With a market cap of $52.1 billion, Warner Bros. Discovery, Inc. (WBD) is a global media and entertainment company. The New York-based company operates a diverse portfolio of iconic content and brands, spanning film, television, streaming, and sports. Its assets include Warner Bros. Studios, HBO and HBO Max, CNN, Discovery Channel, TLC, HGTV, Food Network, Cartoon Network, and DC Entertainment, among others.

Shares of the global entertainment powerhouse have put on a blockbuster performance over the past year. WBD has jumped 175.8% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 18.3%. The momentum carried into 2025, with the stock surging 98.6% year-to-date, easily topping the SPX’s 17.2% climb.

Even when compared with industry peers, WBD stands out. While the Invesco Leisure and Entertainment ETF (PEJ) gained about 19.3% over the past year and 13% in 2025, it still trails WBD’s explosive rally.

WBD shares are climbing as renewed takeover interest and a formal strategic review signal the potential for significant value creation. Reports of prospective bidders and management’s willingness to evaluate asset sales or a full acquisition have strengthened investor confidence in a premium outcome. On Oct. 21, WBD shares jumped 11% after the company announced it had begun reviewing strategic alternatives following unsolicited interest from multiple parties.

For the current fiscal year, ending in December, analysts expect WBD’s EPS to improve 108% to $0.04 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimate in two of the last four quarters, while missing the forecast in the other two.

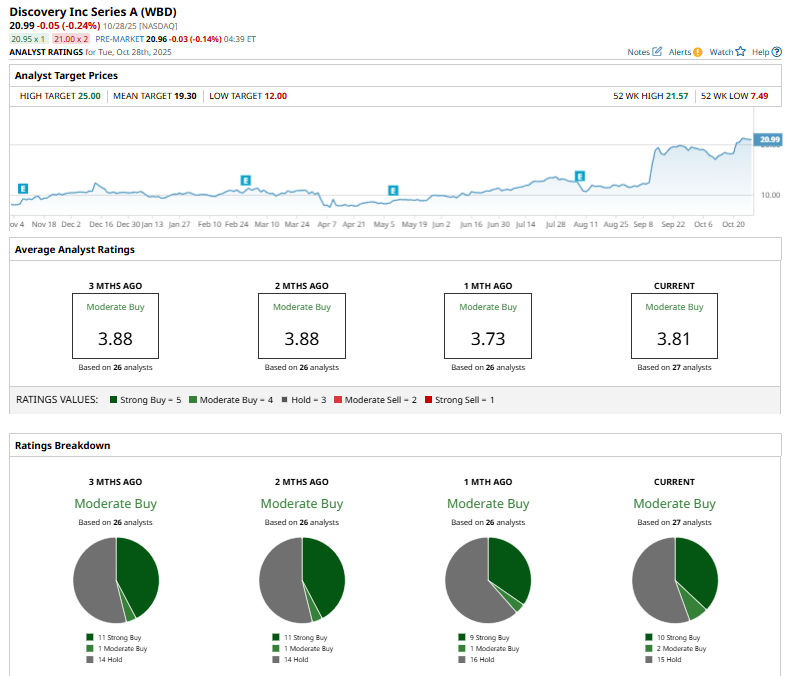

Among the 27 analysts covering WBD stock, the consensus is a “Moderate Buy.” That’s based on 10 “Strong Buy” ratings, two “Moderate Buy,” and 15 “Holds.”

This configuration is more bullish than it was one month ago, with nine analysts suggesting a “Strong Buy.”

On Oct. 28, Argus upgraded Warner Bros. Discovery to “Buy” from “Hold,” citing the potential for a bidding war and management’s willingness to explore strategic options to maximize shareholder value. Analyst Joseph Bonner highlighted the company’s valuable media assets, including HBO Max, its extensive film and TV library, and studio operations, and set a price target of $27.

While WBD currently trades above the mean price target of $19.30, the Street-high price target of $25 suggests an ambitious upside potential of 19.1%.