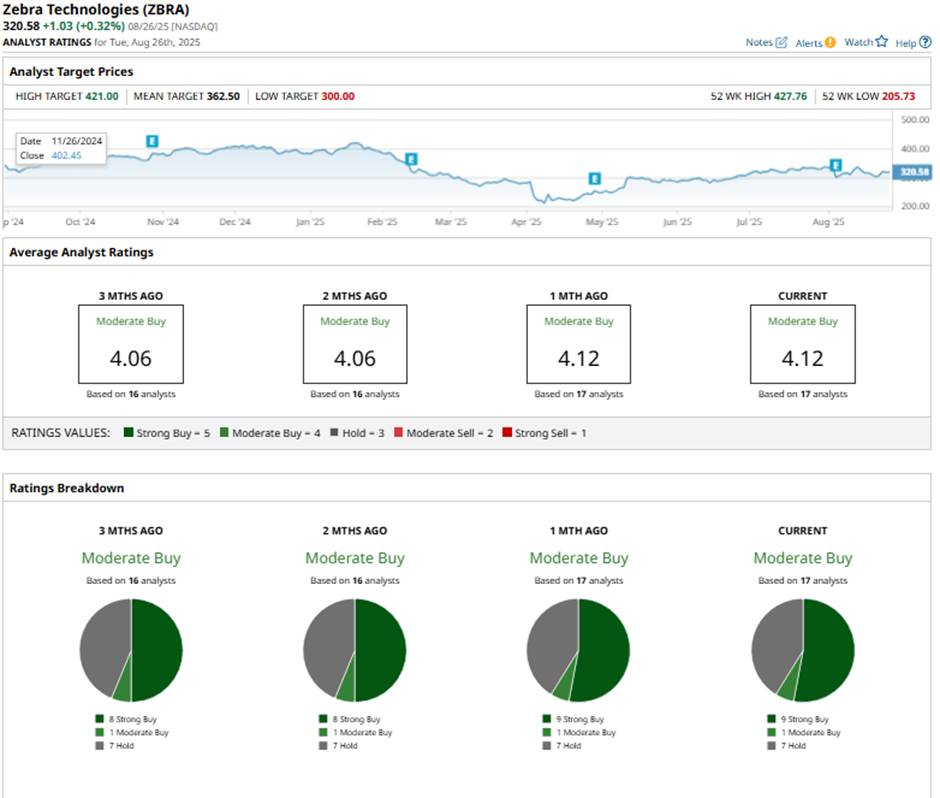

Among the 17 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on nine “Strong Buys,” one “Moderate Buy” rating, and seven “Holds.”

This configuration is slightly more bullish than three months ago, with eight “Strong Buy” ratings on the stock.

On Aug. 6, Needham raised its price target on Zebra Technologies to $345 while maintaining a “Buy” rating.

The mean price target of $362.50 represents a 13.1% premium to ZBRA’s current price levels. The Street-high price target of $421 suggests a 31.3% potential upside.