With a market cap of $41.4 billion, Valero Energy Corporation (VLO) is the largest independent refiner and marketer of petroleum products in the United States, operating in multiple countries. It operates through three segments - Refining, Renewable Diesel, and Ethanol, producing and marketing a wide range of petroleum-based and low-carbon fuels under brands such as Valero, Beacon, Diamond Shamrock, Ultramar, and Texaco.

Shares of the San Antonio, Texas-based company have underperformed the broader market over the past 52 weeks. VLO stock has declined 9.7% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 18.8%. Moreover, shares of the company are up 8.7% on a YTD basis, compared to SPX's 9.8% gain.

Looking closer, shares of Valero Energy have also lagged behind the Energy Select Sector SPDR Fund's (XLE) 5.1% dip over the past 52 weeks.

Despite beating Wall Street’s Q2 2025 estimates with EPS of $2.28 and revenue of $29.9 billion, shares of VLO fell 4.9% on Jul. 24. The renewable diesel segment posted a $79 million operating loss, a sharp drop from a $112 million profit last year. Additionally, investor sentiment was pressured by news of the planned April 2026 closure of the Benicia refinery, which would remove about 5% of Valero’s total refining capacity and 9% of California’s crude oil capacity.

For the fiscal year ending in December 2025, analysts expect VLO's EPS to drop 16.6% year-over-year to $7.07. The company's earnings surprise history is mixed. It met the consensus estimates in three of the last four quarters while missing on another occasion.

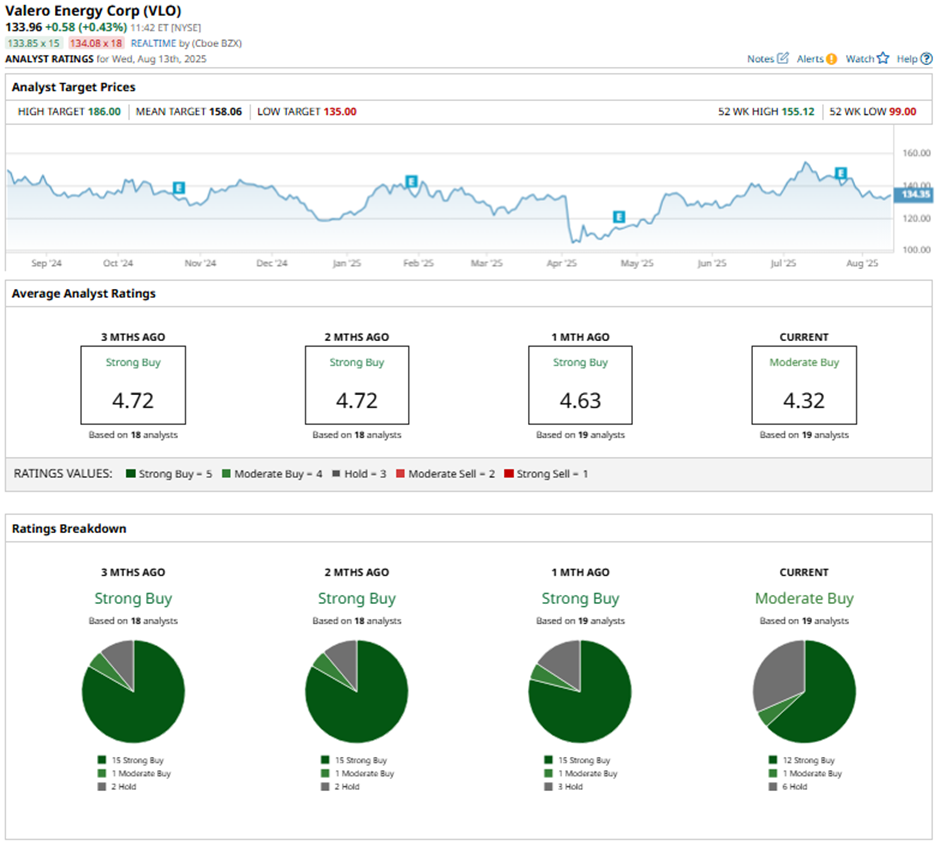

Among the 19 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 12 “Strong Buy” ratings, one “Moderate Buy,” and six “Holds.”

This configuration is less bullish than three months ago, with 15 “Strong Buy” ratings on the stock.

On Jul. 16, Morgan Stanley increased its price target for Valero to $160 and maintained its “Overweight" rating on the stock.

As of writing, the stock is trading below the mean price target of $158.06. The Street-high price target of $186 implies a potential upside of 38.8%.

.jpg?w=600)